This article was first published in the Daily Banter

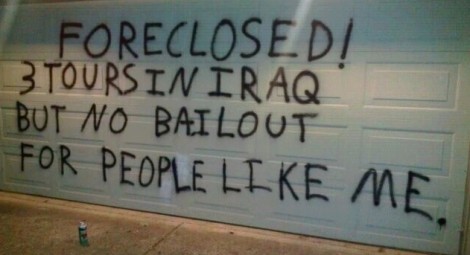

Every week, it seems there’s another tragic story about a suicide or murder-suicides linked to foreclosure trauma. Some of the more spectacular murder-by-foreclosure stories the past few years have been collected by a blog called “Greenspan’s Body Count”—others, myself included, have been writing about these terrible stories of class warfare being waged by the only side fighting it, and winning it, as Warren Buffett rightly said.

Before the 2008 crisis, the media paid little attention to the death toll taken on Americans by the decades-long class warfare waged against the 99%. Now they’re impossible to ignore. Stories like the US soldier in Iraq who committed suicide so that his wife could collect life insurance, and save their family home from foreclosure. Or the courtroom-suicide in Phoenix, in which a Yale-educated banker-swindler swallowed a cyanide capsule after being found guilty of setting his 10,000 sq foot McMansion on fire as a way of collecting insurance and evading mortgage payments he couldn’t afford.

Despite the somewhat increased media attention given to these tragic stories nowadays, there is one suicide directly tied to foreclosure fraud that has been completely ignored by the media. Her name was Tracy Lawrence, and for a brief moment last year, between the moment she turned whistleblower and her untimely and bizarre suicide, Tracy Lawrence’s testimony threatened to blow the entire fraud-closure criminal enterprise wide open, with repercussions that could have easily reverberated all the way up to the major banks and GSEs complicit in one of the greatest crimes this country has ever experienced.

In the months since Tracy Lawrence was found dead in her Las Vegas apartment at the age of 43, her story has only taken on more significance—even as her death has been forgotten. This is a story that demands our attention, a story we must not allow ourselves to forget.

First, some background to Tracy Lawrence’s suicide: On November 16, 2011, the attorney general for the state of Nevada, Catherine Cortez Masto, announced a major first-of-its-kind 606-count criminal indictment against two Orange County, California-based title officers working for Lender Processing Services, the country’s largest mortgaging servicing company and the worst of the predatory “fraudclosure mills.”

Foreclosure fraud had been devastating America unabated for a few years, laying waste to untold hundreds of thousands of American families. The Nevada attorney general’s criminal case against the two LPS title officers—Gary Trafford and Geraldine Sheppard—represented, for a brief moment, the first time in years that American justice threatened the predatory lending class.

What happened to the bombshell indictment of these LPS supervisors?

Yves Smith at Naked Capitalism was among the first to report the Nevada AG’s indictments, rightly pointing out the significance of going after mid-level officers in the foreclosure mill firm as a way of launching a full-scale takedown:

“[A]s mob prosecutions have shown again and again, you start by going after the foot soldiers in the hope that they roll people higher up on the food chain. And at a minimum, this action says that the law and due process matter, and violations, particularly large scale, systematic violations, can and will be punished.”

This marked the first time that bigtime bank fraudsters faced serious jail time—Attorney General Masto’s criminal case sent shockwaves throughout the mortgage lending world. More importantly, her criminal case threatened to finally change the way America deals with the bankster class that has been plundering with impunity for years. Politically, Nevada’s criminal indictment could have enormous repercussions; economically, the case could lead to invalidating tens upon tens of thousands of fraudulent foreclosures conducted in the Las Vegas area over the past few years.

The next day, the Los Angeles Times reported on the scale of the fraud:

In what appear to be the first criminal charges to stem from the fracas over improper foreclosures last year, two Southern California title loan officers have been indicted by a Nevada grand jury for allegedly filing tens of thousands of improper documents related to Las Vegas-area foreclosures.

The Clark County grand jury charged Gary Trafford, 49, of Irvine and Geraldine Sheppard, 62, of Santa Ana on 606 counts, alleging that the two headed up a vast “robo-signing” operation that resulted in the filing of tens of thousands of fraudulent foreclosure documents.

