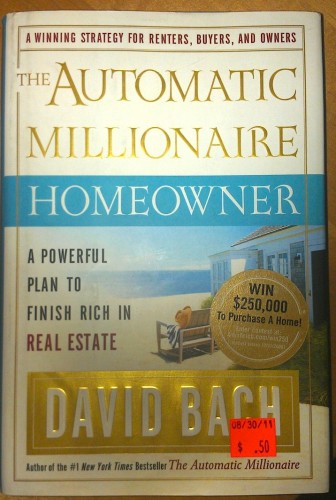

I was passing through the Mojave Desert and by chance stopped by a local thrift store in Joshua Tree. I’m glad I did, because I spotted a book that I just had to own. At $0.50, it was priced to sell. And as you can tell from the title above, the book’s a classic. It’s bound to remain fresh and relevant through the ages—not as a useful guide to homeownership, but as a fossil record of the biggest real estate scam in the history of the United States.

A lot of people still wonder how and why so many millions of people bought such ridiculously overpriced homes and took out mortgages and loans they clearly could not afford?

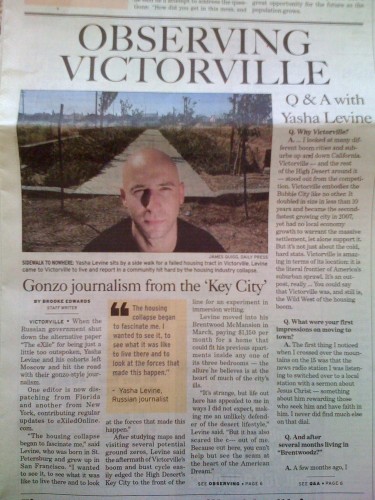

That’s what I kept wondering when I moved out to Victorville back in the Spring of 2009 to do immersion reporting from the front line of the real estate meltdown. Located about 100 miles east of Los Angeles on the edge of the Mojave Desert, Victorville got higher and crashed harder, in terms of real estate, than almost any other place in California. It doubled its size to 100,000 in just eight short years, growing from an isolated hick outpost into a booming commuter suburb filled with the cheapest McTractHomes south of Fresno. By the time I got there, Victorville was a ruined city filled with empty master planned communities, some of them half built and abandoned, rotting dry in the sun. I spent nearly two years reporting on the real estate swindle out there, and I never could stop thinking about the central question: How the hell were people coerced into moving out here? Why would anyone think that buying a $500,000 house in a desert 100 miles away from Los Angeles be good idea, no matter what kind of loan deal you got or how booming the market. What kind of propaganda were these people subjected to?

Well, this book provides a part of the answer: people were explicitly instructed to do so.

The Automatic Millionaire Homeowner hit the front bookcase displays at Barnes and Noble in March 2006, at the very top of the real estate market and just a few months before the whole thing crashed and burned. Its main message was simple: If you take out a mortgage to buy a home, you will always make money. There is no way you can lose—no matter when you buy, how much you pay or what type of loan you get. And the kicker is: both the book and finance expert who wrote it were bankrolled by Wells Fargo and Bank of America.

This book is just one of dozens—if not hundreds—of similar self-help snake oil guides promising a sure bet system to get rich in real estate. But it’s a good example of the massive propaganda effort financed by Wall Street that was designed to funnel as many people as possible into the mortgage meat grinder. The book was packed with blatant lies that seem so obvious and even comic in retrospect. The book was not put out by some shady fly by night operation, but by a supposedly credible financial expert who had the backing of the most well-known and respected banks, TV networks and newspapers.

But the whole thing was a fraud, shamelessly boosted by some of the biggest names in news media—none of whom have been held accountable for their role in defrauding millions of Americans.

So let’s take a look…Crack open the book and turn to the introduction, it begins like this:

What if I told you the smartest investment you would ever make during your lifetime would be a home!

What if I told you that in just an hour or two I could share with you a simple system that would help you become rich through homeownership?

What if I told you that this system was called the Automatic Millionaire Homeowner—and that if you spent an hour or two with me, you could learn how to become one? [emphasis mine]

Would you be interested? Would you be willing to spend a few hours with me? Would you like to become an Automatic Millionaire Homeowner?

Interested? Intrigued? Want to know more? Well, turn a couple of pages and you get this:

As I sit here in August 2005, I have no idea when you will be reading what I’m writing. Maybe it’s March 2006 (when this book is scheduled to be published)—by which time the real estate market could be slowing or cooling down to modest single-digit annual gains (or not). Perhaps this book was bought by a friend of yours who passed it along to you—and it’s now 2007 and those once “certain” boom markets are going bust due to speculation. Or maybe the opposite has happened—interest rates have remained at historic lows, and home prices have continued their march upward.

