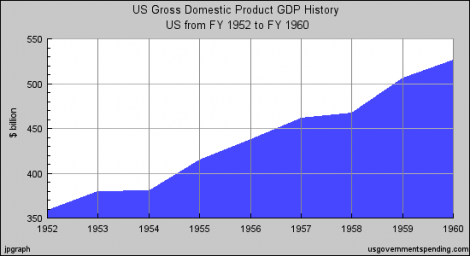

The eXiled has set up an emergency “deficit crisis” website calling on America to restore President Eisenhower’s top tax rate on the wealthiest 0.1% Americans: RATFOCR. Everyone agrees that the Golden Age for America’s middle-class was under President Eisenhower, when the top tax rate reached 91% for the wealthiest Americans. That’s 91%, folks. And look at how the economy performed:

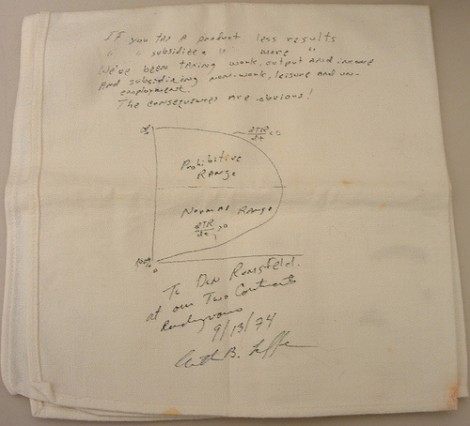

Whoa, what’s this? So the top tax rate was 91%, and yet the economy still boomed during Ike’s presidency? Golly, Mr. Laffer, how’s that possible? Time to go back to your magic napkin and git a-brainstormin’ on those tax cut numbers!

When Arthur Laffer and Donald Rumsfeld agree on anything, you know it’s time to move to Montana and store up on Campbell’s Chunky soups!

Folks, it’s time to stop letting the rats run the show, and time to take matters into our own hands. That’s why we’re calling for America to “FOC the RATS!” Click on our website at www.ratfocr.com and let’s FOC the RATS!

So click here and support the RATFOCR tax hikes on the super-wealthy. It was good enough for Ike, it’s even better for us!

Read more: deficit, eisenhower, grover norquist, Mark Ames, eXiled Alert!

Got something to say to us? Then send us a letter.

Want us to stick around? Donate to The eXiled.

Twitter twerps can follow us at twitter.com/exiledonline

27 Comments

Add your own1. Tubman Chubaisovich Kompot-y | July 18th, 2011 at 9:03 am

Who was it that proved that “deficits don’t matter”? HAHAHAHahahaha HAHAHAHAHahahaha

http://www.washingtonpost.com/ac2/wp-dyn/A26402-2004Jun8?language=printer

“I voted to increase the debt ceiling before I voted against it.” HAHAHAHahahahahaaaa Time to huff some more glue, Mr. Laffer and all you AEI/Heritage/Manhattan/Cato/rating agency/banksters/beltway politicos/CNBCers/ David Mamets/Cokie Robertses and assorted sundry creepster slimebags!

2. terje | July 18th, 2011 at 11:54 am

Correlation, causation… Fucking statistics man. How does it work?

3. WalkerTR | July 18th, 2011 at 4:18 pm

I sincerely hope this is a joke. I don’t care if they are wealthy or not, you want to advocate the taking of 91% of someones earned income? I can honestly say that is evil. Not bad, not misdirected anger, not heavy handed idealism, just evil.

Even thieves don’t take your money and try to convince you it’s for your own good.

4. hon kee | July 18th, 2011 at 4:42 pm

yea, terje, clearly ames is looking to have a nuanced macroeconomic discussion

5. Dick Wad | July 18th, 2011 at 5:24 pm

The whole numbers game we get with economics is a scheme to get everybody to consume as much as possible. economic policies are social rule-making coated with the ideology of the day….

6. Sergei Korolyov | July 18th, 2011 at 6:25 pm

Do not enter Montana, the 22nd Russian republic. Every 100th Montanan is an ‘apparatchik’; every 1000th Montanan a ‘silovik’; and every Montanan a ‘stukach’. To enter is to sign one’s own death warrant.