The documents were filed with the Clark County recorder’s office between 2005 and 2008, according to the indictment. The two title loan officers worked for the firm Lender Processing Services, a foreclosure processing company based in Florida that has been used by most of the largest banks in the nation to process home repossessions.”

Just a few months after the Nevada AG’s 606-count criminal indictment against LPS, Missouri’s attorney general filed a 136-count criminal indictment against a unit of Lender Processing Services, called Docx, as the New York Times reported last February. That meant two major criminal cases.

Given the sheer scale of the crime committed—a plundering so brutal and devastating you’d only expect such a thing from a conquering barbarian horde—what amazes me is how underreported this crime still is, and how few Americans in the Establishment know any of the details, beyond perhaps the word “robo-signing.”

One of the rare exceptions was the excellent reporting done on my friend Dylan Ratigan’s Show, as well as the unforgettable 60 Minutes segment aired last year on foreclosure fraud and “robo-signing” mills. The 60 Minutes investigation focused on the fraud perpetrated by Lender Processing Services unit, Docx, which used blatantly fraudulent “robo-signing” foreclosure documents to dispossess Americans of their homes on behalf of the Wall Street banks. Like the way peasants in a banana republic are treated, hundreds of thousands—if not millions— of Americans have been illegally and fraudulently evicted from their homes. And all the while as it happened, the Obama Administration stood by and wrung its hands—and that’s the kind, whitewashed way of putting it. Another way of looking at what the Obama Administration did with the mass foreclosure fraud crime—the true and honest way of putting it—is that the White House actively provided political and legal cover for one of the largest crimes perpetrated against Americans in modern history. Sorry, but that’s the truth—and the sad thing is, as horrible as the Obama Administration has been on housing, a President Romney will almost certainly find a way to be even worse, even if that worseness has to be invented. That’s one of the lessons we’ve all had to learn these past few decades.

“Obama Lied, Hope Died” should be the slogan

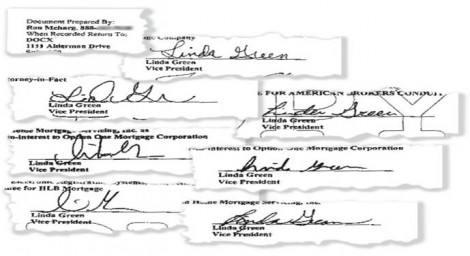

The 60 Minutes segment zeroed in on what is now the most infamous fraudulent-signature of our time: The infamous “Linda Green”—whose signature appeared on an impossibly large number of foreclosure documents. A single fake “Linda Green” was officially listed as a “vice president” at some 20 different foreclosure mills, this same “Linda Green” signing untold thousands of fraudulent documents evicting Americans from their homes.

Among the worst of the foreclosure servicers abusing the fraudulent “Linda Green” signature was Docx, the unit of Lender Processing Services which has since been shuttered.

60 Minutes tracked down the real “Linda Green” whose name was fraudulently abused to destroy the lives of countless Americans, and it’s worth quoting what 60 Minutes found:

We went searching for “the” Linda Green and found her in rural Georgia. She told us she has never been a bank vice president.

In 2003, she was a shipping clerk for auto parts when her grandson told her about a job at a company called Docx. The company, that was once housed in Alpharetta, Ga., was a sweatshop for forged mortgage documents.

Docx, and companies like it, were recreating missing mortgage assignments for the banks and providing the legally required signatures of bank vice presidents and notaries. Linda Green says she was named a bank vice president by Docx because her name was short and easy to spell. As demand exploded, Docx needed more Linda Greens.

“So you’re Linda Green?” Pelley asked Chris Pendley.

“Yeah, can’t you tell?” Pendley, who is a man, replied.

Pendley worked at Docx at the same time and signed as Linda Green.

So you have now a sense of just how vast the foreclosure fraud crime was, and how it involved not only the largest mortgage servicer in the nation, LPS, but also all the major banks that used LPS’s services to throw Americans out of their homes illegally and take possession of them.

No fraud here folks, looks like 1 authentic “Linda Green” to us!