In fact, it doesn’t really matter when you happen to be reading this or what’s going on right now in the markets. This book is not about the boom . . . or the busts. . . . What this book is about is the truth. And the truth is this:

Nothing you will ever do in your lifetime

is likely to make you as much money as

buying a home and living in it. [emphasis in the original]

What’s this sure-fire system? Well, it’s so simple it fits on the inside flap! Here’s how you do it:

What Makes The Automatic Millionaire Homeowner Essential:

■ You don’t need a big down payment to buy a home.

■ You don’t need great credit.

■ You should buy even if you have credit-card debt.

■ You can buy a second home even if you’re still paying off the first.

■ You can get started in any market-boom or bust.

■ It’s easier to be a landlord than you think.

Just a few months after the book came out, the real estate market went into a death-spiral. Victorville and other Mojave Desert exurbs like Palmdale and Lancaster were packed to the brim with people who followed this book’s advice to the letter. They took out no down payment adjustable rate mortgages, bought at the peak of bubble, had horrible credit scores, were struggling to make ends meet and were probably up the hilt in credit card debt. Over the next year and a half, home prices collapsed by 30% and just kept falling. By the time that I packed my bags and fled West towards the Pacific Ocean in 2010, homes that had sold for nearly $400,000 at the top of the market in 2006 couldn’t find a buyer at $50,000 or $75,000. People were kicked out of their homes, lost all the “investment” payments they had made on the loan and had to find other places to live—rental homes if they were lucky; their cars or tents at the hobo camp down on the banks of the Mojave River if they weren’t.

So the Automatic Millionaire was a bust—well, at least as far as the now-former homeowners were concerned. But as we now know, the latest homeownership craze was never meant to benefit the homeowners. The only Automatic Millionaires created by this book were David Bach and the financial oligarchy he served.

See, before David Bach began his bright career as a New York Times bestselling author dedicated to spreading the gospel of homeownership, he was a senior vice president of Morgan Stanley and a partner of The Bach Group, a wealth management outfit started by his father. Yep, he was born into it. Finance runs through his veins!

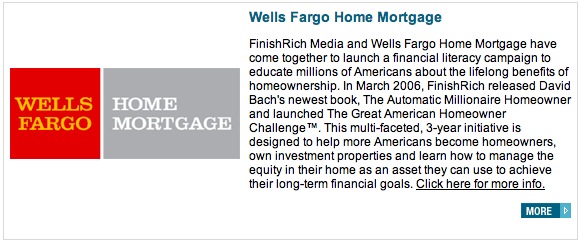

So it’s no surprise that both Bank of America and Wells Fargo sponsored David Bach and his revolutionary Automatic Millionaire Homeowner wealth creation system.

Here’s an excerpt from Wells Fargo’s press release:

Wells Fargo Home Mortgage Joins with David Bach to Promote Shared Vision of the Lifelong Benefits of Homeownership to Millions of Americans

Best-Selling Author, Leading Retail Lender to Encourage People to Build Long-Term Financial Success through Homeownership

DES MOINES, Iowa – Oct. 28, 2005 – Wells Fargo Home Mortgage today announced a three-year agreement with financial coach David Bach, author of several best-selling books including No. 1 New York Times best-seller The Automatic Millionaire. The partnership is designed to increase the number of first-time, second-home and investment homebuyers and help homeowners best manage the equity in their home as an asset to achieve their long-term financial goals.

Yep, Wells Fargo is only interested in educating homeowners for the greater good. And the bank is not alone. Just look at all the smart people who praise and recommend his work. They wouldn’t lie, not with their reputations on the line!

Jean Chatzky, Financial Editor of NBC’s Today, blurbed: “The Automatic Millionaire gives you, step-by-step, everything you need to secure your financial future. When you do it David Bach’s way, failure is not an option.”

Fox’s Bill O’Reilly also endorsed the Automatic Millionaire wealth creation system: “David Bach’s no-spin financial advice is beautiful because it’s so simple. If becoming self-sufficient is important to you, then this book is a must.” Yep, this is the same O’Reilly who bashed homeowner “losers” who took out loans that they weren’t able to pay, and yet here he is endorsing a plan that says there’s no such thing homeowner who loses money. Wonder what kind of cut Bill gets off Bach’s loot?

He rips you off, puts you in debt and sticks by your side to help make sure you pay it off. What a guy!

So what’s up with David Bach today?

