The Guardian just published a piece on Russia’s inequality problem — first and worst in the world, according to a new Credit Suisse report. Funny to see Credit Suisse wringing its hands over Russian inequality, given that bank’s active complicity in designing and profiting off the privatization of Russia in the early-mid 1990s. Shortly before Credit Suisse arrived in Russia, it was the most equal country on the planet; a few years after Credit Suisse arrived and pocketed up to hundreds of millions in profits, Russia was the most unequal country on earth, and it’s pretty much been that way since.

Credit Suisse’s new Russia branch was set up in 1992, and it was led by a young twenty-something American banker named Boris Jordan, the grandson of wealthy White Russian emigres. Jordan was key to the bank’s success, thanks to his cozy relationships with Russia’s neoliberal “young reformers” in charge of privatizing the former Communist country. In the first wave of voucher privatization—when all Russians were issued vouchers which they could then either convert into shares in a newly-privatized company, or sell off—Credit Suisse’s Boris Jordan gobbled up 17 million of Russia’s privatization vouchers, over 10 percent of the total.

Inside connections were the key. While working for Credit Suisse, Jordan advised the Yeltsin government on how to implement Russia’s disastrous voucher privatization scheme. Jordan worked together with the two of the most powerful US-backed Russian free-marketeers: Prime Minister Yegor Gaidar, architect of the shock therapy program that led to the mass impoverishment of tens of millions of Russians; and Anatoly Chubais, architect of Russia’s privatization program, which created Russia’s new billionaire oligarch class. Gaidar’s shock therapy confiscated wealth from the masses; Chubais’ privatization concentrated wealth in a few hands. And Jordan’s Credit Suisse advised, traded off, and profited from this wealth transfer. This was the trio that played a central role in creating the inequality that Credit Suisse is now wringing its hands over. (You can read an interview with Jordan about how he co-advised the voucher implementation in 1992, which is stunning for a lot of reasons— he admits they sped up its implementation of voucher privatization to make sure that Russia’s parliament, i.e. representative democracy, couldn’t interfere with it. Democracy was not something anyone involved in Russia’s privatization in the 1990s gave a shit about.)

The conflicts-of-interest here were so over-the-top, they were almost impossible to wrap your head around: Credit Suisse banker Boris Jordan helped implement the voucher privatization scheme with Russia’s top political figures; and Credit Suisse massively profited off this same privatization scheme. And it was all done with the full backing and support of the US Treasury Department and the IMF.

(Another major beneficiary of Russian privatization vouchers was a murky hedge fund run by the billionaire Chandler brothers. They made a killing snapping up vouchers cheap, converting them into stakes in key Russian industries, and selling their stakes for huge profits. I wrote about them a couple of years ago because one of the Chandler brothers plowed some of his Russia loot into something called the Legatum Institute—a Dubai-based neocon front group that’s been bankrolling the “Russia disinformation panic!” for several years now, issuing report after report after report on the Kremlin disinformation scare by their protege Peter Pomerantsev. You have to let these vulture-capitalist billionaires wet their beaks a little, or they’ll raise an army of human rights activists to regime-change your ass.)

Shock therapy, first implemented in 1992 and not really ended until Russia’s devastating financial crash in 1998, was politically useful in that by confiscating the Russian middle-class’s and lower-class’s savings, it created a massively unequal society. And that alone drove Russia further from its Communist recent past, which was the political goal that justified everything.

In 1994, this same young Credit Suisse banker, Boris Jordan, told Forbes’ Paul Khlebnikov about a scheme he was trying to sell to the Yeltsin regime. It was called “loans-for-shares” and when it was finally adopted at the end of 1995, it resulted in what many considered the single largest plunder of public wealth in recorded history: The crown jewels of Russian industry—oil, gas, natural resources, telecoms, state banks—given away to a tiny group of connected bankers. It was this scheme, first devised by a Credit Suisse banker, that created Russia’s world-famous oligarchy.

The scheme went something like this: The Yeltsin regime announced in late 1995 auctions under which bankers would lend the government money in exchange for “temporary” control over the revenue streams of Russia’s largest and most valuable companies. After a period, the government would “repay” the “loans” and the banks would give the their large stakes back to the government.

In reality, every single “auction” was rigged by the winning bank, which paid next to nothing for its control over an oil company/nickel company/etc. Even the little money paid by this bank was often stolen from the state. That’s because Russia used a handful of private banks as authorized treasury institutions to transfer government salaries and other funds around the country. This allowed the same bankers who were authorized as state treasury banks to keep those funds for themseles rather than distribute them to the teachers, doctors and scientists as salaries—so they did what was in their rational self-interest and kept the money, delaying salary payments for months or even years at a time, while they used the funds for themselves to speculate, or to buy up assets in auctions they rigged for themselves. It was pure libertarian paradise on earth—everything von Hayek and von Mises dreamed of—in practice.