Let’s rewind again to last November 16, 2011, the day that Nevada’s attorney general Masto announced her indictment against the two LPS title officers—two weeks before Tracy Lawrence took her life. Nevada’s case against LPS rested primarily on the testimony of a whistleblower, Tracy Lawrence, who worked in Lender Processing Services’ office in Las Vegas. Her testimony threatened to unravel tens of thousands of fraudulent foreclosures in the state of Nevada between the years 2005-2008, and the criminal activities of the entire mortgage servicing industry. Nevada has suffered the worst foreclosure problem of any state in the union.

In return for turning state’s witness, Tracy Lawrence plea bargained her charges down to a single misdemeanor charge of falsely notarizing a signature, which carries, in the worst case scenario, a maximum of one year in prison and a $2,000 fine. However, her testimony could put her two LPS superiors behind bars for decades—which is why many believed Nevada’s goal was to turn those two LPS officers into state’s witnesses against LPS’s senior executives.

On November 29, 2011—just two weeks after the Nevada attorney general announced the landmark criminal case—whistleblower Tracy Lawrence was supposed to appear before a judge for her sentencing. It should have been a routine appearance, but she didn’t show up. Her lawyer grew anxious, called police to check on Tracy Lawrence’s home, and that’s when they found her dead.

The timing of her death was suspicious, to say the least. Immediately, before any investigation had been conducted, Las Vegas police officially “ruled out homicide” as her cause of death.

Tracy Lawrence’s suicide was given scant coverage in the national media. Here is one of the few national media stories about her death, a short piece on MSNBC’s website:

Foreclosure fraud whistleblower found dead

By msnbc.com staff

A notary public who signed tens of thousands of false documents in a massive foreclosure scam before blowing the whistle on the scandal has been found dead in her Las Vegas home.

NBC station KSNV of Las Vegas reported that the woman, Tracy Lawrence, 43, was scheduled to be sentenced Monday morning after she pleaded guilty this month to notarizing the signature of an individual not in her presence. She failed to show up for her hearing, and police found her body at her home later in the day.

It could not immediately be determined whether Lawrence, who faced up to one year in jail and a fine of up to $2,000, died of suicide or of natural causes, KSNV reported. Detectives said they had ruled out homicide. [So quickly! And we thought only Russian police solved “crimeless” death scenes within minutes of arriving!—M.A.]

Lawrence came forward earlier this month and blew the whistle on the operation, in which title officers Gary Trafford, 49, of Irvine, Calif., and Geraldine Sheppard, 62, of Santa Ana, Calif. — who worked for a Florida processing company used by most major banks to process repossessions — allegedly forged signatures on tens of thousands of default notices from 2005 to 2008.

Police said at the time that the alleged scam had thrown into question the legality of most Las Vegas home foreclosures in the past few years, leaving many people living in foreclosed-upon homes that they unknowingly don’t actually own. [Good thing there’s no motive to make a detective suspicious here or anything!—M.A.]

I recently called the Clark County coroner’s office to find out if they had determined her official cause of death. A spokesperson told me that Tracy died from “intoxication” of a combination of Xanax (Alprazolam) and two antihistamines: Benadryl (Diphenhydramine) and Hydroxyzine. Officially, her death was ruled a suicide.

Though there has been little public discussion about Tracy Lawrence’s suicide, in private forums, her death sent a chill. Although there have been reports that Lawrence was depressed and stressed from her role as the key whistleblower, no one I know who reports on the housing disaster unquestioningly accepts the official version, that Tracy Lawrence’s suicide timing just happened to come at the most convenient time imaginable.

The stakes could not have been higher: As MSNBC reported, Las Vegas police said that her testimony threatened to “throw into question the legality of most Las Vegas home foreclosures in the past few years.”

As one commenter darkly quipped on the site 4closurefraud.org:

I bet Linda Green signs the coroners report….

But seriously,Now people can’t question the validity of the documents she attested to authentic because she is dead.

When they are alive you can challenge the presumption of authenticity. It’s nearly impossible to succeed if you can’t get the notary on the stand and cross examine them. Now there are 25000 properties that are pretty much a lock to be legitimized.

