US Stocks Gain On Report Of Pending Home Sales . . . Pending Home Sales Rise the Most in Over Seven Years . . . Consumer Confidence Spurs Broad Gain . . .

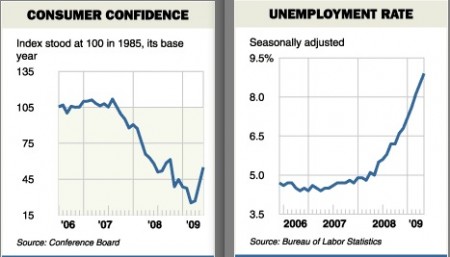

You see the same bullshit headlines churned out everywhere you turn. Yes sir, we’re supposed to believe the recession is over, recovery is underway and prosperity is just around the corner. We need to go out and fulfill our patriotic duty, which means buying things, preferably houses. That’s what smart investors would do, we’re told. And judging by the polls, Americans are starting to believe it.

Contrary to just about every single economic metric — rising unemployment, rising credit card debt, falling production, spiraling real estate values — people are optimistic. The recession is yesterday’s news, everyone’s moved on. People are actually believing the hype and getting into real estate again. And anyway, how the hell can we talk about real estate when America is torturing people and still not closing Guantanemo!

Well, the real estate industry is fine with us not paying attention. Because it has a dirty little secret that shows just how fucked our economy really is, and how insolvent they really are.

In reality this McMansion is worth $30,000

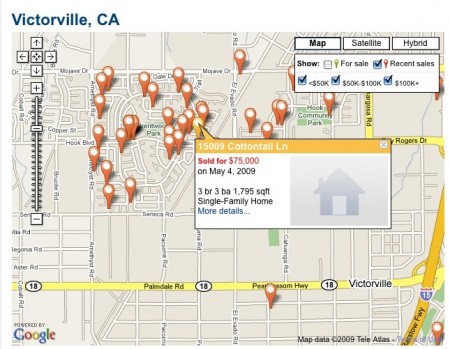

If you, like me, live in a foreclosure-ridden area, it isn’t very hard to notice that the real estate optimism of you hear in the news just does not match reality. Take Victorville, my new adopted home. There are a total of about 30,000 single-family homes in Victorville. As of today, 4,590 of them are for listed sale in the general area (3,500 of them are foreclosures). The average listing price is $150,000, but most of them sell for half that.

There’s a 3 bedroom/3 bathroom McMansion just around the corner from my own that sold for $75,000 a month ago. The house cost $249,500 when it was built in 2004 and sold to some sucker for $338,500 at the peak of the boom in 2006. Three years later it was worth $125,000 — half of its original price — and now belonged to the bank, which was happy to cut the price by another 50% just to get rid of it. Houses sell so poorly, that real estate Web sites don’t bother listing “days the on market” metric.

The Rise and Fall of Victorville’s Real Estate

Pretty grim, right? Actually, it’s much worse. See, the weird thing about Victorville is that while 1 in 4 houses are vacant, and obviously have been for quite some time (just judging by the dilapidated state of the empty houses), very few of these empty houses are on the market for sale. Walking around my neighborhood, you rarely see a For Sale sign. There’s a foreclosure property up the street from me that has been prepped for long-term storage by its bank, with a notice posted on the living room window warning that the house’s pipes are filled with antifreeze so that they won’t burst when the temperature starts plummeting to zero in the wintertime, as it does here in the high desert.

Fact is, banks all across the nation are keeping foreclosed properties off the market. They’re doing it on purpose, to fudge the statistics and make it seem like everything’s alright.

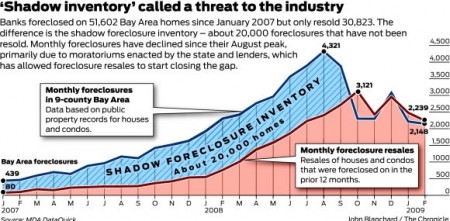

The San Francisco Chronicle:

Lenders nationwide are sitting on hundreds of thousands of foreclosed homes that they have not resold or listed for sale, according to numerous data sources. And foreclosures, which banks unload at fire-sale prices, are a major factor driving home values down.

“We believe there are in the neighborhood of 600,000 properties nationwide that banks have repossessed but not put on the market,” said Rick Sharga, vice president of RealtyTrac, which compiles nationwide statistics on foreclosures. “California probably represents 80,000 of those homes. It could be disastrous if the banks suddenly flooded the market with those distressed properties. You’d have further depreciation and carnage.”