Наши ножи острые. Мы уже давно воспоминания. Даже сейчас находятся сельские Советы на месте.

Oh, and stay the hell off Europa. The Agency is still deciphering Bowman’s last transmission: “My God, it’s full of shit!”

7. Rockstar | July 18th, 2011 at 7:45 pm

“Even thieves don’t take your money and try to convince you it’s for your own good.”

Please, they`re called bankers and reclaiming only 91% of their “earned” income would be letting them off easy. Besides, I for one would be willing to take a page out of the kleptocrats` own poltical playbook and “compromise” on a mere 90.5% tax rate. They broke this country, now they should have to pay for it, it`s as simple as that.

8. tom | July 18th, 2011 at 7:53 pm

“I sincerely hope this is a joke. I don’t care if they are wealthy or not, you want to advocate the taking of 91% of someones earned income? I can honestly say that is evil. Not bad, not misdirected anger, not heavy handed idealism, just evil.

Even thieves don’t take your money and try to convince you it’s for your own good.”

Hard earned money… Lol. Yes, the wealthy earned their bread laboring intensely and a fucked up economic system had nothing to do with the enormity of their riches

9. Mike C. | July 18th, 2011 at 8:22 pm

@WalkerTR

My god, you are a fucking moron. I must admit, you fuckers never fail to send me reeling with your bottomless idiocy. For your own pitiable, groveling sake, I hope you’re at least a stooge on the payroll.

Way to pay attention to the numbers, shit for brains. Oh, but I’m sure Reaganomics will start working for Americans any minute now. Yep. Whoops, it _is_ working. I forgot it was meant to kill the majority off. If we play our cards right, we can have the best of both worlds, thanks to bumbling libertarian/neocon/Tea Party acquiescence (and faithful Democrat paralysis). The economic nuclear winter of Friedmanite unsubstantiated-nomics, plus state’s rights to give us the sweet prejudice of the middle 20th century.

Your enthusiastic complicity in your own rape would be funny if we could somehow strand you on your own land mass, and jettison you far into the Atlantic; then we at the grown up table could get back to fixing your infantile mistakes.

Anyway, am I to understand that one can earn billions of dollars, as opposed to simply _having_ it? Because I’d love to know what someone is doing to “earn” a million bucks an hour (like the top hedge fund managers). Apparently it requires literally hundreds of thousands of times the skill it takes to perform brain surgery. What is it they produce again?

Or shall we admit to ourselves their fortunes are an unfortunate side effect of a financial system that can be gamed?

The world would be better off if Laffer’s magic napkin of unsubstantiated economic theories were used for its intended purpose.

Actually, I can even think of a better one.

10. Doug | July 18th, 2011 at 9:19 pm

Tax rates in the 1950s may have been 91% before deductions, but the tax code was full of loopholes. E.g. oil and gas wells could be depreciated at up to 3x.

http://books.google.com/books?id=Kn_OAuktbq4C&pg=PA153&lpg=PA153&dq=gas+well+depreciation+tax+loophole&source=bl&ots=tGsukJx9Vi&sig=A6U_SIyQv4MbXG2cbfRJKS2XKw4&hl=en&ei=GwUlTveBIOnV0QHo2cDvCg&sa=X&oi=book_result&ct=result&resnum=5&ved=0CD0Q6AEwBA#v=onepage&q&f=false

In fact families like the Rockefellers regularly paid close to no taxes, despite pre-deduction top marginal rates being above >80%. Reagan actually closed these tax loopholes when he lowered top marginal rates from 86% to 28%. That’s why government revenue actually increased under him:

http://money.cnn.com/2010/09/08/news/economy/reagan_years_taxes/index.htm

If you want to bring back the Eisenhower tax code hook line and sinker, I completely agree with you. I would absolutely love to pay close to no taxes.

11. Mr B | July 19th, 2011 at 12:13 am

@ Mike C

+100

Your bile got me laughing bro.

12. Trevor | July 19th, 2011 at 9:24 am

Tax the rich!

And if they won’t pay up, eat the fuckers.

Thank you, Motorhead!

