This article was first published in The Daily Banter

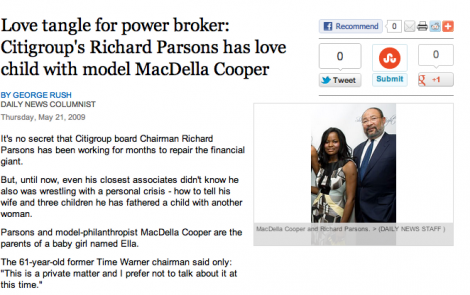

Last month, shareholders finally rebelled against Citigroup, the worst of the Too Big To Fail bailout disasters, by filing a lawsuit against outgoing chairman Dick Parsons and handful of executives for stuffing their pockets while running the bank into the ground.

Anyone familiar with Dick Parsons’ past could have told you his term as Citigroup’s chairman would end like this: Shareholder lawsuits, executive pay scandals, and corporate failure on a colossal scale. It’s the Dick Parsons Management Style. In each of the three companies Parsons was appointed to lead, they all failed spectacularly, and somehow Parsons and a handful of top executives always walked away from the yellow-tape crime scenes unscathed.

This past April, for his final act as Citigroup’s chairman, Dick Parsons made sure that Citi’s top executives were handsomely rewarded for their failures. He arranged a pay package for CEO Vikram Pandit amounting to $53 million despite the fact that Citi’s stock plummeted 44% last year, and has woefully underperformed other bank stocks even by their low standards. Citigroup, as you might recall, got the largest bailout of any banking institution, larger than BofA’s– $50 billion in direct funds, and over $300 billion more in “stopgap” federal guarantees on the worthless garbage in Citi’s “assets” portfolio. Those are just the most obvious bailouts Citi received—this doesn’t take into account the flood of free cash, the murky mortgage-backed securities buyback programs, the accounting rules changes that allowed banks like Citi to decide how much their assets “should be worth” as opposed to what they’re really worth on their beloved free-market, and so on…

So just as Dick Parsons stepped down as Citigroup chairman last month, shareholders finally rebelled, suing Parsons, CEO Pandit and a handful of executives for corporate plunder.

Again, with Parsons, it’s the same story every time: Three executive jobs, three disasters, each worse than the previous one.

Before Citigroup, Parsons headed AOL Time Warner, where he helped pull off what is widely considered the single worst business deal in corporate American history: a fraud-rife merger that wiped out $200 billion in shareholder value, ruined employees, retirees and investors, sparked numerous criminal investigations and dozens of lawsuits, and yet somehow managed to enrich a tiny handful of executives—including Dick Parsons—to the tune of hundreds of millions of dollars.

Why would the government agree to name the AOL Time Warner failure Dick Parsons, Chairman of Citigroup in January 2009, just as the world’s largest banking institution was taking the biggest bailout packages, and just as its legal ownership was taken over by the American public?

It’s a basic question that goes to the heart of Dick Parsons’ rise to the top. It’s a question that should have been put to AOL Time Warner when he was thrust to the top of that firm, considering the giant S&L failure Parsons oversaw before moving over to AOL Time Warner.

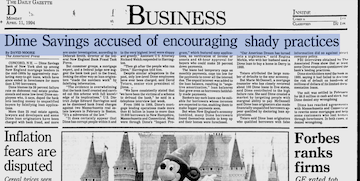

From the late 1980s through the mid-1990s, Parsons served as a top executive and then chairman of Dime Savings, the Northeast’s poster child for savings & loan criminal fraud. Dime was Parsons’ first executive job—and Dime turned out to be the New England region’s closest equivalent to Charles Keating’s Lincoln Savings, a giant criminal fraud mill with victims ranging from gullible low-income home buyers to entire regional economies laid waste to fraud-pumped housing bubble.

At least in the S&L crisis of the late 80s and early 90s, some people went to jail—and Dime’s affiliates in the New England states sent scores of fraudsters to prison. Those investigations led to Dime’s New York headquarters where Dick Parsons was, but for some strange reason, even with a federal judge openly demanding criminal charges for Dime’s senior executives, in the end, Parsons and the others got away with it.

Here, for example, is a 1994 article from the New York Times about what went on at Dime Savings under Parsons’ leadership. Notice the remarkable similarities in the mortgage scam described in the article to the mortgage scams pulled off in our time:

U.S. Fraud Inquiry Into Dime’s Mortgages

Federal officials are investigating the Dime Savings Bank for possible fraud in its home-mortgage business.