In a recent study, RealtyTrac compared its database of bank-repossessed homes to MLS listings of for-sale homes in four states, including California. It found a significant disparity – only 30 percent of the foreclosures were listed for sale in the Multiple Listing Service. The remainder is known in the industry as “shadow inventory.”

The number of foreclosures is not going to decrease any time soon. Sean O’Toole, Founder and CEO of ForeclosureRadar.com, told me that out of the 9 million mortgages in California, 2 to 3 million are upside down, which means their houses are worth less than what they owe on the bank. On top of that, anywhere from 700,000 to 900,000 households have stopped making payments and somewhere around 250,000 are scheduled to be foreclosed.

This adds up to a staggering number: a total of 3 to 5 million homes, one quarter of the 12 million households in California, are going to flood the market very soon. Nationwide, there is a two-year supply of unsold homes, twice what official statistics estimate.

To put it simply: banks are limiting supply in order to keep inflating the bubble. Keeping properties off the market makes sense for two reasons: it allows banks to engage in another round of brazen ripoffs by selling at least some of their properties at artificially high prices to a new wave of sucker investors (many of which are first-time home buyers). But more importantly, it allows the banks to avoid recording a loss on their balance sheets, making them look more profitable then they really are

It looks like the banks are all in on this racket together. Earlier this year, the industry had accounting rules changed to make this kind of market manipulation possible (meaning, profitable.) That’s what those new “mark-to-model” accounting rules back in April were all about. Instead of having the market determine prices, the changes allowed banks to value their assets based on a future projected worth to be determined by the banks themselves.

The change was pushed through with an aggressive lobbying campaign by the financial industry. For a measly $30 million in lobby fees, banks inflated their worth by tens of billions of dollars, instantly. Wells Fargo said the change boosted its capital by $4.4 billion in the fist quarter. In the second quarter, it is expected to increase banks’ earnings by an average of 7%.

It might be legal now, but it’s still fraud and flagrant market manipulation.

Here’s an account by the WSJ of how it went down:

The rules had required banks, securities firms and insurers to use market prices to help assign values to mortgage securities and other assets that don’t trade on exchanges — to “mark to market.” But when markets went haywire last fall, financial firms complained that the rules forced them to slash the value of many assets based on fire-sale prices. That contributed to big losses that depleted their capital and left several of the nation’s largest firms on the brink of failure.

Earlier this year, financial-services organizations put their lobbyists on the case. Thirty-one financial firms and trade groups formed a coalition and spent $27.6 million in the first quarter lobbying Washington about the rule and other issues, according to a Wall Street Journal analysis of public filings. They also directed campaign contributions totaling $286,000 to legislators on a key committee, many of whom pushed for the rule change, the filings indicate.

Rep. Paul Kanjorski, a Pennsylvania Democrat who heads the House Financial Services subcommittee that pressed for the accounting change, received $18,500 from coalition members in the first quarter, the second-highest total among committee members, according to Federal Election Commission records. Over the past two years, Mr. Kanjorski received $704,000 in contributions from banking and insurance firms, the third-highest total among members of Congress, according to the FEC and the Center for Responsive Politics.

The one obvious connection that is not being made is that this change in accounting, linked up with the shadow real estate inventory, is the shady base supporting our entire economy. Without the new rules, banks wouldn’t be able to pad their books in order to appear profitable. And without fudging the numbers, banks would never pass Geithner’s “stress test” or ever hope to to appear even slightly solvent.

It’s a twisted sort of logic, but it’s legal. It’s also very frightening. To think that all these empty homes I see around me are what’s keeping the US economy from total meltdown… If they had For Sale signs on them, the economy would tank even further. For now, these zombie homes don’t officially exist.

Ain’t the free market great?

Read more: foreclosure, linkedin, real estate, stress test, victorville, well fargo, Yasha Levine, Fatwah

Got something to say to us? Then send us a letter.

Want us to stick around? Donate to The eXiled.

Twitter twerps can follow us at twitter.com/exiledonline

39 Comments

Add your own1. captain america | June 5th, 2009 at 4:52 pm

so, you’re saying it’s actually a good thing that my ukrainian wife blows all my money on buying groceries at whole foods and various socially obligatory gifts for weddings, birthdays, and babies of her russian friends, thus keeping us from getting anywhere near being able to afford a house?