One only has to remember that Las Vegas’ gambling industry was created by mobsters like Meyer Lansky—who is also credited with helping invent modern offshore banking in the early 1930s in Switzerland. In this world, deaths ruled “suicides” are not unheard of. One of the most spectacular examples involved the “suicide” of Roberto Calvi, chairman of Italy’s largest private bank, who in 1982 was found hanging from London’s Blackfriars Bridge with bricks stuffed into his pockets along with $15,000 cash. The day before Calvi’s “suicide” his secretary “jumped” out of the bank headquarter’s fourth floor window and died—her death was also ruled suicide.

It took over two decades for authorities to overturn the “suicide” verdict and state the obvious: In 2003, Italian authorities ruled Roberto Calvi’s death a murder.

In the meantime, the fallout from Tracy Lawrence’s suicide has been worse than predictable: In Nevada, the case against Lender Processing Services appears to have all but fallen apart. With the Obama Administration foisting its foreclosure fraud settlement on all the states in January—a deal that left bankers happy, and everyone else screwed— and the key witness to the LPS case dead, the writing was on the wall.

Masto essentially fired her deputy AG, John Kelleher, who headed up the once-aggressive Nevada mortgage Fraud Task Force. With Kelleher gone, the Task Force looks like its work is all but over, as reported in local Las Vegas Channel 8 News:

“Nevada’s mortgage Fraud Task Force — arguably among the most aggressive in the country — has undergone some dramatic changes in the last few months. The changes prompted its former chief to question whether those responsible for Nevada’s housing collapse will ever be brought to justice.”

In the report, Kelleher told Channel 8: “It’s my personal opinion that there was some kind of deal cut, involving signing the multi-state (agreement) for whatever reason: financial, political, you can speculate all day long and back off criminal.”

Along with Kelleher, several other Nevada prosecutors and investigators have since been reassigned or transferred out to pasture. In the courts, a Nevada judge all but gutted the AG’s criminal case against Lender Processing Servicers.

Over in Missouri, the state’s criminal case was recently quietly settled for a paltry sum, and forgotten about.

Meanwhile in LPS’s headquarter state of Florida, the attorney general Pam Bondi has done everything to protect LPS, even firing two of her office’s attorneys who made the mistake of investigating LPS fraud.

Hugh Harris, CEO of Lender Processing Services, recently named “One of the Best Places To Work In Northeast Florida”

In a recent celebratory conference call that Lender Processing Servicers held with financial analysts, Hugh Harris, the CEO of Lender Processing, could barely contain himself as he gloated to analysts from Barcalys, Goldman Sachs and other financial institutions:

“First, let me just say we are very pleased to report strong second-quarter operating performance…we’ve gained greater clarity over the potential resolution of legal and regulatory issues related to the past practices.

“First, we announced yesterday, we’ve settled all our legal issues with the Missouri Attorney General’s office. This settlement includes a dismissal of all criminal charges filed against DocX. Second, an motion to dismiss in the Nevada Attorney General’s case was granted in part which resulted in the scope of the suit being significantly narrowed.”

So Tracy Lawrence’s highly suspect suicide is another major victory for the bankster class, and another giant loss for the rest of us. No matter what the circumstances of her suicide—that is, even if she was driven to kill herself in despair, after turning whistleblower and facing the pressure of confronting one of the biggest criminal fraud scams in history—that doesn’t make her death any less significant, or infuriating, or disturbing. Either way, the criminal lending industry drove a lone and lonely hero to her death.

All we can for now—while this country is still controlled by a rank oligarchy— is remember Tracy Lawrence’s suicide, so that some day we can learn what drove this hero to her terrifying early grave.

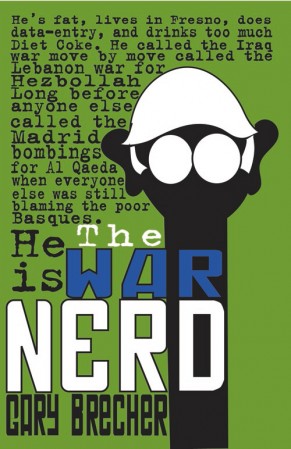

Mark Ames is the author of Going Postal: Rage, Murder and Rebellion from Reagan’s Workplaces to Clinton’s Columbine.

Click the cover & buy the book!

Read more: fraudclosure, lender processing services, lps, Mark Ames, Class Warfare

Got something to say to us? Then send us a letter.