The inquiry, which is being directed by the United States Attorney’s office in Concord, N.H., is apparently seeking to determine whether Dime’s executives knew during the late 1980′s that documents were falsified to allow unqualified borrowers to get loans.

The investigators also apparently want to know whether those executives knowingly allowed such mortgages to be included in packages of loans that were sold to investors.

The loans in question are known as low-documentation loans. Unlike traditional mortgages, they were often approved on the spot, with little or no background check on an applicant’s qualifications, which were often questionable.

Sounds familiar, doesn’t it? What happened at Dime in the late 1980s—the predatory subprime loans hard-sold to the least sophisticated borrowers, loans with hidden adjustable rates which they called “low-verification” mortgage loans… the fraud in the documentation, preying on the least credit-worthy, least qualified borrowers in order to pump out as many bad subprime loans as fast as possible, dumping the losses on the government—what happened under Parsons’ watch in the late 1980s, only to be revealed in the early-mid 1990s, was repeated on a grand scale a decade later at banks like Citibank, resulting in massive payouts to a small group of executives, and devastation for everyone else.

Now that Parsons is finally stepping down as chairman, I want to briefly re-trace Dick Parsons’ career. His rise from a middle-class, frat-boy slacker, to suddenly find himself at the very pinnacle of American power and finance– offers us some insight into the culture and ideology of the ruling One Percent. To quote Starship Troopers: “To defeat The Bug, we must know The Bug.”

Why Dick Parsons? Why is failure so valuable? Why was Parsons so handsomely rewarded in perfect inverse proportion to the spectacular damage he caused to so many others? That is the big question.

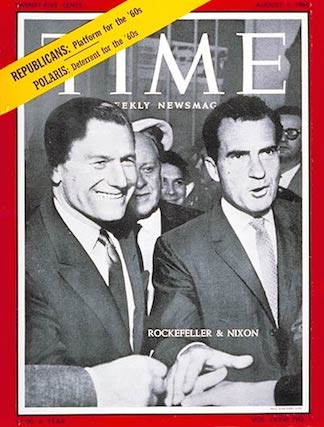

Dick Parsons’ biography can be summed up in two phases of his life: before meeting Nelson Rockefeller, and after meeting Nelson Rockefeller.

Before meeting Nelson Rockefeller, Dick Parsons was a self confessed clown from a middle-class African-American family in Brooklyn. “Left to my own devices, I don’t feel any compulsion to strive,” he told to the New York Times. Race was never an issue with Parsons either: ”I don’t have any experience in my life where someone rejected me for race or any other reason.’

So Parsons dropped out of high school with a “C” average, earning a GED certificate. He enrolled in the University of Hawaii for reasons he could never really explain, joined a frat, and became their social chairman. As one of Parsons’ frat brohs recalled to journalist Nina Munk, “Here’s this guy who’s at the bar sixty-seven days in a row and, as you can imagine, he did very poorly in school.”

Parsons did worse than poorly: He flunked out of U. Hawaii. Without earning a degree.

And then slacker Dick Parsons met oligarch Nelson Rockefeller, and from here on out, Parsons lived out a Cinderella fairytale for the One Percenters. As luck would have it, Dick Parsons’ grandfather was once a favorite groundskeeper at the famous Rockefeller Compound in Pocantico Hills and lived in a hut on in the shadow of the oligarchs’ mansion. Soon, Dick Parsons and his wife would move into one of those same groundskeepers huts under Nelson Rockefeller’s patronage.

As Parsons later admitted, “The old-boy network lives…I didn’t grow up with any of the old boys. I didn’t go to school with any of the old boys. But by becoming a part of that Rockefeller entourage, that created for me a group of people who’ve looked out for me ever since.”

And so, magically, despite failing out of Hawaii without a degree, Dick Parsons was accepted into the Albany University Law School program. Nelson Rockefeller happened to be in Albany too at the time, serving as governor of the state of New York. Dick Parsons was chosen to be an intern for Rockefeller.

Whereas before, when Parsons didn’t study he failed out, now, after meeting Nelson Rockefeller, by some magical twist of fate, he was the law school’s valedictorian. Sandy Stevenson, a fellow law school classmate of Parsons’ who became a professor at Albany Law,recalled: “He didn’t study hard. He played a lot of bridge. He was so smart he didn’t have to study, and he was in the cafeteria playing bridge a lot.”