The man’s still doing regular TV gigs and giving financial advice to unsuspecting victims, including a weekly appearance on NBC’s Today Show. But he’s changed his racket: Bach’s no longer out to make automatic millionaires; these days he’s motivating debtors to get second/third jobs and convincing them to adopt austerity measures in their own personal lives. He’ll help you pare down your consumption footprint to the bare minimum necessary for physical survival. Yep, Bach’s our debt handler. His job is to make sure we peons keep making those monthly payments to Wells Fargo and Bank of America!

The day that degenerate shysters like David Bach are afraid to show their faces in public and feel the need to flee across the border is the day that we’ll know that we as a country are making progress towards a brighter future.

Yasha Levine is an editor of The eXiled and co-founder of the S.H.A.M.E. Project. Read his book: The Corruption of Malcolm Gladwell.

Click the cover, buy the book!

Read more: automatic millionaire, bubble, Class War, david bach, huckster, propaganda, public relations, real estate, scam, victorville, Yasha Levine, Media Whores, S.H.A.M.E.

Got something to say to us? Then send us a letter.

Want us to stick around? Donate to The eXiled.

Twitter twerps can follow us at twitter.com/exiledonline

56 Comments

Add your own1. Ticklemonster | October 19th, 2012 at 2:34 pm

“The day that degenerate shysters like David Bach are afraid to show their faces in public and feel the need to flee across the border is the day that we’ll know that we as a country are making progress towards a brighter future.”

-Yasha Levine

So… never then? If pushy sales tactics and douchey hucksterism were ever looked upon as anything but merits America would have an unspeakable existential crisis within nanoseconds.

This is it folks, this is all we got: David Bach types. His mother is proud, his wife and offspring are seen as adorable. He probably has a shiny white smile…

“Americans may have no identity, but they do have wonderful teeth.”

― Jean Baudrillard

2. jyp | October 19th, 2012 at 2:56 pm

AEC: Only 60 years? Son, you got to learn yout US history.

You rock, Yash. But good luck with that “the day we see..” stuff. Been hearing stuff like that for um 60 years or so. “When the Merican people find out so-and-so then such-and-such will happen.. big time.” Yep. Ha ha ha! Better off betting on the shysters. They’re the only ones ever seem to be right on the money. Barnum didn’t say it though he gets the credit for it: there’s a sucker born every minute. Every micro-second now a-days.You know what? It’s goddamn tragic.

3. damn red | October 19th, 2012 at 4:54 pm

I am still confused that people will buy books that have been endorsed on a TV show.

Drinking game idea.

When you watch a show that is endorsing a book, take a drink for each degree of ownership from the shows corporate owner and the publishing company

Other variants, start with 7 and take one away for every degree of separation.

I recommend the second one, the first one will just leave you sober.

4. BigBubba | October 19th, 2012 at 6:30 pm

Fuck this guy. Fuck this guy long and hard, just as hard as he fucked all those homeowners with his honey-covered lies.

5. Finnucane | October 19th, 2012 at 6:33 pm

This Bach fellow shoud be drawn and quartered, etc. … aint gonna happen, folks. What will happen is that I’ll scrape together some quarters and dimes, stumble down to the convenience store, and buy some barely palatable beer, which I’ll guzzle, without any joy. Perhaps I’ll run into an inexpensive but not too diseased prostitute along the way, in which case the evening won’t be a total loss. Not likely though. In any case, this is your life too, eXholes. Admit it!

6. Punjabi From Karachi | October 19th, 2012 at 10:54 pm

How Wall Street-Funded Self Help Propaganda Greased the Real Estate Bubble

Greased is the right word for it all.

This book is just one of dozens—if not hundreds—of similar self-help snake oil guides

Yeah, I was wondering seven, eight years ago where all the good American books had gone and why this sort of “Get Rich Kwik In America” drivel started popping up. Twas a doozy of a bad time, in terms of separating the cons from the good reads.

7. Punjabi From Karachi | October 20th, 2012 at 3:25 am

If eXile could begin a Jihad against the self-help industry of the last few decades, I’ll be up there on the frontlines with them.

http://www.youtube.com/watch?v=84Mj4dBqoqY&feature=youtu.be

8. casino implosion | October 20th, 2012 at 4:36 am

Yeah, nothing says “self sufficient, free enterprise” like ponzi schemes and real estate bubbles. It’s American as apple pie, going back at least to the days of Andrew Jackson and the cotton state land grabs.

9. vortexgods | October 20th, 2012 at 7:58 am

There’s a good article up on Forbes (yes, I know, surprising) about that Rich Dad, Poor Dad guy filing for bankruptcy. He was another guy pimping the real estate bubble, among other scams.

10. Punjabi From Karachi | October 20th, 2012 at 8:39 am

Punjabi Vs. Irish and Russian eXholes.

LoL-Burger.

Get some English in this eXile thingum!

Like the Sikhs, they don’t have self esteem issues.