13. CensusLouie | July 19th, 2011 at 10:22 am

The world has Arthur Laffer and Rumsfeld for a bad idea barometer, The Exiled comments section has WalkerTR and Dougy “The rich are tapped out” Doug.

In case you needed it, here’s a nice debunk of the “revenue grew under Reagan” myth:

http://krugman.blogs.nytimes.com/2008/01/17/reagan-and-revenue/

Now on to Walker’s idiocy and complete lack of understanding when it comes to MARGINAL tax rates.

http://en.wikipedia.org/wiki/Income_tax_in_the_United_States#1930_-_1980

The 91% rate only applied to additional income OVER $250k, or $2 million adjusted for inflation. How many people with that kind of salary make it by being honest or productive?

This sums up pretty much every rich apologist argument on taxes:

http://static.seekingalpha.com/uploads/2009/11/26/saupload_story.png

14. David | July 19th, 2011 at 11:23 am

Hey, Ames! Your tip e-mail box is full. You need to write this shit up! http://ampedstatus.org/how-your-social-security-money-was-stolen-where-did-the-2-5-trillion-surplus-go/

15. 美国猪的狗 | July 19th, 2011 at 12:36 pm

The only true evil is that when you take even 91% from the top 1% – they are still the top 1%!!

Tax these fuckers to death!!!

16. Mike C. | July 19th, 2011 at 3:32 pm

@ 美国猪的狗

Agreed. For all their social Darwinist whining about how the poor shouldn’t be “entitled” to the barest financial safety net, or jobs that pay a living wage, or healthcare, it so happens THEIR only recourse and justification is complaining about the FAIRNESS of taxing them!

You want social Darwinism? You want uncompromising, pioneering, mavericky aggression? You don’t like fairness? Fine. I say we TAKE WHAT WE WANT from these worthless sacks of biscuit dough.

It’s only … “fair.”

17. Mike C. | July 19th, 2011 at 3:33 pm

By “THEIR” I mean the cocksucking 1% that stumbled over pig shit into the Konami code of finance.

18. super390 | July 19th, 2011 at 6:33 pm

Okay, we’ve had our little snark-fest, but now let’s consider why the 91% rate worked. Doug pointed out that there were plenty of deductions. Well, what kinds of deductions?

As I understand it, the best way for a rich business owner to bring down his tax bill under the old rules was: invest in his own business. This is very logical, because this is the business he knows most about.

But in the system inaugurated by Reagan, it became very easy for the rich to take their vast new surpluses of income and invest in the stock racket – someone else’s business. Not only was this a great way for the rich to marry their fortunes together into a weapon against the rest of America, but it’s at this time that we see an entire class of corporate executives become crypto-owners via soaring stock options. Why is the latter bad? Because they can manipulate their company for short term gain on the Dow, then cash out for some private island and leave their successors holding an empty bag. They don’t really behave like traditional business owners at all.

I’ve heard it argued that the entire structure of corrupt derivatives, real estate superscams, and other exotic investments rebuilds whenever top tax rates get pretty low, because the rich recklessly lose their fear of investing in each others’ rackets. Generally this means less money for product creation, and more money for creation of paper wealth.

So regardless of the truth of Doug’s claims about what the rich actually paid, the evidence seems to show that under the old rules their money was more beneficially invested than in the whorehouse of modern America. And the acid test: overall inequality remained steady instead of the explosive polarization we see today and saw before 1929.

19. rick | July 19th, 2011 at 9:18 pm

The historical “Golden Age of Capitalism” growth = 91% tax rate on the top. No evidence Ayn Rand bullshit theorizing ever fucked with it. I wrote an essay I’m too lazy to look up about how the HUGE tax rate inspires hiring–why the fuck would you give away your 9/10 taxed money when you could convert it into pure power? Are you insane? Why would you want a bigger house when you could hire more useful secretaries to fuck at reasonable compensation rates? It’d be insane to compensate yourself beyond reasonable limits when power and control and sexual dominance were purchasable at tax deductible dynamics.