2. Vas | June 5th, 2009 at 5:59 pm

You should go Hans Reiser on her if she cost too much.

3. DocAmazing | June 5th, 2009 at 6:11 pm

It’s probably more useful to have a number of fairly loyal Russian friends (who might well have useful skills or connections, possibly in the, er, import-export business) than to have a large mortgage and a little equity.

4. Baked Dr. Luny | June 5th, 2009 at 6:15 pm

So the new rule says that rather than valuing their assets at actual market value, they can report them as worth some imaginary value that they determine based on some self-crafted, inevitably over-optimistic model? So they can basically lie on their balance sheets and say that their assets are worth more than they really are, enabling them to dig themselves deeper into a hole? Maybe they’re hoarding bailout cash to try to shore up their assets, and hoping no one figures out their insolvent before they can scrape enough money together to start lending again. Either way it’s just postponing the inevitable and making the bubble worse. What are those new homebuyers going to do when they too are upside-down in their mortgages? Here comes debt slavery!

5. motorfirebox | June 5th, 2009 at 6:27 pm

it’s flagrant market manipulation… but isn’t it necessary? as you say in your article, it’s all that’s keeping the US economy from completely bottoming out.

6. rick | June 5th, 2009 at 7:14 pm

Nice one, Yasha. I’m curious if editors elsewhere aren’t running this because you’re not an “expert”(chortle…guffaw!) with a reddish tie and rubber stamp degree. But hell, I’m not sure why people go to those other “big” web sites anyway. Some sites have literally hundreds of boring columnists and bloggers, and I’m still here.

“They judge a work of art, not by its clarity and sincerity, not by the force and charm of its ideas, not by the technical virtuosity of the artist, not by his originality and artistic courage, but simply and solely by his orthodoxy.”

7. Dennis Redmond | June 5th, 2009 at 9:23 pm

Two additional freight trains are bearing down on the US economy: (1) America’s creditors (China, Russia, Central Europe) have dumped Agency debt (i.e. mortgages) and stopped buying long-term Treasuries, in favor of short-term debt. Result: long-term rates are spiking, dealing a body-blow to any potential recovery. (2) Local and state governments are in a huge financial hole, and will have to slash hundreds of thousands of jobs. Team Obama has two months to launch another stimulus package to fix problem 2, but there’s nothing anyone can do about problem 1.

8. Nat | June 6th, 2009 at 12:33 am

I don’t get it. Free market works when everybody can access to pertinent information and theory, and everybody can read this article. Therefore there is no problem.

9. coldequation | June 6th, 2009 at 3:28 am

Good article – but there are a few complicating factors.

$75,000 for a McMansion really isn’t a bad price. With a 30 year loan at 7%, no money down, you’d end up paying $500/month for the principle and interest. Tack on insurance, PMI and taxes, and you’re looking at, what, $800-900? That’s about what it would cost you to rent, and it’s an amount that lots of people can afford to pay. It’s not an obviously insane bubble price.

The evidence you point to shows that you may be able to get a much better price in the future. But there are complications – you might be paying a much higher interest rate. Inflation could also wipe out the impending price reduction. If you buy now, the price is locked in even if there is severe inflation – which doesn’t seem unlikely with present government policy. If the Chinese stop buying our debt, those who buy now will end up looking smart.

If I were looking for a house in Victorville, I wouldn’t buy now, but I wouldn’t say that somebody is totally crazy to buy. Market timing is hard.

10. colonel frost | June 6th, 2009 at 5:36 am

Exile has a reputable international audience.

By some freak of nature we use English in comments however it’s not a secret the editor is of moroccan descent.

I’m wondering who really cares about the pricing of painted paper boxes the World War III loosers call their “houses”?

The prices fall because the houses were shit. That is the main reason, not evil bankers or Treasurer or whatever. Travel to Europe. Learn to build!

Second, I’m a bit tired of gullible Europeans

still believing Americans are some ‘white people’, wasps, etc and not Indian mongrels.

The backward Indians we were told had been freaking efficiently cleansed don’t worry. Hell yes! The frontiersmen cowboys wiped their asses with blankets then throwed them across the fence and the problem was sold.

None of permanently 70%/30% male/female ratio took themselves enemy’s wives like the first commenter here.