By the time the loans-for-shares was actually put into effect in late 1995, Credit Suisse’s Boris Jordan joined up with an anointed banker-oligarch, Vladimir Potanin, to set up their own investment bank, Renaissance Capital. They raised their first private equity fund, Sputnik Capital—with George Soros and Harvard University as co-investors—and Sputnik Capital went on to take advantage of the loans-for-shares investment opportunities, which had even more help from the fact that Yeltsin made Potanin his Finance Minister in 1996.

This sudden mass wealth transfer from the many to the few had a devastating effect on Russia’s population. Inflation in the first two years of shock therapy and voucher privatization ran at 1,354% in 1992, and 896% in 1993, while real incomes plunged 42% in 1992 alone; real wages in 1995 were half of where they were in 1990 (pensions in 1995 were only a quarter in real terms of where they were in 1990). According to very conservative official Russian statistics, GDP plunged 44% from 1992-1998 — others put the GDP crash even higher, 50% or more. By comparison the Soviet GDP fell 24% during its war with Nazi Germany, and the US’s GDP fell 30% during the Great Depression. So what happened in the 1990s was unprecedented for a major developed country—by the end of the decade and all of the Washington/financial industry-backed reforms, Russia was a basket case, a third-rate country with an even bleaker future. Capital investment had collapsed 85% during that decade—everyone was stripping assets, not investing in them. Domestic food production collapsed to half the levels during perestroika; and by 1999, anywhere from a third to half of Russians relied on food grown in their own gardens to eat. They’d reverted to subsistence farming after a decade of free market medicine.

All of this had a catastrophic effect on Russians’ health and lives. Male Russian life expectancy dropped from 68 years during the late Soviet era, to 56 in the mid-1990s, about where it had been a century earlier under the Tsar. Meanwhile, as births plunged and child poverty and malnutrition soared, Russia’s death-to-birth ratio reached levels not seen in the 20th century. According to Amherst economist David Kotz, over 6 million Russians died prematurely during the US-backed free-market reforms in the 1990s. What’s odd is how little pity or empathy has ever been shown for those Russians who were destroyed by the reforms we backed, advised funded, bribed, coerced, and were accessory to in every way. They weren’t entirely America’s fault; Yeltsin and his US-backed “market bolsheviks” had their own cynical, ideological and political reasons to restructure Russia’s political economy in the most elitist, hierarchical unequal manner possible. But if the US had acted differently, given how much influence the Clinton Administration had with the Yeltsin regime, things could certainly have turned out differently. The point is—they didn’t. The inequality was the surest sign of success. It only became something to wring our hands about later, a soft-power weapon to smack them with, now that we have little to zero influence over Russia.

It’s interesting that our literature is filled with plenty of official empathy for Weimar German victims of that country’s hyperinflation, but nothing of the sort for Russians of the 1990s, who were, it was argued, being ennobled and lifted up by the linear thread of liberal history—they were heading towards the bright market-based future, can’t let a few knocks and scratches distract us! Can’t make an omelet without cracking a few eggs, as the West’s Stalin apologists used to say.

Here, for example, is a typical cheerleader story about the new Russian inequality, published in Businessweek in 1996—a fluff job on Boris Jordan’s Russian backer, Vladimir Potanin. Notice how the headline/subheader make clear that the hero of this narrative is the Russian billionaire, and the villains are the “angry masses” of poor envious Russians:

The Battle for Russia’s Wealth

Can hugely rich new capitalists weather a backlash from the angry masses?

Russia’s answer to J.P. Morgan could not be less like the eccentric, bulbous-nosed original. Vladimir O. Potanin is a shy, athletic man of 35. Holding court in his rosewood-paneled office on Moscow’s Masha Poryvaeva Street, the president of Oneximbank quietly gives instructions to two strapping bodyguards at his door. Cool and controlled, Potanin is a standout in a group of dynamic businessmen who have seized huge slices of the economy.

Which reads a lot like this fluff job in the Los Angeles Times, published around the same time, headlined “Whiz-Kid Banker Named to Russian Cabinet”. Which reads a lot like a Businessweek followup up with even more shameless hagiography, headlined “The Most Powerful Man in Russia”. You can try reading that last one if you want, but I recommend keeping a vomit bag close by—and a cyanide pill for good measure.

So this is the sordid and depressing backstory to the Credit Suisse report on Russian inequality—the story you definitely won’t and don’t read about in Credit Suisse’s own account. They’re a bank; their reports, while perhaps truthful, are far from The Truth—more like marketing pamphlets than serious scholarship.

