People don’t seem that interested in talking about Wall Street’s unpunished and ongoing rape of America anymore these days. And that’s too bad. Because Koch Industries has a lot more in common with Wall Street than most people realize.

Here’s a hint to how deeply the Kochs are involved in the same shady financial machinations we usually associate with Wall Street scammers: an investigation just released by the Center for Public Integrity reveals that the Kochs were major players in the fight against financial regulation in 2009 and 2010, bankrolling an army of lobbyists who swarmed Congress and shredded the fin-reg bill.

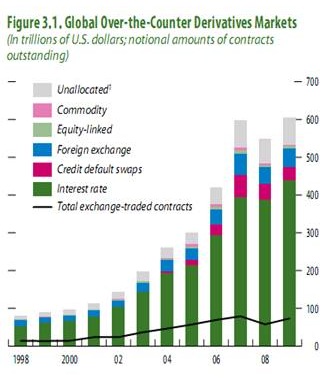

That’s right, we can thank the Kochs for the $400-600 trillion of so-called “over-the-counter derivatives,” essentially unregulated bets on everything from mortgages to oil prices to weather conditions, still being traded in the dark today, despite the fact that they were what sucked money out of the real economy, caused the meltdown of the world’s financial markets, precipitated the bank bailouts and are currently pumping up world food and energy prices:

That’s right, we can thank the Kochs for the $400-600 trillion of so-called “over-the-counter derivatives,” essentially unregulated bets on everything from mortgages to oil prices to weather conditions, still being traded in the dark today, despite the fact that they were what sucked money out of the real economy, caused the meltdown of the world’s financial markets, precipitated the bank bailouts and are currently pumping up world food and energy prices:

[Koch Industries] spent heavily on lobbyists who worked to shape the 2010 Dodd-Frank Act and other vehicles for financial reform. The Koch lobbyists focused, in particular, on provisions aimed at regulating systemic risk in the financial markets, and the use of derivatives. … And in past Congresses, Koch lobbyists labored to preserve the exemption, known as the “Enron Loophole,” that excused energy commodity contracts from regulation.

But the Dodd-Frank law gave the Commodity Futures Trading Commission and the Securities and Exchange Commission the authority to craft new rules to subject traders in the energy industry to increased regulation and transparency, capital and margin requirements, and supervision by a derivatives clearing house. Koch lobbyists worked to favorably shape the bill, and have not stopped working since it was passed.

Within a few weeks after President Obama signed the legislation, Koch lobbyist Gregory Zerzan had secured a coveted meeting with SEC Commissioner Troy Paredes, a Bush appointee, and his counsel, Gena Lai, to discuss how the government would implement the law.

Everyone was focused on demonizing Goldman Sachs and friends, not realizing that the Kochs and other shadowy billionaire families were right there with them. A Bloomberg article from the summer of 2010 gives a bit more detail about intersection of Koch and Wall Street interests:

Industry groups backed by Koch Industries Inc. and Cargill Inc. are fighting a Senate bill that would reshape almost 30 years of policy that allowed the $605 trillion over-the-counter derivatives market to surge and helped trigger the financial crisis in 2008.

Legislation introduced by Senator Christopher Dodd, a Connecticut Democrat, would give the Commodity Futures Trading Commission authority over most of the U.S. market, the broadest expansion of its authority since becoming an independent agency in 1974.

[…]

At stake is control of one of Wall Street’s most lucrative businesses. Trading revenue in unregulated markets last year generated an estimated $28 billion for five U.S. dealers including JPMorgan Chase & Co., Goldman Sachs Group Inc. and Morgan Stanley, according to company reports collected by the Federal Reserve and people familiar with banks’ income sources.

The over-the-counter derivatives market has escaped the commission’s reach since the first interest rate swap was traded in 1981. The transactions fell outside a law requiring that all futures be traded on regulated exchanges. Before swaps came along, risk-management trading outside of the exchanges was generally restricted to “forwards,” or bilateral trades that provided for physical delivery between commercial parties, such as a farmer and a grain elevator.