Parsons took the New York state bar exam, and scored the highest in the state, beating out all the high-achieving Ivy Leaguers that year. It may have been a complete coincidence, but Nelson Rockefeller’s right-hand man, Harry Albright, was in charge of both the law school internship program with the governor, and in charge of scoring the New York state bar exams.

“The key to success is to own nothing, and control everything”

By another coincidence in the 1980s, the same Harry Albright headed the Dime Savings thrift, and this same Harry Albright appointed Dick Parsons to replace him.

Parsons did something right at Dime Savings. Something wrong for everyone else, but something right for those who mattered. A handful of executives pulled off what looks remarkably like the sort of “control fraud” scheme described by Bill Black: Quickly saddle the thrift with enormous amounts of bad mortgage loans, inflate the assets, loot, cash out, and dump the problem on the public.

Parsons proved himself useful in that scam. He played wingman for Harry Albright as they loaded Dime up with bad mortgage loans in warp-speed time, practically doubling the asset base from less than $7 billion in early 1987 to over $12 billion in late 1988. At the same time, as reported in the New York Times, “Checks from thousands of homeowners stopped coming.”

With the asset base pumped up and ready to collapse, Albright cashed out and moved his lawyer, Dick Parsons into the CEO’s seat to cover his tracks.

Often times I hear non-One-Percenter Americans ask, “How do these people sleep at night?” Harry Albright answered that question to the New York Times: “I am entirely unapologetic.”

Promotions and appointments followed in rapid succession for Parsons for a job well done, his career advancement largely to helping hand of Nelson Rockefeller’s brother, Laurance Rockefeller: board positions at Fannie Mae, Philip Morris, Citibank, and most importantly, Time Warner. Thanks to Laurance Rockefeller’s introduction, Steve Ross brought Parsons onto Time Warner’s board, paving the way for Parsons to replicate his “success” at Dime over at the new AOL Time Warner, and later again, to replicate his AOL Time Warner “success” at Citigroup.

After Parsons took over AOL Time Warner, the New York Times summed up his career trajectory:

In 1988, Mr. Parsons was recruited to serve as president of the Dime Bank by Harry W. Albright Jr., another former Rockefeller aide. A few years later, the Rockefeller hand intervened again: on the recommendation of Laurance Rockefeller to Steven Ross, Mr. Parsons was invited to join Time Warner’s board in 1991. He became president of the company in 1995.

Parsons knew where his bread was buttered, as captured with painful, barely-concealed patronizing racism in this New York Times profile from the early 1990s:

”I owe them,” Mr. Parsons said of the Rockefellers one evening as the Dime’s chauffeur took him to Pocantico Hills. ”I didn’t go to the right school. I wasn’t from the right side of the tracks. But when I was fortunate enough to hook up with Nelson Rockefeller, that’s how I developed my own network.”

And the feeling was mutual, in a vague, cold, One Percenter sort of way:

“My brother liked and admired and relied on him very much,” David Rockefeller said. “I’ve always had very warm feelings about him myself.”

In fact, all the One Percenters loved their Dick Parsons:

”He’s one of the few people in this industry that I would just as soon have a shake-hand deal with as a legal contract,” said Rupert Murdoch, chairman of News Corporation, who needed the Time Warner system to carry the Fox News Channel.

Michael Eisner of Disney, which battled with Time Warner for access, also praised Mr. Parsons: ”He handled himself in such a gentlemanly and reasonable way that he got the job done.”

Everyone else would disagree of course—as revealed in the dozens of lawsuits against Dick Parsons and his fellow execs at AOL Time Warner. But they don’t count—and besides, all those settlements and legal fees were covered by AOL Time Warner, meaning Parsons and the executives were able to plunder the company to pay for their previous plunder of the company. No skin off Parsons’ back, and no skin off of the backs of those whom he “owes.”

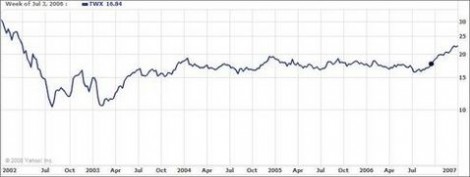

AOL TimeWarner stock during Parsons’ tenure: Oops, missed the entire bull market run!

It all reads like some half-baked hippie’s paranoid Bilderberg-obsession—and yet, Parsons’ failure up to the top, guided all the way by his “network” of oligarchs, is just the flat, unvarnished reality.

