www.doctorhousingbubble.com -- Multiple sets of indicators are clearly showing that the housing market is entering a second winter. Home prices are inching closer to cycle lows and indicators of housing distress are rampant throughout the country. Home prices during the troubling five years of 1928 through 1933 saw a decline of 25.9 percent nationwide and this was during the Great Depression. The latest Case-Shiller data shows that home prices in the 20 City and 10 City composite measures are down by 32 percent from their 2006 peak. This is now nominally the worst housing correction since the Great Depression. The continuing correction in housing is economically challenging middle class households in ways vastly different from those during the Great Depression.

Click here to read full article...

Read more:, , What You Should Know

Got something to say to us? Then send us a letter.

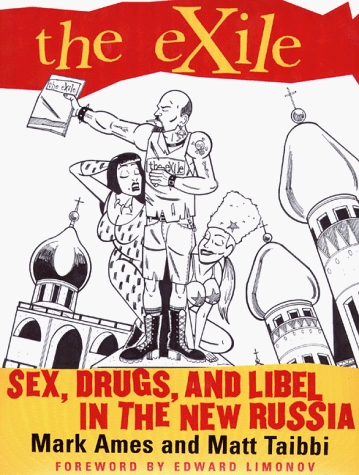

Want us to stick around? Donate to The eXiled.

Twitter twerps can follow us at twitter.com/exiledonline

Leave a Comment

(Open to all. Comments can and will be censored at whim and without warning.)

Subscribe to the comments via RSS Feed