11. damn red | October 20th, 2012 at 9:10 am

@7

Hmm he has a point, I am going to start a self help company now.

Soon we will have an economy exchanging self help to each other for more self help, we’ll think ourselves to a better future.

12. Trevor | October 20th, 2012 at 9:27 am

This gets to the really insidious thing about modern finance capitalism – it has so many people convinced it’s NOT out to control them. “Duh, business good! Gub’mint bad! Atlas Shrugged not just steampunk rape fantasy!”

13. TMC | October 20th, 2012 at 10:24 am

Is there a reason I’m not aware of that explains why the author drops the ‘s’ from Wells Fargo throughout the entire article?

14. Fissile | October 20th, 2012 at 12:32 pm

“And the kicker is: both the book and finance expert who wrote it were bankrolled by Wells Fargo and Bank of America.”

-Yasha Levine

WF and BoA now conduct their swindles openly and without any fear whatsoever. Does anyone need anymore proof that the power of banks/Wall St eclipse the power of the federal government? How far will BoA and WF go before they are finally stopped? Maybe the public will take notice when they start harvesting the organs of orphans?

As for the book, it’s not the first of its type, and I’m sure there are hucksters currently selling books that claim you can get rich on the downside. Years ago I saw a similar book. Contained in the first paragraph on the first page read the following: “History shows that real estate always retains its value.” I stopped right there. Millions of people fall for this shit…..year after year. I just don’t get it. Even a quick study of land speculation in the US will uncover numerous real estate booms and busts, going all the way back to the early 19th century. As proof you can visit the hundreds of ghost towns all over the West, or you can let Groucho Marx tell about the real estate bubble in Florida back in the 1920’s “Oh boy, can you get stucco!”

http://www.youtube.com/watch?v=EQgDOL9SGb0

The Poconos (Eastern Pennsylvania) is the East Coast version of Victorville. The Poconos are located along the Delaware off I80, it’s about 100 miles as the crow flies from NYC. About 10 years ago, real estate grifters were advertising new homes in the Poconos on NYC radio and TV. The ads stated, “Just 90 minutes from New York City!”, implying that it was an easy commute from NYC. Right, an easy commute……clear across the most densely populated part of New Jersey, the most densely populated state in the country. Thousands fell for it. Wanna guess what that Pocono real estate is worth today? Despite telling blatant a lie in the ads…you can get from NYC to Eastern PA in 90 minutes…..no one called them on it. Where were the regulators? Where were the truth in advertising people? Just astonishing.

“The day that degenerate shysters like David Bach are afraid to show their faces in public and feel the need to flee across the border is the day that we’ll know that we as a country are making progress towards a brighter future.”

-Yasha Levine

I don’t know if the likes of David Bach are getting ready to flee the country, but I’m certainly contemplating it.

15. Friendly Coward | October 20th, 2012 at 1:34 pm

There is one guy online who has started a scorched earth campaign against MLM schemes and those ‘self help’ programs that are more like cult programming. http://www.saltydroid.info I think the eXiled would probably get along with the robot.

16. Bill Hicks | October 20th, 2012 at 2:53 pm

“The day that degenerate shysters like BARACK OBAMA and MITT ROMNEY are afraid to show their faces in public and feel the need to flee across the border is the day that we’ll know that we as a country are making progress towards a brighter future.”

I think we are a LONG way from that evert happening.

17. Yasha Fan | October 20th, 2012 at 9:45 pm

Thanks Yasha.

ExiledOnline’s obscurity proves America’s idiocy.

Let it be your new slogan.

18. Mason C | October 20th, 2012 at 11:23 pm

#9 thanks for the heads-up on the Kiyosaki BKO. It turns out he stiffed a bidness pardner and is on the hook for almost $24 mil. His company declared, but this isn’t over. Stay tuned for an intellectual property battle, maybe some (thank fucking Yaweh) limits on his public appearances. http://tinyurl.com/92t8u9u

“I have an urge for other people’s money like salmon want to get upstream.” – BKO Dad

19. Ain't nobody just like this | October 21st, 2012 at 2:08 am

I’d ask you why you thought it appropriate to end an interrogative sentence with an exclamation point.

20. Ain't nobody just like this | October 21st, 2012 at 2:08 am

And I forgot to close the end blockquote. Oh well.

21. skullsneedtobecrushed | October 21st, 2012 at 2:19 am

FWIW, the jackass living in the shack next to mine bought his house in 2007 and it is pending now for 120K more than what he paid for it here in Austin…

22. Anton | October 21st, 2012 at 6:31 am

“The day that degenerate shysters like David Bach are afraid to show their faces in public and feel the need to flee across the border is the day that we’ll know that we as a country are making progress towards a brighter future.”

