I was channel surfing last night when I stumbled upon a couple of Citi commercials—or PSAs, since taxpayers own more than 30% of Citi—that offered viewers a number of depression-era, cost-cutting lifestyle suggestions. With the billions in bonuses Citi has paid out to their workers, the ads so brazenly mock Wall Street’s massive plundering of taxpayer wealth that it’s almost hard to believe that Citigroup had the guts to have them made—and bill us 30 cents of every dollar paid for production and air time costs. But they did.

The first one starts out with a white post-college hipster type who says he maps out the cheapest gas stations to save a few bucks. An African American yuppie dad says he buys everything in bulk, including movie tickets. A white woman in her 40s buys dog food with credit cards that gives her cash back. A voice over says Citi has ways to help us spend wiser, and then the screen is subliminally flashed with a scattered list of ways you can save: car pool, cheaper gas, buy in bulk, diversify investments, save 2% of salary, purchase off-seasony, buy generic, drive less, make gifts personally, debit cards with rewards, but most importantly: get FREE FINANCIAL ADVICE. That part is in bold.

The second one has, among other segments, an office worker talking about biking to work to save the money he spends on gas, and a woman who says she hasn’t bought shampoo in years because she takes hotel shampoo bottles when she travels.

Yes, Americans. Drastic times call for drastic cost-cutting measures, not to mention the use of predatory Citi credit cards and giving the power to Citi financial advisors to diversify your savings into personal bonuses.

As I watched these spots, I couldn’t help but think of the $5.3 billion in executive bonuses that Citigroup paid out last year, straight out of the $45 billion in bailout money we handed over to them. Then I remembered last week’s story about the Citigroup trader who’s fighting for his “right” to receive a $100 million bonus, which he is willing to sue Citi to get.

The man in question is Andrew Hall, an oil trader for a Citigroup subsidiary called Phibro. He’s being supported by Wall Street types because he’s seen as very important to Citigroup, meaning he’s made them a lot of money speculating on the oil market and will continue to do so. Hall is credited with “predicting” the price of oil would skyrocket and made hundreds of millions of dollars for the company.

Trader Hits Jackpot in Oil, As Commodity Boom Roars On

Mr. Hall Bet Early On Market Shift; Buoying Citigroup

One of the biggest beneficiaries has been Andrew J. Hall, an enigmatic British-born trader who, five years ago, anticipated an important shift in the way the world valued oil — and bet big.

Over the past five years, Mr. Hall’s compensation has totaled well over a quarter-billion dollars, according to a Wall Street Journal analysis of securities filings and Mr. Hall’s compensation structure.

Who is Andrew Hall? According to New York Mag, he is “one of the few eccentric and wonderful folks who float among or above the wretched, amoral meatheads” of Wall Street. He leaves his office every afternoon to “to row or practice calisthenics with a ballet teacher” and is “also one of the world’s top collectors of contemporary art.”

But in reality Andrew Hall, who looks like a cancerous Billy Bob Thornton, is a hardcore insider gambler with a long winning streak. He works in a trading outfit that has a long history of market speculation by virtue of manipulation. Hall was one of the key players responsible for driving up the price of oil, creating a speculative bubble that spiked 700% in price and cost the economy an estimated $500 billion dollars just from 2006 to 2008.

A Secret Oil Gusher Inside Citigroup

By PAM MARTENS

If you want to flush out market manipulation, don’t turn to the sleuths in Congress. They’ve been probing trading of the oil markets for two years and completely missed a company at the center of the action. During that period, a barrel of crude oil has risen from $50 to $140, leaving a wide swatch of Americans facing a choice this coming winter of buying food or paying their heating bill.

The company that Congress overlooked should have been an easy suspect. It launched the oil trading career of the infamous fugitive, Marc Rich, pardoned by President Clinton in the final hours of his presidency. It was at one time the largest oil and metals trader in the world. In the late 90s it bought up 129 million ounces of silver for legendary investor Warren Buffet’s company, Berkshire Hathaway, in London’s unregulated over-the-counter market. In 1990, it was one of the first entrants into an ill-fated Russian oil venture called White Nights. In 2005, while part of Citigroup, the largest U.S. banking conglomerate perpetually scolded for obscene executive pay, it handed its chief and top oil trader, Andrew J. Hall, $125 Million for one year’s work. According to the Wall Street Journal, that was five times the pay package for Chuck Prince, CEO of the entire Citigroup conglomerate that year and $55 Million more than the CEO of Exxon-Mobil.

Read more: andrew hall, bailout, citi, Citigroup, Class War For Idiots, speculator, Yasha Levine, Class War For Idiots

Got something to say to us? Then send us a letter.

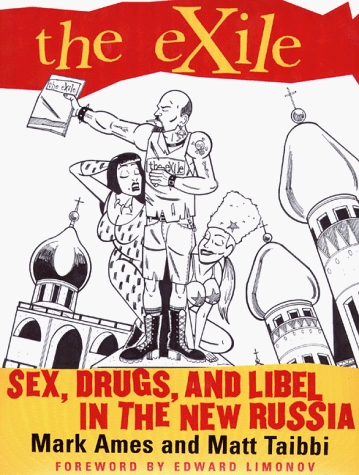

Want us to stick around? Donate to The eXiled.

Twitter twerps can follow us at twitter.com/exiledonline

14 Comments

Add your own1. T. Hallman | August 1st, 2009 at 4:59 pm

What kind of interest rate can I get from Citi for purchase of a few hundred kilos of Vaseline?

2. Paul Yarbles | August 1st, 2009 at 5:25 pm

Why are fucking welfare queens getting bonuses?

