Back in April I wrote a couple of articles about how rampant speculation by Koch Industries, Goldman Sachs and other big players in the energy markets has been driving up the price of oil. Immediately, a bunch of freemarket sockpuppets came out of the woodwork and infested our comments section, repeating the same invisible-hand-knows-best bullshit: Speculators are a force of good, not evil; they don’t drive up prices, but in fact help keep them low. Sounds plausible, right?

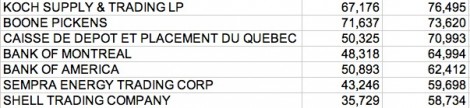

Well, a few weeks ago Senator Bernie Sanders leaked a small batch of secret energy trading data compiled by the U.S. Commodity Futures Trading Commission which showed that in the summer of 2008, when the price of oil was spiking to a record $148 per barrel, the oil commodities market was one giant speculatory cesspool dominated by the largest fraud-ridden banks, investment funds and oil companies in the world, including Goldman Sachs, JP Morgan Chase, BP and Koch Industries.

Thinkprogress’ Lee Fang recently wrote about the leaked data:

As experts from Stanford University, Rice University, the University of Massachusetts, and authorities have concluded, rampant oil speculation was the prime driver of the record high prices for crude oil three years ago.

Notably, the top speculators are noncommercial players, meaning they are companies that simply and buy and sell crude contracts with no interest in actually refining and selling the product. Each contract in the list represents 1,000 barrels of oil. The documents show the total volume of trades made on one specific day shortly before the record high price of $148 per barrel.

The data, though revealing, still does not give a complete picture of trading strategies. Speculators invest in multiple private exchanges, and trading tactics can shift from day to day. Moreover physical plays, such as buying up large quantities of actual oil and storing it on tankers or in large containers, are still largely hidden from public view.

I looked at the underlying data myself, and what it shows ain’t pretty: For instance, as far as the oil futures are concerned, speculators from financial and commodity trading outfits accounted for 65 to 80 percent of the entire market. Just the two top speculators of the bunch—Goldman Sachs and Dutch/Swiss energy trading company Vitol SA—represented 20 percent of the market, while the top five players—which included Morgan Stanley, Barclays and JP Morgan Chase—accounted for more than 30 percent of all oil trading activity. (A bit of oil speculation trivia: Vitol was the first company to buy oil from Libya’s rebels a few months back, and just made $1 billion on the gamble.)

And here’s the kicker: not only did speculators dominate the energy market, they appeared to be playing both sides of the bet—meaning that they had positioned themselves to make money on both the expansion and the popping of the oil bubble. The Wall Street Journal made this stunning admission itself in an article published last month, which they naturally buried way down in the article:

The list was drawn up amid intense scrutiny faced by the CFTC during the 2008 spike. The CFTC sought data on rapidly growing corners of the commodity markets, including private contracts negotiated “over-the-counter.”

Commodities are traditionally traded on exchanges via futures contracts, which the CFTC regulates. But the CFTC typically sees the impact of over-the-counter trades indirectly, as when a bank sells a contract and buys related futures. And banks often offset the trades internally.

Over-the-counter trading exploded in recent years amid rising investor interest in riding the wave carrying prices for oil and other commodities higher.

“We were under enormous pressure to find out what was going on,” says Jeffrey Harris, then the CFTC’s chief economist.

Wall Street was the biggest presence because banks often take one side of over-the-counter trades.

Goldman topped the list, with the equivalent of 451,997 contracts that would profit if oil rose, or “long” bets, and 419,324 contracts that would pay off if prices dropped, or “short” bets. Much of that likely represented Goldman being on the other side of client trades, according to people familiar with the matter.

You might remember that the good folks at Goldman have been known to bet “on the other side of client trades” before. Most recently, Goldman Sachs bet against crap mortgage-backed securities at the height of the real estate bubble in 2006, even as it was selling/peddling them as sure-bet investments to their clients.

SEC accuses Goldman Sachs of defrauding investors Marcy Gordon, AP Business Writer, On Friday April 16, 2010The government on Friday accused Wall Street’s most powerful firm of fraud, saying Goldman Sachs & Co. sold mortgage investments without telling the buyers that the securities were crafted with input from a client who was betting on them to fail.