In 2007, as Citigroup director in charge of the compensation committee, it was Parsons who approved the obscene pay for outgoing CEO Chuck Prince. Parsons also played a key role in hiring current CEO Vikram Pandit, and in Citi’s awful decision to buy Pandit’s failing hedge fund, Old Lane, for $800 million in 2007—netting Pandit a cool $80 million. Shortly afterwards, Citi shut down Old Lane, collapsed, and turned to taxpayers for a $50 billion bailout and hundreds of billions more in guarantees and the like.

In November 2008, lifelong Republican Dick Parsons was brought into President-elect Obama’s transition team, thanks to then-Citigroup chairman Robert Rubin. There was talk that Parsons might be Obama’s Treasury Secretary; instead, in January 2009, he replaced Rubin as Citi’s chairman.

Almost immediately, Parsons went to work fighting executive compensation limits, and obstructing banking reforms and making sure that FDIC chief Sheila Bair was unable to do her job effectively. Using taxpayer dollars, Parsons hired one of the darkest operators in DC, lobbyist Richard Hohlt, to fight against the interests of the same taxpayers who had bailed Citi out and who now effectively owned the bank. Hohlt’s impressive resume includes his role in drafting the 1982 savings & loan deregulation bill that most agree made possible the S&L collapse possible—a bill that helped make Dick Parsons and his Dime Savings pals rich. Hohlt lobbied for the scandal-ridden Fannie Mae (where Parsons served as a board director), for Washington Mutual (which took over Dime Savings), for Time Warner… Hohlt even played acentral role in the Valerie Plame scandal, serving as go-between in the leak between Karl Rove and Robert Novak.

When news first hit that Parsons had hired Hohlt, former banking regulator Bill Black commented: “It is singularly obscene that any recipient of taxpayer assistance through the TARP program during the current financial crisis would hire one of the most infamous lobbyists in the world to represent them.”

Naturally, Dick Parsons hired him to protect Citigroup—and it worked. Talk of breaking up “Too Big To Fail” Citigroup is pretty much over now. The perpetrators are safe. The shareholders are angry, as are Citi’s victims of fraud in the years since Parsons joined, as are the rest of us who didn’t profit from the plunder of Citigroup, and the plunder of the treasury to keep Citi going.

Today, Parsons is gone from Citigroup, but he’s not gone from our lives: He’s just been appointed as Gov. Andrew Cuomo’s “education czar” for education reform in the state of New York. Sorry kids.

All of this begs the question: What makes whacky conspiracy theorists any worse or any more deluded than the “Meritocracy Theorists” who’ve been promoting a fairy-tale version of America since Reagan’s Revolution, a fairy-tale version in which talent, hard work and innovation are supposedly rewarded, and failure is punished? It’s time to admit it once and for all: Failure is the whole point. Failure makes looting easier and quicker. In that sense, Dick Parsons has been rewarded for a job well done.

The game is rigged, and Dick Parsons’ rancid story gives some insight into how the rigging operates, and why failure is so valuable. What looks like failure to us, like losing our jobs and our future and our democracy—is success and riches to the One Percent who profit from this dystopian setup.

Read more: aol, aol time warner, bill black, citibank, Citigroup, dime savings, nelson rockefeller, Obama, robert rubin, rockefeller, savings & loan, the dime bank, Mark Ames, Class Warfare

Got something to say to us? Then send us a letter.

Want us to stick around? Donate to The eXiled.

Twitter twerps can follow us at twitter.com/exiledonline

19 Comments

Add your own1. Anarchy Pony | May 14th, 2012 at 9:55 am

Boy that profit motive sure leads to some upstanding behavior.

2. Fissile | May 14th, 2012 at 10:49 am

Nice!

I saved this to show to some unreconstructed “free market” types….not that they will admit any of this is true. The best I can hope for is that I can cram enough of this into their miss-wired brains to cause an overload…..like one of those Star Trek androids trying to reconcile a cognitive dissonance problem.

“He is successful because of merit, but he was given preferential treatment, but he is a operating in a free market, but he gamed the a system, which by definition can not be gamed…..DOES NOT COMPUTE, DOES NOT COMPUTE, DOES NOT COMPUTE…….DOES NOT COMPUTE…..SNAP….CRACKLE….BBZZZZZZZZZZZ

3. Fissile | May 14th, 2012 at 10:52 am

“The game is rigged, and Dick Parsons’ rancid story gives some insight into how the rigging operates, and why failure is so valuable. What looks like failure to us, like losing our jobs and our future and our democracy—is success and riches to the One Percent who profit from this dystopian setup.”