3. Realist | August 1st, 2009 at 5:47 pm

Having witnessed the public sentiment in Germany and France, I am astonished by the reaction (or lack thereof) of the american plebs. Biggest heist in history, bankers marauding in the debris of a once great nation. And the only reaction being angry YouTube videos…

I do not believe in the inherent bravery of the old continent, but at least the French are crying for blood. And if this continues, they will get it.

4. atothek@ak47.com | August 1st, 2009 at 5:57 pm

Yeah, this is the same deal as the alleged “sanctity” of GS’s contract with AIG. Too bad motherfucker. Your counter-party went BROKE, so what should have happened was rich dude gets in line with the all the other creditors at bankruptcy court, and his actual payday is pennies on the dollar after the cubicles are auctioned off. The only reason this asshole still has an employer to sue is cuz of nobody knowing what degree of Road Warrior scenario happens if Citi goes broke. His “fair’s fair” claim is totally invalidated by the nationalization in lieu of bankruptcy that happened. If he was a moral or thoughtful being he’d forgo the claim, cuz the only reason it’s even an issue is the WELFARE that was given by the taxpayers. But obviously what we’re dealing with here is no man but a vampire in want of a stake through the heart.

5. אברהם | August 1st, 2009 at 6:51 pm

Realist:

I can’t help but think there’s a silver lining to American cowardice. When European bosses threaten to lay off workers, or cut benefits or pensions, or increase hours, the plebes riot a few days and some kind of deal gets worked out. Back to capitalism as usual, albeit less parasitic than the American species. Definitely prettier than the misdirected rage (workplace shootings and racism) you see in the US. But that same lack of spine has allowed American political culture to sink to the point it’s at now. And it’s only going to get worse in the next decade — just look at the health care “reform” coming down the pipe.

Surely there’s a point where Americans will fight back (and if not, they deserve what they get). The oligarchy has already racked up a historically unprecedented score; it’ll take a revolution to settle it. I’m not so sure that’d a bad thing, either — do any of you honestly believe that American democracy is still functional?

6. Gaucho | August 1st, 2009 at 8:43 pm

I have to grant that his castle is surprisingly well built, not at all the kind of tacky architecture a parvenu usually buys into. I didn’t think you could find this kind appropriate taste outside of Europe. It is because of talent like this that these evil fuckers end up ruling us.

7. Realist | August 2nd, 2009 at 9:51 am

@ אברהם

The hope for a more benign order after a political collapse, the hope for a quick collapse itself, may not lead to instant gratification. The US government seems to be very much aware that the current model of ripping off the productive class is not sustainable for much longer. And, from my perspective, it is obvious they are preparing for domestic unrest. The “homeland brigades” under NORTHCOM, the growing police state (+DHS), the contingency drills, the threats of martial law…

It seems probable that the scenario “collapse” would leave Joe Blow in the midst of economic devestation, facing a ruthless security apparatus similar to the 2005 Katrina preview. This will get very ugly.

But even assuming the ruling oligarchy would be displaced: Alternatives? Who would take their place? And would such people and institutions prove to be any more legitimate than the current crop of kleptocrats?

I am not an American and I dont live there. I have no stake in how this turns out. But without a clear conception of viable alternatives, a revolution is nothing but a rebellion. And rebellions always fail.

8. Mike Gogulski | August 2nd, 2009 at 9:58 am

It’s at times like these that I take delight in no longer being a US tax slave.

9. אברהם | August 3rd, 2009 at 6:40 am

Well, Realist, I have this fantasy. As existing institutions lose all legitimacy (and I think this is already happening; that nobody cares about Goldman et al’s shenanigans indicates they don’t expect any better) and the global supply chains that feed our consumption dissolve (peak oil, economic collapse, et cetera whatever) Americans would spontaneously form anarchist communes and live happily ever after.

I’m cynical enough to recognize that as delusional. At this point I’d settle for authoritarian government that’s more equitable to the bottom 90% than our current oligarchy. That probably won’t happen either.

The best I can see happening is a mass social movement forming as conditions further deteriorate. That’s the only way even marginally significant change has occurred in the US. Judging by the history of the civil rights and labor movements, though, your image of post-Katrina New Orleans writ large is scarily accurate.

Sometimes I wonder whose wife I fucked in a past life to deserve being born into such interesting times.

10. RT Carpenter | August 3rd, 2009 at 8:28 pm

The axis of evil runs from the FED and Treasury to Wall Street. Goldman Sachs is a triple dipper! $10 billion TARP, $13 billion AIG conduit, $29 billion FDIC backing. Ben Stein commented on GS about two years ago in the NYT. He called Paulson’s Treasury appointment improper since his firm GS was shorting the same derivatives it was selling the suckers. But the Bush and Obama pay-offs are more than unethical. This is the greatest fraudulent transfer of all time.

11. Tommy Jefferson | August 4th, 2009 at 10:55 am

The American people deserve the butt-raping they are receiving from their fascist government. They voted it into existence based on promises of being able to use government violence to live at someone else’s expense.

Using violence to appropriate other peoples’ resources is immoral. They deserve to suffer.

12. aleke | August 7th, 2009 at 3:19 pm

If Thomas Jefferson were still alive he would’ve sent you to gulag. He’s a rational man after all. Just like Adam Smith.

13. aleke | August 7th, 2009 at 3:19 pm

[in response to Tommy]

14. Realist | August 8th, 2009 at 9:24 am

I acutally contemplate buying some former middle class american slaves. You can get the suckers with worthless BA degrees for 25 grand or less. The sole purpose of their 90hr week will be to to come up with odes to my visionary greatness and to formulate new rationalisations for my sadistic abuse of them.

Leave a Comment

(Open to all. Comments can and will be censored at whim and without warning.)

Subscribe to the comments via RSS Feed