Well, spineless comments like this won’t take us one inch towards that direction. On the contrary, commentards like me create the illusion that there is no way to change anything and that articles exposing this bullshit ultimately do nothing. Bullshit.

I know that nothing much changed when the eXile threw a horse sperm pie on that shill’s face, so that doesn’t work. Then again, when you outed the Kochs role in the Tea Party and their role in using Citizens United to intimidate workers, that had an effect. Also, when you busted Adam Davidson and Malcolm Gladwell and Megan McArdle, that clearly has had an effect on their work; as has Taibbi’s takedown of Goldman Sachs for Rolling Stone. Keep up the great work, and definitely do not listen to worthless commentards!

23. Anton | October 21st, 2012 at 7:20 am

And btw, you really should be thanks for having Greenwald on your Shame the shills- file. Shame on Greenwald and all the Glenbots, you actually convinced me, too, because he is constantly advocating for Citizens United and he never disclosed his relationship with the Kochs. It’s funny, he’s saying some things about Social Security lately that some might think is “not libertarian” but then again, I remembered that Friedrich von Hayek was also in favor of Social Security in his book “Road to Serfdom” so if anyone tries making that point for Greenwald, you can smack the Glenbot libertarian down.

Thank you for calling out this secret libertarian!

24. gc | October 21st, 2012 at 10:02 am

@1

Stupid.

25. Fischbyne | October 21st, 2012 at 11:16 am

@1 + 2: Maybe it won’t fall for another 60 or 120 or 180 years, but capitalism isn’t forever. It’s not a matter of how stupid or ignorant Americans are, it’s a matter of lurching systemic inevitability. You cheer on the David Bachs of the world when you trivialize those who persevere in yearning for retribution.

26. AEC WORSHIPPER | October 21st, 2012 at 2:25 pm

Thank you AEC for wasting your precious time improving a special needs commenter such as myself.

27. boson | October 21st, 2012 at 4:11 pm

Finnucane’s comment was such a pleasure to read.

28. the original Strelnikov | October 21st, 2012 at 6:56 pm

@15

I second that; the Salty Droid pretty much knows where the bodies are buried.

Speaking of which, David Bach needs to be shot in the head and given a Victorville Viking funeral.

29. Epode | October 21st, 2012 at 8:29 pm

By the time one is receiving supposedly excellent advice in investing that’s readily been available to god-knows how many people, it’s shitty advice.

There are sensible dictates to follow in investing. None of them advocate getting rich quick. Pigs get slaughtered. All these people who lost everything, believing they would win everything, were stupid fucking pigs and deserved to get slaughtered.

It’s unfortunate for them, but there’s no excuse for being fucking stupid.

30. Ticklemonster | October 22nd, 2012 at 2:53 am

@24

Yes, I forgot. They are also stupid. Thank you.

31. Fissile | October 22nd, 2012 at 6:20 am

@29. Epode,

There is an old cliche that says, “You can’t cheat an honest person.” Here is an example, the classic lottery scam. “I just won the lottery, but can’t cash in the ticket because I’m a: Illegal alien. Owe money on child support. Have fines or judgements…. I’ll sell you the ticket for half the winning amount.” People who get taken in by such a scam deserve what they get, because they had a choice: honest labor or get rich quick by exploiting some who presented himself as being vulnerable.

The problem with your view point is that most people in our society now have no choice but to participate in the swindles. It’s not a choice between getting an education by working your way through school or taking a student loan, it’s now impossible to work your way through school. Your choice is become a debt slave or go without an education.

Same with home ownership. It’s now impossible for most people to save enough to purchase a home for cash or even to put down a large down payment. Back in the 50s, my uncle bought a 4 unit building in Jersey City for cash, my uncle worked as a longshoreman. In the 70s my parents bought a house in suburban New Jersey, they put down 50%. Neither of my parents went to college, and both worked blue collar jobs. Try and do either of the above today.

32. Nastarana | October 22nd, 2012 at 6:56 am

Dear Punjabi from Karachi,

One of the best things about The Exiled is the absence of Brit twits.

33. rossiya | October 22nd, 2012 at 7:42 am

The 2008 stock crash was precipitated by a change to banking rules allowing insured loans to be put back into capital and loaned out again. (http://www.federa…cbem.pdf page 531) This made capital virtually infinite as long as an insurer could be found! Huge incentive for banks to loan where they can get insurance on loans they make. In USA it was in home loans. Companies like AIG created software models “proving” home loans seldom go bad. That created a perverse incentive: Banksters decided to defraud the insurers, presuming that taxpayers would repay the losses. Citibank gave home loans to unqualified people. They bought insurance from AIG. They made another loan against that insured money, then sold off the first loan – but kept the insurance. When the homeowner failed to pay, the buyer of that securitized loan was screwed. Meanwhile Citibank collected full value from AIG on the insurance ctd.