This is like a real life Mel Brooks movie, if you replace all the comedy with evil, horror and misery.

4. Trevor | May 14th, 2012 at 11:09 am

Those eight years of Bush were not an anomally. American culture always rewards the most shameless idiot. If there’s a moral lesson in that, it probably involves mustard gass.

5. Cum | May 14th, 2012 at 11:38 am

Thank goodness that people like Bill Black exist.

6. one-eyed jesus muffin | May 14th, 2012 at 3:06 pm

When did Parsons start dating Tim Tebow?

7. rick | May 15th, 2012 at 8:28 am

I like this stuff that’s almost free of traditional “liberal” whining–just presenting the workings of capitalism as straightforward “extraordinary popular delusions and the madness of crowds,” vs. the farcical “wisdom of the market.”

8. Michel Delving | May 15th, 2012 at 10:06 am

Mark,

Thank you !

F I N A L L Y, someone ties in the Dime scheme with the financial crisis.

Dime’s mortgage servicer EMC Mortgage Corp. perpetrated egregious servicing fraud, fabricating bogus defaults.

It wasn’t unti 20 years later that the FTC caught up with EMC with a pidling 28 mil settlement.

http://www.ftc.gov/opa/2008/09/emc.shtm

Late 1980s through the mid-1990s was a time that real estate still held a lot of equity, so Dime/EMC would foreclose, run up fake list of charges and thus “keep the change”. It essentially began as an equity stealing scheme. AS equity declined, banksters saw they could make more money cashing in on credit default swaps.

Yes, the Dime mortgage scheme emerging in late ’80s on D i c k Parsons’ watch, ultimately went viral and became a major playbook in the financial crisis.

9. Generalfeldmarschall von Hindenburg | May 15th, 2012 at 11:30 am

The myth that “if someone fucks up, the free market takes care of it by noone trusting that person again” – similar to “if a company pollutes and degrades the atmosphere or the food supply, then the market will respond by rewarding other competitors who don’t do these things” is all shown to be the cant and gruelpropaganda that it is. Sure in a world populated by Vulcans. But power protects itself. That’s ultimately what Obama is for. Shielding the elite from the punishment it’s due for. “Just let us loot the country ten more years..” The Senatorial class thought it would run Rome forever and a day. That didn’t end well – none of those families even exist anymore. Though their daughters likely served Attila’s soldiers well enough…

10. Erik | May 15th, 2012 at 12:34 pm

Top notch. Thanks.

11. DeeboCools | May 15th, 2012 at 2:41 pm

Donation worthy article!

12. DeeboCools | May 15th, 2012 at 2:43 pm

And if there were any real “meritocracy” or “wisdom” in our “free market” system, This dude would be working in a restaurant under my supervision.

13. Hick | May 15th, 2012 at 6:20 pm

Dick Parsons? Looks more like a Ben-Eliezar Goldfarb to me…

14. Krokodile | May 15th, 2012 at 8:35 pm

Story about a Soviet Gosplan official.

15. Dave | May 16th, 2012 at 6:22 am

Please check this out and take action if deemed necessary:

A guy named Joshua Davis is suggesting that less voters will make a better democracy in this “Wired” article

http://www.wired.com/opinion/2012/05/st_essay_voting/

It obvious Bull Shit, I’m suspicious that this is another shill

16. suoerstupid | May 16th, 2012 at 9:53 am

Shit, why did I take these drugs. This is madness.

17. Davrus | May 16th, 2012 at 5:45 pm

#15

I wouldn’t go for it, far to easy to rig. For example say they decide to use a computer to generate the random numbers. Computer random number generators are what’s called pseudo-random, that is to say they look random if your not looking to deeply, but if you no what method is being used to generate the random numbers, and you know the seed number then you know every other number which will be generated by that sequence, and thus you also no what number you wish to assign to your designated electors.

18. David Patrick | May 20th, 2012 at 5:24 pm

A college dropout is “education czar” in New York?

19. Jim Vail | June 11th, 2012 at 8:05 pm

Great story Mark! So who was Obama’s sponsor?

Leave a Comment

(Open to all. Comments can and will be censored at whim and without warning.)

Subscribe to the comments via RSS Feed