20. proletariat | July 19th, 2011 at 9:36 pm

and once again, right wingers show they have no fucking idea how taxes work.

alright, let me lay it out real simple for you all.

there are these things called tax brackets which represent certain income levels. all income made WITHIN THAT BRACKET is taxed at a set percentage.

so, say you made 40k a year. your first 5000 would be taxed at, say 2%. your next 5k would be taxed at 5%, and so on. assuming 5k brackets and a 3% increase for brackets each bracket, that gives you a 23% top bracket for your income, and $5000 in total taxes. now, if we do some basic fucking math, we find that $5000 is 8 percent of 40k, not 23! amazing how that fucking works, isn’t it?

the top tax rate on the rich did not mean that they were having 91% of their income taken in taxes. it meant that at the very top bracket, there was a 91% rate. if you were to actually do some fucking math, you’d realize that these people were being taxed nowhere near 91% of their total income, and probably not even near 50%.

this is not a hard concept to understand, but then again anyone who is honestly dumb enough to believe randroid, right wing bullshit is probably just smart enough to dress themselves.

it’s pretty fucking funny how these self described fiscal experts don’t even understand the very basics of how our tax system even works.

21. proletariat | July 19th, 2011 at 9:41 pm

whoops, fucked up my math! 5k is actually 12.5% of 40k.

just goes to show that someone who is terrible at math is still better at it than any right winger.

22. nimdok | July 20th, 2011 at 9:20 pm

I’m such a fucking idiot that I can only see things in terms of liberal versus rightwing, so from my dumbfuck mind, I’m going to assume that this proves Mark Ames is being a pathetic liberal. Plus, I really know “how it really works” and that means that I know that nothing like this will ever pass, and even if it did it wouldn’t mean much considering the vast corporate domination of our country and the rest of the developed world. Now, you might reply that I’m either completely humorless or that I’m a bit envious of Ames, to which I’d reply, “Moderator please write something here for me because I’m still trying to frame this in democrat-vs-republican terms.”

How the hell has the man not realized yet that there is nothing more retarded than a commenter who comes on here thinking he has the right to pollute this great website with a mind like mine that can only be described as “this is your brain on adult education classes, any questions?” bla bla bla Jesus you people are sucking so badly that you’re wearing out the eXile Censor’s patience.

23. DrunktankDan | July 22nd, 2011 at 3:17 pm

I’m all for class warfare and whatnot but what the fuck happened to Brecher? Sometimes I need to read about a war that is actually happening to take my mind off of the one that I dream of (pitchforks and torches off to Wall Street)

Cheers

24. One-eyed Jesus muffin | July 24th, 2011 at 7:43 pm

McNugget the rich.

25. Steamed McQueen | July 31st, 2011 at 2:29 pm

How about this instead:

Meet with every CEO who made billions by selling out the American people and moving everything that made this country great (manufacturing and innovation) offshore and offer them the following option:

1) Bring the facilities and the jobs back to the United States and employ Americans with a decent wage, benefit and retirement package

OR…

2) Expect to pay a 90% tax on every dollar you and the corporation earn. Don’t worry, there will still be plenty of money for you to charter a private plane to send Junior to summer camp.

Don’t like those choices? Well then here is another option:

Move to the shithole country where you have your factory.

Those are the choices. Bring back the jobs, pay up, or GTFO.

Side note: History is chock full of incidents where oppressive governments and arrogant elites were toppled because they disregarded the general citizenry. It WILL happen here, it’s only a matter of time.

You greedy bastards brought it on yourselves.

26. Chris | July 31st, 2011 at 6:02 pm

The richest americans have brainwashed the weak, uneducated masses to believe that tax cuts are good for the them when it really only benefits the rich! This has happened throughout history; we are simply peasants to the richest people who control our politics. Taxing the rich to provide revenues to finance the infrastructure and military that allows them to be so rich is not out of line.

27. DeeboCools | August 2nd, 2011 at 12:08 pm

I’ve been thinking, and this is too good of an idea to let die because of an offensive (to the average chump) and contrived acronym.

Reformulate it to an “Eisenhower 2012” campaign; a progressive backlash, hounding democrats to push for Ike’s tax rates. Then this has a pretty good chance- progressives are mad

Leave a Comment

(Open to all. Comments can and will be censored at whim and without warning.)

Subscribe to the comments via RSS Feed