Then AIG couldn’t pay anymore and the bottom fell out. Suddenly all those insurance-backed loans were based on nothing at all. Citibank’s reserves at the meltdown were worse than 1:2,000. (A normal reserve level is 1:20). Essentially, what Citibank did was like you buying some homes, getting fire insurance, pouring gasoline throughout the house, then selling (and collecting full price) on the homes. When the houses explode and burn to the ground, you collect the insurance money. You have collected twice. A magnificent business model, especially with the taxpayer paying the $trillions in losses. This new tweak in banking law destroyed the banking multiplier. This would make Central Banks obsolete. Economies can function forever purely on privately created money under the law now, and Americans are debt slaves to fund new insurance scams!

34. rossiya | October 22nd, 2012 at 7:51 am

Sorry link is http://www.federalreserve.gov/boarddocs/supmanual/cbem/0005cbem.pdf

35. Flatulissimo | October 22nd, 2012 at 7:59 am

@15 – I also live in Austin. Used to be a cool town, but post-bubble, not so much. I think it is hilarious that Texans claim there wasn’t a bubble here when they are still trying to sell the stucco McMansions a block from my shitty apartment for $750K.

If real wages haven’t improved since 1990, shouldn’t homes be selling at 1990 prices?

Sign up for a 30-year indentured servitude deal with a banker? I’ll stick to my shitty apartment, thanks.

36. Flatulissimo | October 22nd, 2012 at 8:07 am

^ I meant to call out #21, who said he lived in Austin. Got it confused with the comment with the link to the Salty Droid blog. Never heard of that site before, but it appears to hold promise.

37. Generalfeldmarschall von Hindenburg | October 22nd, 2012 at 11:27 am

@ 34 : Thanks for the link.

We’re living in the End Times, dear friend. Once the counterweight of the USSR disappeared from the scene, there was nothing to stop Wall Street and its ‘intelligence community’ enforcers from pushing the species into a death spiral. When I was a kid, the aspiration of humanity was colonizing space. Now it’s what? Make money off pyramid schemes? The only hope is a worker’s revolution in someplace like China. The change we need isn’t going to come from anyone in the USA. I could ran for hours…

38. Bengt Batron | October 22nd, 2012 at 3:42 pm

And soon you will have Mitt Romney sold to you by advertisments and through lies. Anyone here believes he will stop this?

Hehe. Did not think so.

There will be more poverty, more speculations and the rich will get even richer. Tensions will mount and I doubt China will be happy if the US stops paying when loans they have given US runs out.

Chaos and strife will result.

And that may well be the end of democracy even in the thinned out version we enjoy today. Read up on Tony Judts book Ill fares the country and you will see the parallells to how Hitler got to power.

It truly is sad.

39. skullsneedtobecrushed | October 22nd, 2012 at 4:49 pm

@35 agreed — I rent my hovel, too. Half a mil with 10K property taxes for a cubist McMansion with an up-lit agave, a carport and a corrugated metal fence (the apartheid-era South African township building material du jour)?

Somethin’ wrong here…

40. Andy Mayo | October 22nd, 2012 at 5:06 pm

I hope the many people who commented approvingly get out and vote.

Yasha, great reporting. It’s sad what a short memory Americans have. Thanks for jerking their chain.

As for that time in America, the book was a symptom of ‘received wisdom.’ The dotcom bubble had taught people that stocks were ‘bad’ but real estate was ‘good.’ So the stockbrokers were selling mortgages and home equity loans. The same people who bought Qualcomm at $90, to see it drop to $10 and change, were the ones who took out no-down-payment loans for overpriced houses. What Americans have to learn is that there is no such thing as an easy way to make money. Unfortunately, history makes that achievement unlikely.

41. G-Mo | October 22nd, 2012 at 5:07 pm

This post is genius. I’ve been looking at these books in the Goodwills for a while now thinking I should become a rabid collector.

This reminds me of the article a while back about prosperity gospel churches’ role in the bubble at that time. Obviously for the game to work it couldn’t be restricted only to those who bought self-help books.

http://www.theatlantic.com/magazine/archive/2009/12/did-christianity-cause-the-crash/307764/

42. Fischbyne | October 23rd, 2012 at 7:35 am

People were swindled, to be sure, but for those of us who were everywhere told WE were the stupid suckers because we accepted the fate of renting an apartment, this video was tonic. (It’s since spawned many bad imitations, but this is the inspired original.) The common real estate speculator as Hitler in the bunker: http://www.youtube.com/watch?v=bNmcf4Y3lGM

43. Ozinator | October 23rd, 2012 at 8:17 am

@40,

vote for what?