Want us to stick around? Donate to The eXiled.

Twitter twerps can follow us at twitter.com/exiledonline

28 Comments

Add your own1. Gray Seal | August 23rd, 2012 at 9:44 am

The 1% are gangsters, were always gangsters, and will always be gangsters. Just keep your head down and mouth shut and they won’t mess with you. Oh,,,,lol, no I’m not talking about North Korea! I’m talking about the USA!

2. That Man | August 23rd, 2012 at 10:01 am

The more I look at this mountain of shit called foreclosure fraud, I have to wonder just when the breaking point will be–when a significant number of Americans are going to start giving a damn and wakening to the rotten core of fraud that’s been festering in their country for more than thirty years, now. But if The eXiled has taught me anything, it’s that Americans are always eager to have more and more abuse heaped on them by the kings of financial control.

3. Vendetta | August 23rd, 2012 at 10:03 am

No amount of horse cum pies could ever bring justice to this.

4. Gustavo Millebrand and Lavrentij Lemko | August 23rd, 2012 at 11:14 am

Dear eXholes,

“Too much money in too few hands, exhibit #2,283,002,394,384:

http://www.guardian.co.uk/world/2012/aug/23/gawker-mitt-romney-offshore-accounts

Cheers,

Gustavo Millebrand and Lavrentij Lemko, Turks & Caicos Islands

5. thomzas | August 23rd, 2012 at 11:24 am

Great work, Mark.

Nice piece backing you up here…

http://litigationlady.com/?p=104

Can’t you all join forces to get this story the attention it needs?

6. crazy_inventor | August 23rd, 2012 at 11:59 am

Obama and the Robo-Thieving Banksters

20110907_gf_BankDeal.wv (as aired)

Glen Ford’s blog | Black Agenda Report

How Obama Helps the Banks Rig the Housing Market

Wed, 08/08/2012 – 02:31 — Glen Ford

Why Obama Won’t Help Foreclosure Victims

Tue, 05/01/2012 – 23:41 — Glen Ford

Obama Administration Withholds Home Foreclosure Aid to Hardest Hit

Tue, 04/17/2012 – 23:44 — Glen Ford

Obama and Bush Administrations Are Complicit in Bankers’ Massive Foreclosure Scheme

Tue, 10/04/2011 – 21:13 — Glen Ford

7. Steve Patriot | August 23rd, 2012 at 12:43 pm

Chilling as this is, these psychotic monsters have NOTHING on Lockheed Martin, Boeing, or Enron.

8. crazy_inventor | August 23rd, 2012 at 4:36 pm

a a a stop the war profiteers take back our country.wv

a a a a Iraq Veterans Against the War_ End the War Now.wv

each_soldier_cost_25_jobs_clear_channels_pro_war_rallies.wv

9. paul cripps | August 23rd, 2012 at 6:35 pm

you americans , of which i am quite fond of, well you just love getting royally fucked.all the macshimo, all those lovely guns, and all you do is mow down schoolkids and some poor barstards watching a fuckin batman movie, are you fucking kidding me .anyway all the best exile readers, stay single, minimal responsability ,lots of good wine, food and sex and take good care of your friends , cheers crippsy…

10. Ed | August 23rd, 2012 at 9:39 pm

I always wondered- what if the Going Postal types were to target the 1%? Like, what if James Holmes had shot up the Stock Exchange? Or if this guy shot one of the men most responsible for fucking people with foreclosures?

11. Gavine | August 23rd, 2012 at 11:14 pm

mark,

congrats on your new gig

12. Gavin Lives! | August 23rd, 2012 at 11:14 pm

also at next book signing i will come and you will not be prepared in any way for me because you would never imagine that I would try to pie you or attack you, that’s how dumb you are and smart I am

13. Bat-Mite | August 24th, 2012 at 1:02 am

@10 well then the government would pass a law giving millionaires tax breaks for hiring bodyguards and any opponents of the oligarchy would be equated with spree killers in the national media.