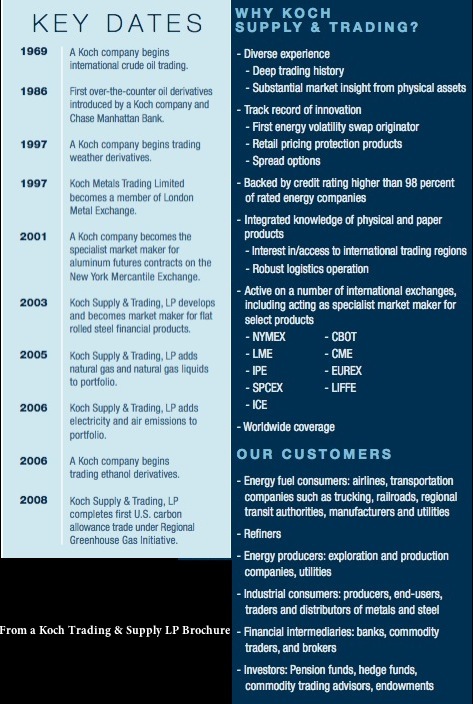

What has not been reported is that a big part of Koch Industries’ expansion over the past few decades has occurred in the dark realms of unregulated derivative trading. The Kochs weren’t just playing the market for themselves, but provided financial and risk management services to other companies. Now their clients include airlines, utilities, oil companies, pension funds, hedge funds and endowments.

It’s no secret. You can read all about in a brochure put out by the good folks at Koch Supply and Trading LP, one of the Koch Industries subsidiaries that provides financial services. The company trades in all sorts of derivatives, including crude oil, fuel, natural gas, electricity, emissions credits, metals, fertilizer, currency, municipal bonds, interest rates…the list goes on and on. Hell, they even trade in Leninist carbon credits and brag about being the first to offer clients weather derivatives—that’s when you place bets on the chance of rain.

But Koch Industries is not just a regular financial/risk management services provider. Because the company is a major producer and/or distributer of many of the commodities that it bets on, it not only has insider knowledge but physical control of market conditions. That gives it a whole lot of power to game and manipulate markets from both the speculative and physical ends—something that even the most powerful investment houses can’t do on their own. Best part is: only insiders know how much or how little manipulation exists because the derivatives are exempted from regulation.

Remember when Enron conspired to shutdown their power plants to jack up the price of electricity in California?

On one tape, an Enron official named Bill tells an employee called Rich at a Las Vegas power plant to take the plant offline on a confected excuse. The conversation took place on January 17 2001, in the last days of the Clinton administration, as blackouts were rolling across California, cutting off electricity to more than one million people, and after the energy secretary, Bill Richardson, had ordered generators across the west to direct their output to the troubled state.

“Ah, we want you guys to get a little creative, and come up with a reason to go down,” Bill says on the tape. “Anything you want to do over there? Any cleaning, anything like that?”

“OK, so we’re just comin’ down for some maintenance, like a forced outage type thing?” Rich replies, according to transcripts published yesterday. “I think that’s a good plan, Rich,” Bill says. “… I knew I could count on you.”

Is it so far fetched to think that the Kochs would do something similar with oil, ethanol, natural gas, fertilizer or any of the other commodities that they physically control? Of course they’re doing it. Why else would they fight to keep the “Enron Loophole” from being regulated out of existence?

As the Bloomberg article noted, the Kochs are not the only secretive multi-billionaires scamming America by gaming unregulated markets completely under the radar. So, if you’re a salaried journalist and want to dazzle your editors with a great story, you might want to look into the role that “family-owned” Cargill, Inc., the largest private company in America, has played in pumping up world food prices. That I’ll give out for free. Anything else will cost money.

Want to know more? Check out the new The eXiled Vs. The Koch Brothers page. And watch Dylan Ratigan giving us props for breaking the Koch/Tea Party story first:

Read more: cargill, charles koch, commodity futures, derivatives, energy, Enron, enron loophole, financial regulation, fraud, koch industries, kochs, scam, wall street, Yasha Levine, Class War For Idiots

Got something to say to us? Then send us a letter.

Want us to stick around? Donate to The eXiled.

Twitter twerps can follow us at twitter.com/exiledonline

21 Comments

Add your own1. L. Holst | April 9th, 2011 at 10:28 pm

It’s Bourgeoisie bully politics. Unfortunately, too many of those who are affected can’t even spell Proletariat. I’m not even sure this can be called class warfare. “War” implies both an offense AND a defense. Otherwise, it’s simply a hostile takeover of democracy by opulent combatants.