Poor red-faced gook fiancees were all mob-lynched (16-19 centuries) for the preservation of the great race. (hell yeah again)

Sceptics are encouraged to talk to Sarah Palin’s husband, he will tell you who the ‘real American’ is.

So (summing up) dear Jakob Ludwig, you are a serious man, a businesman of sorts, enough of this ‘wtf, why my wigwam costs nothing shit’.

Nobody of importancy on the planet Earth is interested in that.

11. Paul R. | June 6th, 2009 at 6:24 am

“Ain’t the free market great?”

How can you say that right after you tell us how the accounting rules were changed to fudge the numbers? Besides, without the TARP the banks couldn’t afford to play this game, so they’d be forced to sell even if they didn’t want to.

But this kind of price fixing is an old trick. Whether it’s done by banks or the gvt(like in the 30s with food for example), it always fails. Propping prices up encourages production, so in the end the crash gets even worse, because the supply is that much bigger.

12. alexa | June 6th, 2009 at 7:31 am

break the sucker up. Alaska to Russians, West to Mexico and Indians, East Coast to EU, Florida to Cuba, midlle for White Trashomelandia

13. Jerome | June 6th, 2009 at 11:02 am

Alaska to Canada, please.

Also, I believe Colonel Frost is in no danger of using English in these comment sections, ever.

14. captain america | June 6th, 2009 at 11:41 am

i think col. frost is my new hero.

also, thank you to yasha and doc for giving me some new perspective on my life.

as long as my wife remains hot, i am now prepared to consider my situation tolerable.

15. Allen | June 6th, 2009 at 12:44 pm

The “free market” (whatever that means) does work. It works when human beings are replaced by angelic rational choice model bots. It is also necessary to believe that irrational notions of self-interest are extremely rare and that the system isn’t extremely easy to game.

I think I’ll take the safer bet and pray for an end to the recession at my local Church, Mosque, or Synagogue.

16. Cap'n Kapo | June 7th, 2009 at 2:48 am

well done some of the best stuff I have read on the subject.

17. Indifferent | June 7th, 2009 at 8:08 am

this is an article worth paying for

18. captain america | June 7th, 2009 at 2:50 pm

i was thinking that if limonov isn’t going to be back, maybe you guys could offer col. frost a regular column?

19. Tam | June 8th, 2009 at 3:47 am

Anyone else remember all of of those US bankers who were saying arrogant crap like ‘China needs to make its banking system more transparent if it wants to prosper in the global economy’ a few years back?

No one outside the USA is going to take these guys seriously for at least a generation.

20. isamu | June 8th, 2009 at 5:56 am

Protip: 1,800 sqf is not a McMantion.

Also, there are dozens of sites dedicated to covering the Bubble that are much more accurate and informative and don’t have some silly political spin on what is happing (gosh, those banks don’t want to flood the market with houses all at once! How evil of them!).

yours in Christ,

isamu

21. inflation | June 8th, 2009 at 11:28 am

Doesn’t matter. The FED is just going to keep printing money until the whole thing blows.

22. Carlito | June 8th, 2009 at 11:48 am

Decent article, but not the most timely: http://www.financialsense.com/fsu/editorials/schiff/2009/0403.html

23. geo8rge | June 8th, 2009 at 12:18 pm

coldequation: “$800-900? That’s about what it would cost you to rent”

How many people have a secure income of $2400 to $2700 a month with secure familly health care benefits? Don’t such people already own?

24. Jeff | June 8th, 2009 at 12:40 pm

Like the article up until the last line.

This hasn’t been a free market since 1913. The Fed Reserve caused this and the first Depression. Facts I get, but irony is totally out of reach for idiots like me.

25. Scott Blanchard | June 8th, 2009 at 2:16 pm

This is the truth. Its going on in my neighborhood in Central Virginia. The banks put the houses in the paper for auction, but they have a reserve and if they don’t get that they just create a mortgage for themselves and start paying 8-900 a month and save having to write off the big numbers. They can pay that for 3-4 years with no problem and come out ahead, since we’re footing the bill for the difference. After a few years they figure things will turn around and they’ll make up the difference. Nice theory but they don’t keep up the neighborhoods when they do that.