14. Cum | August 24th, 2012 at 5:24 am

@10: In Going Postal, Ames says that in America’s past, the people most likely to get killed in a slave rebellion are other slaves. So maybe it’s this weird self-destructive cultural legacy;

15. Gustavo Millebrand and Lavrentij Lemko | August 24th, 2012 at 9:13 am

Dearest eXholes,

Behold a visual display of the meaning of the phrase the “banality of evil”:

http://video.cnbc.com/gallery/?video=1301828700&play=1

Cheers,

Gustavo Millebrand and Lavrentij Lemko, Turks & Caicos Islands

16. Mr. Marcus | August 24th, 2012 at 1:22 pm

Fantastic work, Mark. Thanks for putting your mind to this and helping us understand what happened with Fraudclosure Nakhba 2005-2008.

17. Dumb Trucks | August 24th, 2012 at 4:24 pm

Yet more evidence for your Going Postal thesis from the NYC shooting, Mark.

The target for the shooter was Steve Ercolino, described as a “coworker” of Johnson’s (actually a vice president of the wholesale company).

Johnson believed that Ercolino had singled him out and was not promoting Johnson’s products as a designer.

http://www.guardian.co.uk/world/us-news-blog/2012/aug/24/empire-state-building-live-coverage

It happened exactly how you describe in your book: the media played this immediately as an indiscriminate “crazy” massacre, when it was actually a targeted attack on an executive with a specific reason behind it, like most workplace shootings.

In this case, the target was actually present and Johnson found him – so there was no breakdown and subsequent violence against other workers. All of this seems perfectly in line with your argument for why and how workplace violence happens. (And the “indiscriminate” shooting was by the NYPD.)

18. Gavine | August 24th, 2012 at 5:32 pm

@AEC

🙂

19. Jim Goad's Hair Plugs | August 25th, 2012 at 2:11 am

still stalking you after all these years, some day those trial transcripts where skye threatens to reveal my sexual history and my upper-middle class childhood will come out and I must stop it at all costs

20. JD | August 25th, 2012 at 8:48 am

First of all, you have to bypass everyone but the bank’s Legal Department by filing a suit. In my case, $20 small claims case in Jan, 2011. After making 250 calls to BofA with no response I got emails from the Office of the President of BAC and a telephone call from a Legal Assistant.

After 90 days, I got $2,000 cash, all fees taken off, a home modification backdated to the date I sent them my first paperwork and a guarantee if someone else comes along (and they will) who can prove they own the house, they have to indemnify our ownership forever.

Why did filing in a Court that doesn’t even have jurisdiction work? It BROUGHT IN the bank’s Legal Department. The Legal Department knows that their bank doesn’t own your house and can’t prove it either. (Think RoboSigning here!)

And, they don’t they just move the case into a court room that does have jurisdiction? Well, maybe because I told them if they did, I would enter evidence (FORENSIC LOAN ANALYSIS & TILA COMPLIANCE http://stores.livinglies-store.com/-strse-Search-%26-Analysis-Reports/Categories.bok ) that they didn’t own the house and move for Quite Title and get my home for free! Their high priced New York City attorneys never proceeded in the Small Claims Court, except to put off the hearing over and over (which we let them do), until everything was settled.

If you don’t have the guts to go to court you probably don’t deserve to keep your house. The future is going to demand some real guts if we are going to take our Government back. Why don’t you try a harmless, little, tiny, legal action and test some waters. The whole country isn’t like Congress, the Legislatures, the Governors or the Presidents. We have (what is called, remember this now) a Judicial System. JUDICIAL SYSTEM!

21. crazy_inventor | August 25th, 2012 at 11:20 am

JD you were lucky, if you read or listen to the links I provided above, you’ll see tens of thousands that weren’t lucky, in court. In many jurisdictions the judges are accepting fake paperwork and stealing people’s homes anyway, despite the case making it to court, while in a few (very few) lucky cases the judge does the right thing. These are cases that went further than yours did, you settled before that point.

The links are some of the many horror stories mainly people of color have experienced who did just that – fought it legally. Investigative journalism looks at many cases, not just one lucky outcome, then labels the victims ‘gutless’.

> The whole country isn’t like Congress, the Legislatures, the Governors or the Presidents.

No, but MOST of the country is. That’s why this is such a huge scandal.

22. JD | August 26th, 2012 at 11:03 am

Yes, yes _inventor.

There ARE lots and lots of “Horror Stories”. Yes, indeed. This is a very serious issue. Very serious.