Credit Suisse made a killing in Russia in the early-mid 1990s, dominating two-thirds of Russia’s capital markets deals—while tens of millions sank into desperate poverty. That too is inequality.

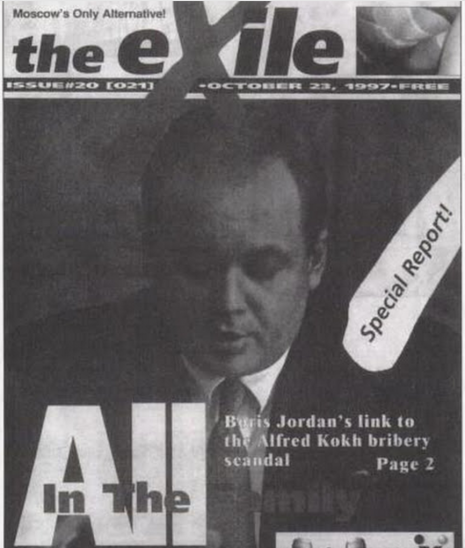

Jordan himself remained a powerful celebrity-investor through the early Putin era. In 1997, Boris Jordan was caught up in a major scandal surrounding the privatization of the national telecoms concern, Svyazinvest—which was won by a consortium that included Soros, Harvard, and a bank owned by Finance Minister Potanin and his partner, Mikhail Prokhorov, who today owns the Brooklyn Nets. The scandal was this: The government official in charge of auctioning off the telecoms to Soros-Harvard-Potanin-Jordan consortium, Alfred Kokh, had been given a shady $100,000 book advance by a shady Swiss company connected to Potanin’s bank. The book had not been written; the advance was unusually high; and the Swiss “publisher” which had never published a book before was itself incorporated and led by none other than Boris Jordan’s cousin, Tikhon Troyanos.

The revelations led to scandals, and Yeltsin was forced to fire his privatization chief Alfred Kokh, along with a handful of other corrupt US-backed “young reformers” caught getting paid on the eve of a rigged auction.

But what did it really matter? What really mattered to everyone who matters was the political structure of Russia’s economy. No longer egalitarian, no longer a threat to the neoliberal order—it now had the world’s most unequal society, and that was a good thing, because the new elites would identify their interests more with the interests of their Davos counterparts than with the interests of the “backwards” Russian masses, whose fate was their problem, not ours. This is when racist caricatures of the “backwards” Russian masses help—you don’t have to empathize with them, history is sending them to the trash heap of history, not you. The world was safe for business, and that was all the affirmation anyone needed to hear.

At the end of the Yeltsin era, I visited the sprawling suburban Moscow “compound” owned by Potanin and his banking partner, Mikhail Prokhorov, as well as Renaissance Capital—the bank first founded with Boris Jordan in the mid-1990s. It was a huge gated compound with several buildings, a mini-hotel, and a nightclub/concert hall. One of the first things I saw entering the gaming hall building was two familiar-looking men in track suits playing backgammon: Vladimir Potanin, billionaire oligarch; and Alfred Kokh, the fired, disgraced head of Yeltsin’s privatization committee.

The financial crisis of 1998 left Russia’s in complete tatters, and Boris Jordan was never the big shot that he had been before. His real value was providing cover for the new boss Vladimir Putin as he re-centralized power under Kremlin control. The first upstart oligarch that Putin took down was Vladimir Gusinsky. He was briefly jailed and then exiled to Israel. His once-respected opposition TV station, NTV, was “bought” by Gazprom, and Gazprom, needing a western-friendly face for its hostile takeover, hired Boris Jordan as the new general director of the network—and his old partner-in-crime, Alfred Kokh, the disgraced ex-privatization chief, as chairman of NTV’s board. Almost immediately, 25 NTV journalists— half the staff— “resigned”. Jordan’s job was to blunt western criticism of the Kremlin as it destroyed the lone critical voice on Russian television, and two years later, his job done, he moved on.

Today Jordan still runs the Sputnik Fund, such as it is—mostly a web site as far as I can tell. And he is listed as the founder of New York University’s “NYU Jordan Center for the Advance Study of Russia”. He looks like such a minor figure now.

Without any of this context, it’s as though Russia’s extremes of inequality that Credit Suisse just reported on suddenly appeared out of nowhere, as a manifestation of Vladimir Putin’s innate evil. As though nothing preceded him—the 1990s had never happened, and our Establishment has always sincerely cared about how Russians must suffer from inequality and corruption. Erasing history like this has a funny way of making America look exceptionally good, and Russia look exceptionally bad.

Mark Ames is co-host of the Radio War Nerd podcast with Gary Brecher (aka John Dolan). Subscribe here.

April 26th, 2017 | Comments (2)