26. gary | June 8th, 2009 at 2:28 pm

banks bad bad bad…butwhat good does it do a bank to hold hundreds of millions of dollars worth of houses when nobody is paying mortgages..rather sensible not to try and sell them all at once

27. jimbo bubba | June 8th, 2009 at 9:19 pm

Peak Oil is here. The bad economy has pushed it back temporarily. If the economy picks up again, We are instantly against the wall of peak oil. If the economy does not pick up depletion will set in anyway. Peak oil is how much can be taken out of the ground in a given time, the production rate. Oil in the ground is not a big pool, rather the oil seeps throw the ground to where the well is.It seeps at what ever speed it does, nothing can change that.

28. eee | June 9th, 2009 at 8:11 am

Let’s see if we can get addresses of “shadow inventory” homes, then burn them to the ground. That will really increase the value of the homes for sale and maybe create construction jobs. Only problem is that with fire depts. going broke, the entire neighborhood might go.

Hmm … better yet, how about the bankers’ addresses!

29. Matt | June 9th, 2009 at 10:59 am

So true. The lies just get worse and worse, everywhere. Below, the housing recovery in NYC is on!

http://www.nytimes.com/2009/06/07/realestate/07cov.html?ref=realestate

Meanwhile the magazine reports that there has been a 26% increase of so-called “unusual cases” (lumpen bougey whites, I guess) signing on for food-stamps, in fucking Manhattan. 26%! Those two trends just do not jibe.

30. captain america | June 9th, 2009 at 8:40 pm

hey eee, why don’t you and mark ames go and kick off the banker house burning party?

yeah, i thought so.

31. dunnart | June 10th, 2009 at 3:26 pm

dont get a loan if ya’ cant sevice it… shiiiit!

32. aleke | June 11th, 2009 at 3:21 am

@ captain america

Mark Ames and Yasha are writing about it, and what are you doing? Being a bitchy reactionary. Go burn down your own banker’s house, asshole. Or at least do some sleuthing around for people who aren’t cowards.

Maybe you aren’t some sad-sack rightist with a deep sense of cognitive dissonance pervading your every thought ( a troll? yes, that’s the troll archetype isn’t it). Maybe instead you’re some sad-sack coward that needs a leader to take the plunge for him to normalize revolutionary violence, make it okay to burn a scumbag’s status symbol down.

Nah, you’re probably just the former. No wonder irony is such an English-language phenomenon, wrapped in disenfranchisement and the workings of a sophisticated caste system. Troll and reactionary, how thin the line.

33. captain america | June 11th, 2009 at 4:15 pm

i advocate arson as a valid form of political protest. that’s why i dream about burn down buildings.

unlike the exile and mark ames, i approve of self-mutilation and prison rape as forms of masturbation against my political enemies. if that’s “yum-yum” (ouch…big penises make my mouth hurt), so be it.

34. Captain my captain | June 11th, 2009 at 4:50 pm

Col. Frost for Congress! Running on the Lumpen Bougey Whites ticket.

35. captain america | June 11th, 2009 at 8:12 pm

guess that last post was too boring for you, exile guys. i was just calling to say i love you, spade. my calls for murder and rape are just that…calls for someone to love. i definitely understand your preference to ignore easily-influenced sycophants like myself. however unlikely, it could occur to a few of your other stalker freaks besides me that I support every human rights violation of the bush administration, as long as it’s directed against the “right” victims.

you may be smarter than i am, but you’re not as pathetic as i am.

36. motorfirebox | June 13th, 2009 at 10:09 pm

Col Frost is an idiot. “the prices fall because the houses were shit”? if it were that simple, the prices would have never risen in the first place. yes, much of the housing built during the bubble’s expansion is comprised of prefab crap homes that will rot apart within two decades, but the price on those homes is derived from a combination of many factors, only one of which is quality.

of course, i suppose i shouldn’t expect reasoned analysis from the sort of special needs case that puts stock in white power.

37. cyprus | January 15th, 2010 at 7:30 am

thanks for the info..a lot of people here are discusing about it..

38. cyprus | January 25th, 2010 at 4:12 am

btw..my professor told me that the cause of the economic crisis were in the housing industry..and part of the housing industries are the banks since its them who supply the people with money to buy real estates..

39. apartmentpaphos | January 27th, 2010 at 5:57 pm

thanks for the post..really great to see how the banks are gaming the real estate market..

Leave a Comment

(Open to all. Comments can and will be censored at whim and without warning.)

Subscribe to the comments via RSS Feed