And fail they did. The securities cost investors close to $1 billion while helping Goldman client Paulson & Co., a hedge fund, capitalize on the housing bust. The Goldman executive accused of shepherding the deal allegedly boasted about the “exotic trades” he created “without necessarily understanding all of the implications of those monstrosities!!!”

The civil charges filed by the Securities and Exchange Commission are the government’s most significant legal action related to the mortgage meltdown that ignited the financial crisis and helped plunge the country into recession.

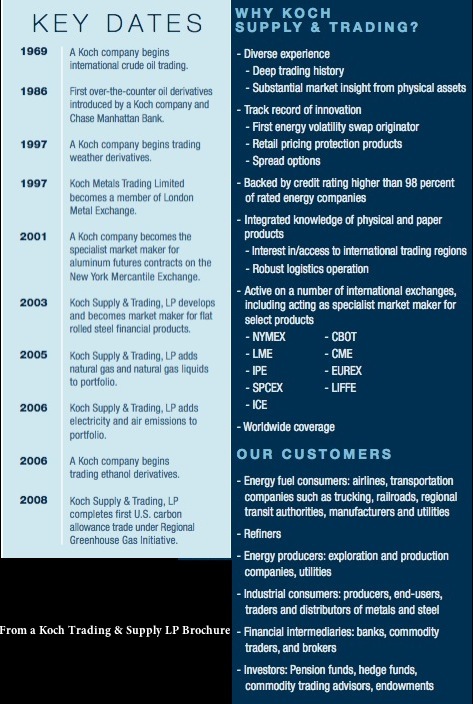

So is the Wall Street Journal saying that Goldman Sachs was doing exactly the same thing in the oil/energy futures markets as it did with CDOs and mortgage-backed securities? Was the firm helping drive the price of oil sky high and steering its investors into the market, only to simultaneously bet that the whole thing would come crashing down? It appears that may be exactly what they were doing…and Goldman wasn’t alone, either. The data clearly shows that just about all the big financial/trading houses had the same one-to-one long/short spread. And that includes Koch Industries’ commodity trading subsidiary, Koch Supply & Trading LP, which had $9.75 billion in bets riding on the price of oil going up, and $11.1 billion on it going down.

You can check out all the energy speculation data for yourself here.

While most Americans find this not just odious but bad for everyone who’s not an oil speculator, the Cato Institute’s Mark A. Calabria, director of Koch-oriented financial regulation studies, sees things another way: “Speculators deliver value and help price assets more precisely.” That’s right, they price them higher so as to extract more money from peasants like me and you.

Yasha Levine is an editor of The eXiled. You can reach him at levine [at] exiledonline.com. Want to know more? Read Yasha Levine’s previous posts on the Koch-oil speculation connection: “The Koch Brothers: Dark Lords of Derivatives” and “Koch Industries Lackeys Admit to Manipulating Oil Prices…and Gloat About It, Too.”

Read more: bernie sanders, cato, energy markets, fraud, freemarket bullshit, Goldman Sachs, koch industries, leaked documents, oil, shills, speculation, Yasha Levine, Class War For Idiots

Got something to say to us? Then send us a letter.

Want us to stick around? Donate to The eXiled.

Twitter twerps can follow us at twitter.com/exiledonline

31 Comments

Add your own1. Gatorade | September 18th, 2011 at 3:46 pm

That was a good call, Yasha. I just wonder how long it will take for this whole businessmen are good guys thing to wear off. Will it ever?

2. Hamsterfist | September 18th, 2011 at 4:13 pm

Does Peak Oil fit into any of this, or am I just retarded? Look at me. I’m a Peak Oil theorist guy that wants to believe that peak oil is driving up oil prices above all evidence to the contrary…like the fact that speculators dominate 60 to 80 percent of the energy markets! Doyeeee! Guess I am retarded. (Unedited!)

3. Tyler | September 18th, 2011 at 4:26 pm

The vampire squid is hard at work doing “God’s Work.”

Except, this is definitely an old testament God, not the love-dovey new testament kind. I’m talking book of Job kill your family, burn your fields, skull fuck you and then have the audacity to demand that you thank God for showing you his love this way.

The global power elite will fuck us until we love the, and thank them for it.