2. vortexgods | April 10th, 2011 at 10:03 am

“People don’t seem that interested in talking about Wall Street’s unpunished and ongoing rape of America anymore these days. And that’s too bad.”

People in the media and people in politics, you mean. If you mean in the sense of “We The People,” well, we don’t get a say.

3. floodingupeconomics | April 10th, 2011 at 11:26 am

Good Grief. The sad thing is that everyone who knows anything about finance isn’t surprised by this article. I mean, the more unregulated the market the higher the profit. And outside of the drug market, which Wells Fargo got in trouble for dabbling in recently, the derivatives market is one of the most unregulated.

It is pretty messed up that such a market mover is playing the derivatives game. In any market where there is a profit always ask who is the winner and who is the looser (this is a basic econ lesson). Seems like Wall-Street is inserting itself as a middle-man in the commodities market and the average joe who buys things made with commodities is the looser.

4. Jyp | April 10th, 2011 at 12:45 pm

Well, had you read the books, you’d have known that ol’ Marx guy predicted all this stuff a long time ago. A few years back it was fashionable among smart alecs to say about Marx, “No accumulation.. no immisuration.. therefore no relevance.” Um.. do you still hear ’em sayin’ that? I think not. Well, except for the drones of ol’ Ayn Rant and similar nutjobs, of course, but the terminally obtuse.. do we really care what they think or especially what they say? The insane rantings of, say, Francis Dec are like way more fun that anything that droid Ayn Rant ever coughed up ie., while she was coughing her stupid tobac-addled lungs out. Neener neener.

5. lotario castillo | April 10th, 2011 at 6:41 pm

The Koch credo: “Let them eat cake.”

We need to remind the Koch bros. what happened to Marie Antoinette. These times desperately call for another Paul Revere and a John

Wilkes Booth with a road map to these boys or maybe we should put them into a submarine and send them to Libya — they would be more at home with that system of governance.

6. Fischbyne | April 10th, 2011 at 7:16 pm

Derivatives will remain unregulated because, like Lenin said, capitalists will sell you the rope to hang them. And soon the Democrats will be asking us to put Summers, Geithner and/or their pals in for another term. They really can’t help themselves from self-destructing.

7. Derp | April 10th, 2011 at 8:42 pm

I may be on vacation somewhere between San Francisco and the Gulf of Mexico but I am too much of a Koch-sucker to just sit back and let you denounce sucking on Koch! What’s so wrong about it? It’s a perfectly fine lifestyle between two or more men and God has no problems with it, who are you to be prejudiced and cast judgement upon this fine lifestyle? If there’s anything I can’t stand it’s intolerant, petty bigots like you guys!

Oh great mighty overlords of money and Republican principles, Mighty Lord Kochs! I know you and your many pasty white servants read this blog! I, Derp, your most loyal and subservient of Koch-suckers beseech thee to bribe Mark Ames and Yasha Levine so they’ll stop writing bad stuff about you!

Seriously, you’ve made like 20 billion in the last few years. A bribe of a few million would be like a fart in the wind to you guys and would save you a ton of headaches and you could even have them sucking on your Kochs too, derp derp! And if you bribe em successfully then be sure to bribe me too, derp derp!

8. allen | April 10th, 2011 at 11:37 pm

The problem is that the public has a hard time being reflexive about shit that’s over their heads. They hear the word “derivatives” and they get their blank stare on.

Only the sheer volume of pain and anguish associated with an even deeper crisis — and it looks like we’ll be getting one sooner or later — will shake them up enough to really think about it and string people like the Kochs up.

We will need to pray it happens when a Republican is in office rather than a Democrat. That could be all the difference between our seeing a reactionary fascist response to the crisis or a more enlightened turn.

Yes, in my opinion, people really are that dumb.

9. Erik | April 11th, 2011 at 7:29 am

First class stuff as always, Mr. Levine.

10. floodingupeconomics | April 11th, 2011 at 9:02 am

@allen

“The problem is that the public has a hard time being reflexive about shit that’s over their heads.”

As a graduate student of economics I’ll tell you this is patently false. I can’t remember how many times I’ve heard some loon blabbing on about the wonders of the free market, or why taxes are bad,… or some x,y,or,z… who clearly has no idea about anything other than a few talking points they heard a pundit mention on TV.

The problem is more likely control of culture/discourse and willful stupidity.

