Ames emailed me a New York Times blog post from last February by one Casey B. Mulligan–which may sound like a fictional baseball player’s name, but no, he’s real all right, just another in a long line of insane econ professors from the University of Chicago. In the blog post, Mulligan cheerfully announced that when it comes to commercial real estate, we’ve got nothing at all to worry about. There’s no danger of a CRE crash, like the one we’ve experienced in the residential market, so we can all go back to being happy free market beneficiaries.

No CRE crash? Ha-ha! I just love these Chicago School alchemy frauds! It is truly a joy to see them make such fools of themselves on the permanent public record. And not surprisingly, although Mulligan struck out, he’s still at the plate, batting out barely comprehensible economic fatwahs for the New York Times like nothing ever happened—that’s the kind of free market a real Chicago School economist likes.

So that you don’t have to wait, here’s what Casey wrote for the Times in February 2009. Note how he denigrates those damn pesky “experts”:

For months now, experts have been predicting that commercial real estate will be “the other shoe to drop.” But in fact, non-residential building fell far behind housing construction during the housing boom. This shortage of commercial buildings relative to housing suggests that a commercial real estate crisis will not occur, or that at worst it will occur with much less severity than did the housing crash.

. . .

We all know that there is a nationwide surplus of housing. But there is little if any nationwide surplus of non-residential buildings.

You heard him right. He said there is “little, if any, surplus in non-residential buildings.” That’s how fucking stupid Casey “1000 Strikes And I’m Never Out!” Mulligan is! Even back in February, any lay person could see dangerous levels of empty storefronts piling up in just about every city in America, but now commercial real estate types are starting to have a major freakout. Here’s a sample of how bad it is: There is a 20% vacancy rate in the Silicon Valley right now. Atlanta has a 18% office vacancy rate, with many estimating that it will take a decade or two to get back to normal occupancy levels. In Manhattan, office vacancies are hovering somewhere around 13% and are expected to go up to nearly 20%.

Nationally, about 1 out of every 5 offices stand empty. Properties that do manage to find tenants rent at a 30 to 50% discount, compared to two years ago.

It’s even worse in Buttfucksville, America. Here in my newly-adopted home of Victorville, California, some neighborhoods have brand new strip malls that have vacancy rates somewhere around 75%.

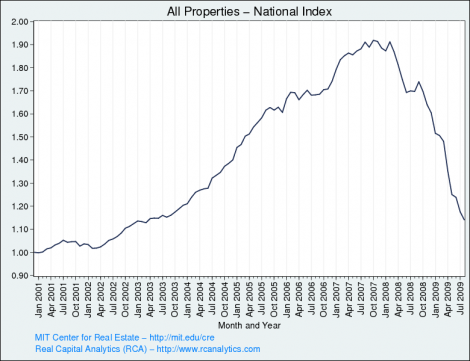

Nothing illustrates the size of the speculative bubble in commercial real estate better than this simple line graph:

You can see that commercial real estate is back down to pre-boom years, but the graph only goes up until July 2009. And the past three months have been none too good on the market, which is sinking further into a deep, dark depression the likes of which it hasn’t seen in many a decade. There’s been about a 3% drop in value every month since July, with no bottom in sight.

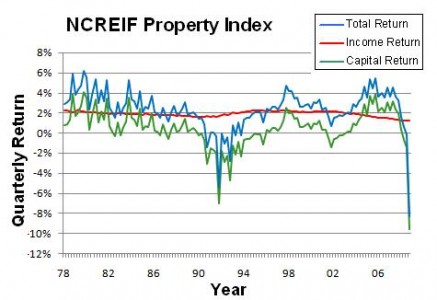

So just how wrong was Mulligan? Here’s how: the National Council of Real Estate Investment Fiduciaries (NCREIF) has an index tracking the rate of return on investments in commercial property. Since it was started in 1978, the index has never dropped more than about 7% in a single year. This year it has dropped by 15%, and there is still one quarter unaccounted for.

To put it another way: Most investment funds with commercial property in their portfolios are scarily underwater and are finding it hard to unload them in these vanishing market conditions.

To put it yet another way: Check out the NCREIF index in visual form above. See the inverted spike of the current crash? Keep going lower. The graph is slightly dated, so the tip of it should be placed well into the margins. Now compare it to the inverted spike of the early 90’s on the left. See how our crash is already almost three times as bad?

Well guess what? That’s exactly the opposite of what Mulligan predicted. According to him, today’s slump in the non-residential sector would not be as bad as the crash that happened in the 90’s because the ratio of residential to non-residential structures was 1% lower today than it was back then (meaning that there were 1% less commercial buildings when compared to residential ones). It is a weird comparison to make, as if the supply and demand of office space and housing are locked to each other. Seems like Mulligan got lazy, grasping at any data that would give his boosterism credibility. That’s part of Mulligan’s economic prowess, I guess: the ability to shill by shifting numbers around, but not the ability to get things right.