4. Omri | September 18th, 2011 at 6:34 pm

I can hear you saying, “Oh, Christalmighty, please don’t let another Peak Oil dumbshit in here screaming about the END OF CIVILIZATION.” Well, too bad cuz here I am! Boo!

You don’t have to be a libertard to notice that the market is sending a signal at you with the volume of 76 vuvuzelas. It’s not just that prices rose so high 3 years ago. PEOPLE KEPT PAYING. When you need the gas that badly, that’s called “demand.”

And when you can’t increase production without building entire towns in bumfuck, Alberta, that’s a supply crunch. Stubborn demand, falling supply, ergo high prices.

The only to not get fucked by the elites over gas is to make enough changes in your life to reduce your dependence on it: change where you live, where you work, where you shop, or better don’t shop at all, because everything has to be delivered to you via oil power, how you get around. Here’s an idea: don’t have the produce be shipped to you. You go to the produce. First walk to that farm located 300 miles, then swim to a chicken coop 1500 miles away, then hang glide to a Pepsi plant to get your years’ supply of diet Mountain Dew! You can dew the dew, dewd!

We have to do this. The market is screaming at us to do this. And the power elite is on a media campaign to get us to ignore the problem until we’re well and truly fucked.

5. Hamsterfist | September 18th, 2011 at 6:50 pm

Finally you Lords of eXiled improved me! Love you guys! Yep, that was a bit too much Koch sucking? Sorry. Now I learned that it can be both peak oil and squid banks. One reinforcing each other, yes.

6. calripson | September 18th, 2011 at 7:11 pm

Yasha, if a company is long and short contracts the only economic exposure is the net position: whatever Goldman would make on the long side if oil went up would be offset 1:1 by losses on the equivalent number of short contracts and vice versa. Don’t make yourself look completely stupid by basing your premise (speculators position themselves for a win/win by being long and short oil futures contracts) on a misunderstanding of how futures markets function. Your premise would hold water if those contracts were in different months (calendar spreads), or if option contracts at different months/strikes, but the data does not indicate if this is the case. What even a casual observer should note is how close the long/short positions are in your data….market makers do not as a rule make money by directional betting, they make money by scalping a small spread on each trade.

7. Hamsterfist | September 18th, 2011 at 7:14 pm

Thanks for the smiles and giving me something to brag about.

When will Amerikan’s wake up? It’s too late, isn’t it? It irks me that no matter how much you show people the truth, whether written here or elsewhere, no one cares. Where is the call to action? Perhaps I am reading too much Derrick Jensen……

8. Omri | September 18th, 2011 at 7:15 pm

Well, Yasha, you can count yourself in respectable company for screaming “speculators.” That doesn’t put you in with Bill Fucking O’Reilly, but I’ll pretend that it does because I assume you’re a liberal and you’ll be like “oo! I’m compared to Bill O’Reilly! Oo! I must have done something wrong, I’ll change, I’m so embarrassed! Ooo!”.

9. iCONOCLAST | September 18th, 2011 at 7:43 pm

I’d applaud your nation’s move towards fascism if it means this sort of behavior is merited with a bullet to the head.

10. burbl | September 18th, 2011 at 10:23 pm

Please explain to me how holding SIMULTANEOUSLY long and short positions allows you to “profite”

(unless there IS a dissymmetry in timing if one of them gets the juice the other screws you, this is called “hedging” BTW)

Oh that’s right, sorry about that, I’m just a dumb fucking freemarket apologist…I’m gonna pretend like the piece didn’t say that, according to the Wall Street Journal, they are probably betting against client trades…don’t mind me, gosh, just read the passage for yourself:

See and that makes sense b/c, as I saw recently written here Koch Supply & Trading LP is basically a investment/financial services operation…not only investing on the Kochs’ behalf, but doing it for all sorts of clients: hedge funds, pension funds, airline companies…

11. Norway | September 18th, 2011 at 11:47 pm

Not all of what is described here is fraud. As another commenter noted, large firms like Goldman Sachs hedge and there’s nothing surprising about the Kochs betting on the up and downside. Those two are insulating themselves against shocks in the oil market. No matter where the market moves, they’re relatively OK – and they still pocket a spread. Airlines do the same thing. But no hedge is perfect and you can stand to lose money.