44. Palmer Eldritch | October 23rd, 2012 at 8:18 am

@15 – “There is one guy online”… not only have you given away within five words that you are advertising your own blog, but you’ve managed also to inadvertently date yourself at age 50ish in the process.

@28 – This is the Internet self-promotion equivalent of PUA techniques. I’m curious as to how many sites you post this shit on, on a daily basis. Please let me know.

45. CensusLouie | October 23rd, 2012 at 11:46 am

I once took a gig editing videos of real estate seminars for fix & flip housing. This was in 2006 and even those speakers were admitting that the whole thing was going to crash in the next year or two.

46. helplesscase | October 23rd, 2012 at 4:27 pm

CensusLouie: you should write-up your experience.

47. SaltyDroid | October 23rd, 2012 at 9:54 pm

@44. Palmer Eldritch ::

I wasn’t @15 or at @28 … and @0 is how many sockpuppet self-promotional comments I’ve left on the Internet since 1896. So I’ll thank you to bite me.

@Yasha ::

If you want to go on a self-help warpath, then you’re in luck because they already put themselves on a list for you …

http://www.expertsindustryassociation.com/

48. DeadlyClear | October 24th, 2012 at 1:38 am

Would you please send a copy of the book to Obama with explicit instructions to read it carefully? Thanks.

49. Destro | October 24th, 2012 at 8:21 am

Read my post http://www.the-peoples-forum.com/cgi-bin/readart.cgi?ArtNum=21295&Disp=Refresh8&

Freepers in 2005 were denying real estate bubble and were pushing Nevada as the new right wing all white people promise land fooling rightwing fools into losing their fortunes. Now 80% of Nevada real estate is worthless. Right Wing Suckers!

50. DrktkDan | October 24th, 2012 at 10:24 am

It’s a start:

http://finance.yahoo.com/news/u-sued-bank-america-over-162731460.html

51. Friendly Coward | October 24th, 2012 at 6:43 pm

@15 Here. Absolutely not self promoting, just promoting. I never knew the phrase ‘there is this one guy’ held such a depth of hidden nuance. It just seems to me there is something of a venn diagram to Yasha and Salty’s beats, you know, the whole “scumbag scammer’s promising people financial stability and happiness while selling them awful, unhelpful, unproducts” If those products are horseshit self help retreats, horseshit multi-level marketing businesses, or horseshit mortgages, or horseshit mortgage backed securities, the end result is the same: the hustled get a great big sack of debt and misery, and the hustlers walk with their cash.

52. super390 | October 25th, 2012 at 9:16 pm

Just need a place to post this article on the ideological ties between Paul Ryan’s social security privatization scheme, and General Pinochet’s:

http://www.talk2action.org/story/2012/10/25/9257/3229

No SHAME Project for Ryan, he is too low to qualify.

53. exileDEAD | October 27th, 2012 at 2:40 pm

> they canned alyona

jane hamsher wanted her more

after a long day of work jane hamsher is very dirty

and sweaty

you are incapacitated with a drug she has injected

into your spine

jane hamsher is doing something odd

jane hamsher sat on your face

54. Bresner | November 7th, 2012 at 5:22 pm

So they read this guy’s book and then they bought a home? Get serious, most people don’t read at all. This guy was just riding the wave.

The U.S. govt has subsidized the troll market for decades now via the non-profit no taxes scheme and the tax write off for “charitable” contributions to orgs that pay troll monkeys like myself $6.95 per hour, no benefits to come on here and shill for poor Mr. Instant Millionaire. Yes, I will say onto you that Big Government did all this by offering VA, FHA mortgages, artificially low interest rates, tax deductions for mortgage interest, and not taxing gains on housing below $500k. You reaped what was sown.

55. Vernon Hamilton | November 9th, 2012 at 9:55 pm

@47 I am delighted to learn of the expertsindustryassociation, thanks for sharing – perhaps the least productive “industry” ever devised!

56. wietog | September 23rd, 2013 at 3:55 am

Our grandparents and parents were able to buy homes while working blue collar and mid-to low-level white collar jobs.

Our salaries have not kept up with inflation.

While it may be true that we overspend, it is NOT the reason we aren’t wealthy nor have adequate savings or retirement accounts. A few hundred a month makes NO DIFFERENCE when a root canal or basic car repair costs $2,000. You won’t change your life by saving a hundred or two dollars a month, is what I’m saying.