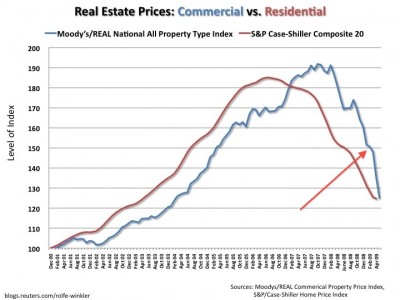

Moving on to Exhibit C of the Mulligan smackdown:

“We all know that there is a nationwide surplus of housing. But there is little if any nationwide surplus of non-residential buildings . . . it is a mistake to assume that commercial real estate shares the housing sector’s ailments,” he so presciently wrote.

Ah, yes. Just because we built too many houses does not mean we built too many office buildings, right? Well, wrong. About the only thing different between the two real estate markets is that the commercial side of it started crashing a little later. The timing and speed of their rise and fall were slightly different, but in the end, the two real estate markets followed very similar bubble trajectories.

See the place I marked with the red arrow on the chart above? That’s when Mulligan used Chicago School’s patented free-market statistical analysis to predict that commercial real estate prices weren’t going to drop much further, weeks before that little flatlining knob plunged downward at a nearly vertical pitch.

How did Mulligan manage to get it so wrong?

Hard to say, but what is clear is that anyone with a functioning brain stem could see that commercial real estate was the next bomb to drop a year ago. It couldn’t have been more obvious that Mulligan would be proven wrong, so totally, obvious-to-anyone-who-reads-Bloomberg-News-or-walks-through-business-districts wrong that it truly is funny, in a what-the-fuck kind of way. Kinda reminds me of the Chabad-Lubavichers, a weirdo Jewish Orthodox sect in Brooklyn whose supreme leader started proclaiming that he was the second coming of the messiah who would bring peace and everlasting tranquility to Earth. All of his 200,000 followers believed him and worshipped him like a god in human form, and then the old man promptly died in 1994. Ever since, the movement has been pretending that the whole thing never really happened, but that hasn’t stopped them from being the laughing stock of the Jewish world. And that’s exactly the position Mulligan and the rest of the Chicago School minions should be finding themselves right now: ridiculed by their peers and divorced by their vapid wives, pelted with rotten tomatoes and fired without notice.

But that ain’t where he’s at. Mulligan still enjoys a blogger position at the New York Times, and still spews incoherent freemarket dribble and economic predictions, which proves that for the idiots running this country, it’s all about the “free markets” and the “free pass for whatever fuckup I make, no matter how disastrous the consequences for you!” People like him need to be outed and ridiculed as a matter of public service. Have they no memory or shame?

There was a great psychology study done at Cornell about a decade ago called the “Unskilled and Unaware of It: How Difficulties in Recognizing One’s Own Incompetence Lead to Inflated Self-Assessments.” The experiment proved that stupid people are consistently, pathologically unable to recognize their own mistakes. Their brains just weren’t wired for “learning from mistakes”; in fact, they were always convinced that they were always right, reality be damned.

We argue that when people are incompetent in the strategies they adopt to achieve success and satisfaction, they suffer a dual burden: Not only do they reach erroneous conclusions and make unfortunate choices, but their incompetence robs them of the ability to realize it. Instead they are left with the mistaken impression that they are doing just fine.

. . .

It is one of the essential features of such incompetence that the person so afflicted is incapable of knowing that he is incompetent. To have such knowledge would already be to remedy a good portion of the offense.

That’s right, some people are just born too incompetent to learn, no matter what. They’re missing the necessary brain module. They didn’t come equipped with the deluxe instant playback analyzer package that most of us come standard with.

Howler monkey to Mulligan: “You are the weakest link”

“Unskilled and Unaware of It” goes a long way to explaining the Mulligan phenomenon: the ability to keep on consistently and shamelessly spewing wrong predictions. Thoughtless shill-drones like him may be semi-hairless, five-fingered bi-peds with linguistic abilities, but they aren’t really human beings like the rest of us. Learning ability-wise, they’re more on level with Costa Rican howler monkeys—the dumbest, loudest, shrillest primates around. And last I heard, they had open huntin’ season on the howler monkeys down there because not only does shooting howlers make for good fun, those stupid monkeys make for some good eatin’s.

(Mark Ames contributed his vanity to this article.)

Yasha Levine is a McMansion inhabitin’ editor of The eXiled. He is currently stationed in Victorville, CA. You can reach him at levine [at] exiledonline.com.