The really volatile element are the commercial slips of paper that are reflections of other pieces of paper that somewhere down the chain link up with a barrel of oil. These derivatives proliferate like paper coming out of the towers. They’re extremely effective at generating volatility, and for gambling-addicted day-trading speculators greed-raging on cocaine, a volatile market is the best market.

The big firms and corporations, Koch and Goldman Sachs, are fine, because they’ve hedged. The ‘little people’ – what we in this country have taken to calling ‘folks’ instead of ‘citizens’ or ‘people’ – are the ones that are pummeled and abused under this system. There’s no hedging against the cost of a tank of gas for your Honda.

Total deliveratives have a ‘notional’ value (that word notional is a mathematical and philosophical quagmire) of around one quadrillion dollars. They’re a virtual specter hovering over the ‘real economy’ – the streetlights and strip-malls – that you almost have to look away from because it makes no sense; it’s as if the financial system is giving off a quantum excretion. There was a great moment described in Atlantic Magazine a long time ago: the Chinese head of the state company that invests in Treasuries – who by the way worked in Nixon’s law firm – tells a bunch of Chinese bureaucrats that the derivative is like taking a reflected image of a book and selling it, and making reflections of that and selling those, as if those were the book. At a certain point, it does get that absurd. The bureaucrats laughed.

I have it on good authority that some of the financial products sold at the height of the mania were simply nonsensical algorithms, like they came out of a boiler-room at MIT. I’m serious guys, I really think that some of those “financial products” really was just a fucking scam! Hahahaha! Bet you didn’t know about that! That shows how much you should listen to what I tell you! I’m sharp, right on the money here.

The other problem are brokerage firms like Goldman Sachs. First, they bet against their clients, because they’re in it for themselves and a few privileged rich clients, and not the guy with a paltry 2 million, or some pension fund, or village in Norway. They’ll perfume the turds and sell ’em like tulips sold.

And the final problem is that firms like Goldman Sachs really do manipulate supply. You heard about the warehouse where they’re keeping a truly massive stockpile of aluminum, in the midst of global shortage? The shortage is not necessarily a coincidence.

12. bob | September 19th, 2011 at 1:22 am

All of the “supply and demand” apologists are well represented in the comments. Just like Krugman, they contend that the price reflects the fundamentals.

What everyone, including the author, forgets is the HUGE influx into continuous commodities contracts over the past few years. One day of trading data would show none of this.

Want to know why gas costs so much? Ask your pension fund. They are sitting on tons of oil, and hoping to profit from rising prices.

That much money moving into a market does move the price, and they are called SPECULATORS.

And to the Libya connection, Libya was the only nation on earth with no national debt before the “war”. The first thing the french did was acknowledge the “rebel government” so that Libya could form a new Central Bank and BORROW from france to buy all of those guns. Now they HAVE to pump oil to pay them off.

13. WillEK | September 19th, 2011 at 2:21 pm

So, I don’t get much time to do my own investigations about the ‘real’ world, but theoretically we’re all just remembering what we knew in a past life time anyway.

If the market is an invisible hand, it’s the severed hand of slaves laboring in diamond mines. The market is also the very ‘respectable’ suited breast of the protestant work ethic. The market is a whole spectral host of ghosts mirroring and attempting to possess the whole world.

For people that work in financial sectors, they often see no difference. So we constantly hear about ‘increased volatility’ in oil producing regions. Libya doesn’t produce that much oil, both sides of the conflict are selling oil, and the war hasn’t actually moved that quickly. The real volatility is in the market itself, but financiers pretend they’re betting on something real.

If financiers pretend they’re betting on something real, the difficulty of navigating the quickly shifting financial market itself become the prime cost and ‘risk’ of speculation on oil–and all that’s priced into what we pay. In response the price of oil goes up, the market becomes even more unstable, all of which contributes to volatility which the market actually likes. Only in a quickly changing uneven plane can transactions occur at an ever quicker rate and high profits be collected, with the difficulty of collecting those profits always priced in. Just as advertising(the ghost of desire) is the preeminent feature of demand, capitial(ghost of dead labor) markets pricing precedes any ‘base reality’ of supply.