11. underdoglet | April 11th, 2011 at 10:26 am

Is the research report organization Center for Public Interest (AEI supported) or Center for Public Integrity?

12. lololol | April 11th, 2011 at 2:04 pm

my head hurts when i think about derivatives.

it sooo much easier to say “abortion is murder” and get indignant over keeping condoms out of johnny’s classroom 🙂

won’t anyone think of the children?

13. Ilona | April 11th, 2011 at 4:08 pm

As Tacitus notes in Annals: “Sorry folks. There’s not really anything inspiring to write about nowadays, because of the absence of all-out war. So, now all I’ve got is scribble down these utterly boring topics like economics, politics and blaa, blaa.”

I reckon it goes to show something fundamental about human nature.

14. allen | April 11th, 2011 at 8:10 pm

floodingupeconomics:

I think I should have been more clear. By “reflexive” I don’t mean simply having an opinion (including heated fervent ones). I mean taking the time to really sift out what’s going on, and reflect on it, rather than just shoehorning the broad outlines of what seems to be happening into whatever their set “script” diagnosis already is.

15. King Mob | April 12th, 2011 at 4:10 pm

People don’t understand commodity investing at all. They don’t really get that unless you buy physical oil, and hoarded, you can only drive the price up so long. Or, you have to buy more and more futures. Speculative purchases can only increase the price of goods in production for a transient period, unless you have infinite money.

The funniest thing, look at that derivatives chart. What is really dominating the OTC market? It isn’t oil. The commodity sliver is almost invisible. Almost all of them are fixed income and currency market products.

16. Jimmy | April 12th, 2011 at 4:19 pm

Apparently no one looked at the Over the Counter bar chart before this was published. All I can see are interest rate hedges, forex contracts, and Credit Default swaps. The commodity sliver is paltry. If you connect the dots, not that you are trying, you will notice everyone is hedging their currency and fixed income exposure. Possibly because the value of paper currency is falling, and this shows up in the commodity market. But don’t let get in the way of a good story.

Do you know who uses these hedges? A lot of them are union pension funds, municipalities, and bond portfolio managers (and yes, the banks who facilitate these transactions). The people who are probably just trying to make it so people can retire when they get old. Very sinister stuff, this bond market. People who want to borrow and people who want to lend, getting together so one can have income and the other can have cash today. Worse yet, they try to use hedges so they can adjust their risk. Now doesnt that sound nice? Who would be against the Kochs helping a couple of pensioners to retire?

Yep, it’s one happy derivative family, with Wall Street banker jocks and Grandma Millies all coming together under the great white arches of a new economic paradigm of technology and efficiency. Working together in synergy like AOL Time Warner.

17. CommentingID | April 13th, 2011 at 8:40 am

@ King Mob,

The Koch’s core biz is OIL. They have pipelines that could zig-zag from coast to coast several times over and from Canada too.

They have refineries also.

They also have a combined personal wealth of 44 Billion and hold spot 4 & 5 on Forbes new richest in the world list.

They make over 100 Billion per year.

18. King Mob | April 13th, 2011 at 2:26 pm

@Commenting ID

What exactly is your point? Their pipelines and refineries allow them to hoard oil?

19. Derp | April 14th, 2011 at 8:22 am

@16 DERP DERP, YEAAAAAHHHHH! The Kochs are not shadowy, evil, greedy, money-grubbing, river-polluting corrupt SOBS like these Commies think, they’re all about helping out the working man cause they just love poor people so much, derp derp!

20. Jimmy | April 16th, 2011 at 8:04 am

@ Derp, I really don’t give a fuck about the Koch brothers. They don’t do anything to me personally that is worse than say, the US Government. The author did nothing in this article but bring in a bunch of Koch funded sock puppets.

21. unfairly balanced | July 20th, 2011 at 7:26 am

The Reign of the Koch dynasty will only end when the foot soldiers of the Tea Party find out they’ve been fucked, royally. This could take a long time as Fox and the neocon media continue to preach how bad it is now and how good it’s going to be when the Rightou$ finally win. Wonder if the Kochs know their Tea Partys brainwashed grass roots are in control of more automatic and big clip semi-automatic weapons than the US military. I pray they do not die from natural causes,like rope burn.

Leave a Comment

(Open to all. Comments can and will be censored at whim and without warning.)

Subscribe to the comments via RSS Feed