Read more: casey mulligan, chicago school, Commercial Real Estate, dumb, economics, howler monkey, mulligan phenomen, Yasha Levine, Gloats

Got something to say to us? Then send us a letter.

Want us to stick around? Donate to The eXiled.

Twitter twerps can follow us at twitter.com/exiledonline

24 Comments

Add your own1. Allen | November 4th, 2009 at 9:24 pm

The will of the market can sometimes be mysterious. I’m sure Mulligan (what an usually appropriate surname) would tell you that its workings are ultimately ineffable, but still we must have faith. With as many, rule-free, economic exchanges as possible, the invisible hand will eventually move us all towards perfect divine equilibrium. Ignore the failings of its humble servant, but do not fail to listen to any and all future sermons.

2. Rob | November 4th, 2009 at 10:25 pm

I recall that Joyce’s Mulligan was so named as an insult to an acquaintance he based the character on. Mulligan being Irish slang at the time for a cheap offal pie.

3. Realist | November 4th, 2009 at 10:30 pm

Sadly a trait shared by so many academic economists.

The Chicago School more of a intellecutal dressup for the establishment than coherent economic theory, as it proposes brutal exposure to the “free market” while stressing the need for a dirigist central bank favoring and sheltering the associated institutions of the “more equal than thou” category. It is the financier vatican.

4. Evan Harper | November 4th, 2009 at 11:09 pm

Actually, Allen, what you said is half the story. Yes, during boom times, the Chicago boys will talk up the invisible hand. Then after everything bursts, suddenly they take an interest in government interventions, and find some absurd connect-the-dots rationale for why the whole bubble – which they previously praised as evincing the wisdom of the market – was actually the inevitable result of wicked bureaucratic meddling.

5. subgenius | November 5th, 2009 at 12:06 am

Fucking epic. Kudos

6. thomzas | November 5th, 2009 at 3:29 am

Can we have some graphs to illustrate the wrongness of various economists predictions?

It would be like an actor’s career chart – only funnier because billions of dollars are at stake.

7. twohandsclapping | November 5th, 2009 at 6:08 am

brilliant graphic: “Howler Monkey to Mulligan” loved it, shared it.

bravo

8. DarthFurious | November 5th, 2009 at 6:32 am

“Unskilled and Unaware of It” – my god (the real one, not the fake all you fools worship) that explains everyone in my office…

On a more serious note, I read a study done in australia on “positive thinking,” where they show that those who “think positively” have fucked critical reasoning and awareness skills and basically believe any goddam thing they’re told. Surprise surprise surprise, the idea of “the power of positive thinking” has become a virtual religious faith here in the states, even going so far as to infiltrate the medical community, who routinely spout nonsense about “have faith” and “stay positive” to people like terminal cancer patients, even though study after study has clearly shown that “staying positive” has no effect whatsoever on mortality outcomes.

Just another example of the rot at the core of this fading republic.

9. Jon Ezell | November 5th, 2009 at 6:32 am

I remember getting into a long argument with an acquaintance who was Wall Streeter and Math Whiz about Milton Friedman and Pinochet. He eventually came to say things like: More people would’ve starved under Allende than were killed or tortured by Pinochet, the entire modern economy would collapse without people with 160 IQs running Wall Street, and that, because I am a socialist, I was guilty of having “religious convictions” in place of rational analysis.

This was, of course, a few months before the beginning of the crash. I haven’t talked to him since, but I’m sure he just blamed everything on the government for biting the invisible hand.

Also, good call on the Dunning-Kruger effect! Before I dropped out of business school I saw more than enough to go around. You just can’t lose with some people!

10. S. A. | November 5th, 2009 at 9:15 am

Despite being published in an academic journal (usually home to the most boring writing on god’s green earth), “Unskilled and Unaware of It” is remarkably interesting and easy to read. More papers should start their introductions with dumb criminal stories.

11. אברהם | November 5th, 2009 at 10:41 am

@Jon Ezell

Every try explaining to a free marketeer that capital can’t function without a sovereign authority to safeguard it? …Shit. It’s not even worth the time.

12. Metallica | November 5th, 2009 at 11:34 am

It should be obvious that economists are paid propagandists whose job is to make economics incomprehensible so the little guy won’t realize he is being robbed. There’s no point trying to weigh out how wrong they are, much like there was no point trying to fact-check communist posters.

13. subgenius | November 5th, 2009 at 2:47 pm

Taibbi is on the same page…

http://trueslant.com/matttaibbi/2009/11/04/goldman-one-ups-gordon-gekko-says-jesus-embraced-greed/

14. jazzage | November 5th, 2009 at 3:53 pm

You should not insult Howler monkeys by comparing them to U of C economists. What have they done to you? I used to believe in guillotines to solve our current economic woes but I have decided that the middle ages had it right – burn them at the stake!