So Goldman’s not doing anything particularly nefarious on this one, it’s a basic function of the market come to fruition in late capitalism. In fact if they’re betting against their clients, then they *are* in fact taking an actual position on oil futures. We’ve been seeing an across the board surge in commodities all because the securitized bundled mortgages didn’t turn out so swell as a commodity. It’s a big parasitic ghost called financial capitalism.

14. Confused | September 19th, 2011 at 5:54 pm

With articles like these how did you guys avoid being assassinated in Russia?

15. captain america | September 19th, 2011 at 9:20 pm

no one has anything vile to say about the sort-of-cute-but-not-a-nine-or-ten girl in the daisy dukes in the pic? you guys are losing your edge.

16. Cernunnos | September 20th, 2011 at 7:31 am

@ 15 Captain America

I’d hit it for sure.

17. choodak | September 20th, 2011 at 9:48 am

What is so hard to understand here? These oil traders are not driving up the cost of oil and hence gasoline. They are actually philanthropists who trade oil to keep the prices low. This is evidenced by the free market phenomena called the “invisible pocket”, which is the source of their profits. You see the “invisible hand of the market” reaches into the “invisible pocket” of the market and hands the traders enormous amounts of money which is not built into the price of the oil being traded and has no effect on it. This only happens when the market recognizes that an actor is doing good things for the market, like keeping the price of oil low. This is just basic free market theory. Everyone knows this.

18. John Figler | September 20th, 2011 at 1:34 pm

The chick on the first photo is hot. Where is she?

19. captain america | September 20th, 2011 at 9:30 pm

well, i’d obviously hit it too. it’s just that with that goofy smile and the general daily-show-democrat look about her, i thought you guys could come up with something loads more offensive.

disappointed.

20. bob | September 22nd, 2011 at 12:43 am

Directly on point-

http://www.nakedcapitalism.com/2011/09/randy-wray-the-biggest-bubble-of-all-time-%E2%80%93%C2%A0commodities-market-speculation.html

21. I.N. | September 22nd, 2011 at 4:56 am

quote:

Goldman topped the list, with the equivalent of 451,997 contracts that would profit if oil rose, or “long” bets, and 419,324 contracts that would pay off if prices dropped, or “short” bets. Much of that likely represented Goldman being on the other side of client trades, according to people familiar with the matter.

close quote:

If Goldman were both long and short the SAME FUTURES CONTRACTS, than they were essentially market-neutral. Which means they would neither make money nor lose money, no matter what the market did. Except that not all the money they were investing was their, but their clients: meaning they could be pushing their clients into investing long, while privately betting the other way and watching the market price of oil tumble down and contract by over 5X in next year.

22. Mike C. | September 23rd, 2011 at 4:29 pm

I don’t know, man. That chick has anorexic legs and knobby knees. That and her expression (and that stupid sign) weird me out.

23. boogie mama | September 23rd, 2011 at 7:47 pm

the chick looks like 19 so no thanks

the dude is kind of retarded looking too

i demand more attractive protesters

24. Petkov | September 24th, 2011 at 10:58 am

You can edit my comments

25. tt | September 24th, 2011 at 4:34 pm

Disagreeing with a sockpuppet.

26. Brian | September 25th, 2011 at 7:10 pm

I am a big exile fan but this article is not convincing. Comment #6 is completely correct. There is no doubt that banks and investment funds are up to mischief on a regular basis, but nothing in this article points to that.

The banks make money by charging fees to clients to take these positions and they balance out the positions under a lower fee structure than the clients take… which is hardly scandal. And until you show me a smoking gun, literally a smoking fucking gun with a little white tag that says “You got me copper! I, Goldamn Sachs, and my buddy, Koch Supply and Trading, we did it! Take us away!” I won’t believe those nice friendly GS executives could do anything other than help the lead the market by the hand to the land of milk and efficiency.

27. rossiya | September 25th, 2011 at 11:58 pm

Howdeee there, folks! Have you got a minute to hear out yet another speculator apologist? I’m not like those other anonymous rat fuckers. I swear. I’m the real deal and entertaining, too! I gotta whole new angle to it, a story about speculators, Toyota and a sweet little grandma you might now by the name of Millie. I swear you won’t regret it! Step right up! Cuz I gotta a helluva show for ya! Show begins in 3 seconds….Here weeee go!