So serious indeed that you can’t really make it about your downer “Links”.

But, being that you brought it up, I will have to respond.

Yes, some have lost. And, I wouldn’t pursue this course without doing homework and making sure I had the right attorney, if it went further. (In my case I was going to use Carl Person, who ran for Attorney General in the last election.)

BUT, there isn’t enough space here for me to put the hundreds of successful and partially successful cases that people have gained FOR ALL OF US and we all should be informed about…

Indeed, come to think of it, why isn’t Exile doing pages and pages and pages of reports of the many cases of these successes. I have other things to do…AND, why haven’t they called on people like me? Or a long list of people I can give them? Isn’t DOING something about the problem what they are all about?

Hmmmnnn. Maybe…or is their job to simply satisfy readers like you?

Just askin’…

23. crazy_inventor | August 26th, 2012 at 1:43 pm

> your downer “Links”.

reality is such a downer

> people like me? Or a long list of people I can give them?

that list is nothing compared to the much bigger list of people who went further than you and were screwed by the system, including the courts. Including class action cases, as ‘my downer links’ explain – which is real investigative journalism and is reporting the news.

> Isn’t DOING something about the problem what they are all about?

The occupy tactic is doing something about it, Exiled’s job is simply investigative journalism, reporting the news.

> satisfy readers like you

If I was satisfied I wouldn’t have posted the links. Links to investigative journalism reporting the news which is what empowers the occupy tactic, which is the only recourse left, as the above ‘downer links’ make crystal clear.

you didn’t follow the links, and the majority of people don’t matter to you, you’re here to message force multiply a narrative, like a broken record on assignment. BoA has hired sockpuppets to do exactly that.

So are you employed by Themis?

Just askin’…

24. Zhu Bajie | August 27th, 2012 at 5:13 pm

Why don’t more 1 percenters get killed? I’ve often wondered, too. One reason: there aren’t many of them and they stay away from the rest of us. Some, at least, are smart enough to make friends with their guards, their maids and cooks, etc. Most Roman emperors were assassinated by their guards, not po’d ordinary Romans.

25. crazy_inventor | August 28th, 2012 at 5:51 am

It’s due to the media campaign that uses wedge issues and dog whistles to distract the public, plus our culture of worshiping the lowest common denominator as heros and the media (both corporate and ‘independent’) that feed this by publishing sensational blood stories while ignoring or being tragically late in reporting real problems and the real sources of those problems.

26. Margo Adler | August 31st, 2012 at 5:24 am

Important story!

Forclosure fraud is obscene.

I know people who live in Nevada. The recession and the forclosures torpedoed that state. The economy tanked and the Libertarian politicians didn’t help anything. It’s terrible. There are neighborhoods and subdivisions that are still like ghost towns. Like, there will be one occupied house on a street. People were doing weird 3rd-world things like going into forclosed homes and stripping the copper and the marble tops of the sinks. I think Yasha Levine (?) captured the spirit pretty well on one of this articles about Victorville.

@24 The 1 percent are so sequestered, they might as well live on Mars. In Manhattan, a prole might glimpse one in the luxury stores or restaurants. You can go to Daniel at night to observe them in their natural habitat. It is my personal finding that the very rich have a peculiar sort of freeze-dried look about them.

27. matt weidner | October 6th, 2012 at 4:33 am

great story mark, sad how much we’ve all forgotten. the fascists are brutal…and they are winning. a methodical campaign to snuff out malcontents. just yesterday florida’s attorney general announced they dropped all the investigations into the foreclosure mills and fraud factories. these were crimes….real crimes…systemically perpetrated…but they are powerful enough to walk away from everything. the darkness descends….

28. MMN | October 13th, 2015 at 9:03 am

Please be forewarned not to use Living Lies

trolls who offer loan audits. I got ripped off by a very visible scam artist who continually promotes himself on that site.

We victimized homeowners are easy “prey” for opportunists out there.

Additionally the save your home scammers will steal your identity and even try to get you to sign over power of attorney. We have too many criminals infiltrating this arena and no protection at any level for those being victimized.

Leave a Comment

(Open to all. Comments can and will be censored at whim and without warning.)

Subscribe to the comments via RSS Feed