15. adolphhitler | November 5th, 2009 at 4:51 pm

@11..i think you have nailed it. the big money conglomerates have become anti nationalistic. they yearn for a world without borders where they can transfer their capital so that it brings its greatest return without ever considering how their actions may affect the population of a given nation ( say the u.s.). if their actions impoverish the american middle class they really dont care so long as the corp. balance sheet shows a profit.

however, they desperately need a sheriff to protect them and their assets while they fuck every one but themselves…that is where the american armed forces come in. they use our army to futher the governments policy of redistributing american wealth to the rest of the world. we are funding our own military to fuck us so that the oligarchs turn us into a third world state.

16. Pablito | November 5th, 2009 at 7:46 pm

If you’re going to damn the Chicago school for bad predictions, you should probably praise the Austrians.

17. captain america | November 5th, 2009 at 8:02 pm

i skipped all the stats proving that the commercial real estate market is in trouble. like you say, i’m a layman, and i can tell that by driving around and checking out my surroundings.

18. Tommy Jefferson | November 6th, 2009 at 5:21 am

Chicago School = Freemarket Economics

I don’t understand. Does By Yasha Levine actuality believe this, or is it part of the joke?

19. dudeman | November 6th, 2009 at 10:12 am

YOu just have a different definition of a crash. The CRE market represents only about 10 percent to 15 percent of bank assets. It’s nowhere near the percentage of CDO’s and MBO’s etc. You can always show examples of crumbling infrastructure. But this is nowhere near a nation-toppling crisis. Yes we are going to have quite a few unoccuppied and under occupied buildings, but the sky is not falling on this one. It may be a crisis to some people, but it is not a generalized crisis. In fact for small businesses and professionals the cheaper rent that usually occurs in this part of the real estate cycle is a real boost.

20. machete | November 6th, 2009 at 2:03 pm

The Chicago schools concepts are misinterpreted. There concepts saved me a fortune. 1: They claim that you cannot make excess profit in stocks. Well the stock market has collapsed and I never invested in them. Thanks Chicago School. 2: They claim that you can make more profit by owning your home versus renting. Home values have collapsed. I never bought and I rent an apartment. Thanks Chicago School! The Chicago School concepts advise the government not to give 25 trillion $’s to the banks. Obama didnt listen and he gave 25 trillion $’s to the banks. Thats Marxism.

21. Fissile | November 6th, 2009 at 2:12 pm

Yesterday, I was in Manhattan on some minor business. The amount of empty storefronts in midtown is truly astonishing. I was a boy during the recession of the mid-1970’s and I don’t recall midtown having any vacancies at all. It was the dodgy parts of the city that took it in the shorts back in the day.

The office vacancy rate in “wealthy” Northern New Jersey is currently hovering around 25%.

BTW, the Lubavitchers’ leader, Menachem Mendel Schneerson, never claimed, “that he was the second coming of the messiah..” Had he claimed that he came back, that would have made him and his followers Christians, and not Jews. Schneerson claimed that Jesus was a fake messiah, and that he(Jesus) is currently residing in hell where he’s being boiled in a vat full of shit and jizz. Schneerson claimed to be the one and only messiah — Jesus being just a lying drama queen.

On an additional note, Lubavitchers hate the Satmars(a competing Hasidic sect) like poison, and the Satmars send the hate right on back. One of the funniest things you see in this life is a street fight between Lubavitchers and Satmars. Not so much, punching, stabbing or shooting, but a lot of insults and spitting. Be sure to bring your umbrella.

22. az | November 7th, 2009 at 1:46 pm

Well these Chicago boys are at least more rational in their behaviors than what libertarian ‘economists’ preach. I mean, subconsciously or not, they know that capitalism is not economically sustainable, so they want to have the last piece of everything from Russia to Argentina to America to belong to them or the masters who listen to them and pamper them.

20 re:Marxism: you’re cute, can I take you out for dinner? 🙂

23. Jonathan | November 7th, 2009 at 8:48 pm

That study actually found that everyone over estimates their skill/knowledge when they are unskilled/ignorant. It also found that how unskilled/ignorant you are is proportional to how grossly wrong your estimation of your skill/knowledge is going to be. It’s why people think they know how to build a nuclear bomb after taking High School Physics. All humans think anything they don’t know must be both simple and easy.

24. Peter | November 8th, 2009 at 9:28 am

So Mr. Levine, in your little mind, are listless vaginas more important than freedom?

Leave a Comment

(Open to all. Comments can and will be censored at whim and without warning.)

Subscribe to the comments via RSS Feed