I agree with #6 and #26 if speculators were to make profits on volatility they would choose the options market, not oil futures. Hedging with futures is REQUIRED in commerce. When Toyota ships a $billion of autos, they would be incompetent not to lock their profits against currency fluctuation, when shipping “Cost and Freight” instead of “Free on Board.”

Then there are technical and fundamental speculators. These parties add liquidity to the market, and are vital in modern times. Without liquidity you get market crashes. In the 1987 US stock crash buyers could not find any sellers, who had disappeared off the board due to abusive trading practices like quote hunting. It is rather the systemic issues like flash crashes which make unfair, illiquid markets and usher in cascade failures which can take out 80% of a market in weeks. Disparaging traders will only hasten the stock crash, which is inevitable due to the demise of the baby boomers. Only the severity of the downturn in question.

28. Mike C. | September 26th, 2011 at 3:19 am

The rambling sock puppet comments sound punchy today. Are you guys drinking while you moderate? Or doing _other_ drugs? If so, e-mail me.

I agree with the right wing sock puppet lickspittles that it’s hard to tell what’s right and wrong in this crazy world. How can a speculator act against the interests of investors paying for his services when there is no you and me, only us, and we’re all interconnected, like Rand Paul said?

Except when we’re corporations, when there’s no us at all. Only a name representing people that can’t be prosecuted for their decisions under that name (except when Mitt Romney says that corporations are people, which they are — for the sake of argument, in the span of time that he’s saying it, and in no legally binding way). I mean, corporations got their rights through the same amendment granting them to former slaves. So are you some kind of racist or something?

And anyway, a disproportionate number of descendants of those “other” beneficiaries of the 14th Amendment wind up in jail, or subject to rushed, politicized executions anyway, so doesn’t at ALL JUST BALANCE OUT?

Sure, maybe you or I (or mostly African Americans, depending on the state’s history; though we’re all post-racial these days, so who can say WHO’S being fed into the state-subsidized private prison racket?) would go to jail for doing these things (if such “things” even exist, but y’know, it’s a crazy world and what not) on an infinitely smaller scale, but if “WE” suffer, isn’t everyone suffering? Haven’t the corporations, and the super studly CEO Atlases of the world, suffered enough… through us? They’re like Jesus in a way, really, if you think about it, and then stop thinking before the logic unravels itself. Why punish them further for serving their functions in the world, many of which no one can identify, prove are necessary, or that are actually demonstrably harmful?

How can we worry about an economy that’s been stripped to the bones by 19th century robber barons, filled with death from curable illnesses and despair on an unprecedented scale, when people who’ve never known real work or hardship in their entire lives have their VERY PRIDE and repulsively excessive discretionary income at stake?

What I’m saying is that rich people are simply awesome, and we shouldn’t bother to question it, but rather just get over trying to argue with their decrepit logic, and instead focus our energies on grinding ourselves to workaday nubs, saving all spare moments for praising them as unto gods. UNTO GODS!!! OUR BODIES ARE UNFIT TO INSULATE THEIR BLESSED SEPULCHERS!!!

On a related note, I have a wonderfully pithy article that mentions how people with money they can’t justify having prefer to view themselves. Number six in my horrible journey through libertarian scripture, Atlas Shrugged.

http://www.buffalobeast.com/?p=8057

29. The Other Jon | September 26th, 2011 at 10:56 pm

@ captain america

I’d fuck her harder than Julio the pool boy on Viagra fucking Lloyd Blankfein’s wife.

30. captain america | September 27th, 2011 at 7:26 pm

now that’s more like it.

31. amir_timur | October 14th, 2011 at 6:11 pm

They were also responsible for the subsequent crash to below cost of recovery prices for over a year.

Exiled is not becoming becoming fucking amazing, it always has been fucking amazing…Dolan/warnerd, included of course.

-Timur, professional rusty trombone player. I do private parties, bar mitzvahs, over-the-hill get togethers. I come with impeccable references. Clientele strictly VIP.

Leave a Comment

(Open to all. Comments can and will be censored at whim and without warning.)

Subscribe to the comments via RSS Feed