Yes, there was a strong push to encourage people to purchase homes, but that has been going on for some time. Why? Well, the mortgage brokers/banks, realtors and all the other quasi professionals (escrow officers, inspectors, contractors, etc.) stood to benefit as well. It was the exponential result of all those marketing campaigns, both subtle and overt.

So what happened? Those of us who were in a position to buy – some more likely than others – were caught at a bad time.

Case in point:

In 2005, my husband and I had decent jobs; we made over $100,000 per year. We were renting, and had about $20,000 saved.

We had NO DEBT, no kids, no pets and no student loans, nor did we have any medical issues or other responsibilities.

My husband was managing properties, and we saw that a snazzy 2-bedroom in our town (in the NW) was about $1500-2,500/month.

At the time, we were paying far less per month, however, we lived near bums, crappy retail and in a small, old building.

We knew that if we had a kid/kids, that we couldn’t stay there. We had to move.

So, we considered renting…but as we viewed places, we were painfully aware of all the limitations and the fact that we would have little to no control over our living space.

Would there be drug addicts, alcoholics, bums, smokers, partiers and/or criminals in the building/neighborhood? Most apartment communities that weren’t super high-end were iffy.

We weren’t keen on having neighbors right above/below us or sharing walls – we wanted some privacy and a sense of ownership.

We had been brought up to believe that renting was “throwing your money away.”

And yes, we assumed that if we bought a nice property in a viable neighborhood, took good care of it, kept up payments and lived there for 5-10 years that at WORST we would break even (but have good credit and the experience of owning a home) or we would make some money. We NEVER factored in that we’d lose, but that’s because so many things in our life were OK at the time.

The person in my life who encouraged us the most to buy was my boss, who, it would turn out, had not purchased her own condo – as she claimed – but had coerced her “business partner” into doing so for her (interesting side note: this “business partner” was an insecure woman who was raking in money in the CA real estate market and was influenced by my woo woo boss into funding her soon-to-implode “lifestyle business”.

My parents are invalids and were never homeowners; my husband’s mother depends on the state and his father was handed part of the family business (rich grandaddy). My husband did get help paying for his undergrad degree, but nothing more. His dad? Retired early, traveled and blew money on expensive property (he got burned eventually, too).

So, we didn’t have trustworthy advisers. Although we did have friends who have been successful in the NYC real estate market (even through the bubble). However, they operate in a completely different strata (millionaire developers) so their only useful advice – which we did not take as it seemed ludicrous at the time – was to hire a lawyer. We would live to regret that.

We shopped around for some time, and even though our mortgage broker prequalified us at half a mil, we balked and self-imposed a ceiling of $350K or less.

We strongly considered a rental property (a place with a mother-in-law unit or a duplex) but after a long hunt, we realized that the price would be too high AND if anything went wrong, we would be required by law to fix the problem – plus, we could end up dealing with evictions or just plain late payers. We didn’t have enough in reserves to cover it, so we abandoned the supposedly “smarter” idea.

We were shown a LOT of junk and then found a great place ourselves (although it would turn out to be WAY too small eventually). It was in one of the best neighborhoods, it was adorable, it had been upgraded and well cared for and had a lot going for it: a new deck, a garage, an alley, great landscaping, skylights, nice finishing touches, a gas fireplace, original pine floors, and it needed ZERO work to move in.

Our inspector tried to buy the house out from under us, and there was a bidding war. We ended up paying a little more than we had hoped, but it was still close to $350K.

However, after all the fees, it turned out that we didn’t have much for a downpayment. We turned to family, but no one stepped up. We had really good credit, but our mortgage broker processed us in a way that was more lucrative and easier for him – which resulted in a higher interest rate, with a long prepayment penalty period and the dreaded ARM adjustable rate mortgage loan.

At escrow, this was all revealed. We had no one there (our realtors sucked and the mortgage broker tried to bail) but we got him in. I hesitated (my husband trusted the guy – he was our very much above board insurance agent’s boyfriend). We went through with it.

Afterwards, our realtor flipped out. We approached the mortgage brokerage and got ALL our fees back. The broker was fired (lots of drama; our insurance agent let us go, it was a mess). But he had screwed us and had processed us with a no-paperwork loan. EVEN THOUGH WE HAD GREAT CREDIT AND AWESOME JOBS.

A month later, the company I had worked for for years went belly up. I found more work, and we proceeded to outfit the house, buy lawn equipment, spruce it up, etc. Not anything major, but here are some additional expenses that increase your monthly costs:

Mortgage (much higher than the rent we would have paid – $2500).

Homeowner’s insurance (which is offset by the tax deduction at the end of the year, so it’s a wash).

Utilities: ALL of them (including water/sewer/trash). These are MUCH higher than when you rent.

A water leak costs us $4,000 and was never even resolved!

An inept pruner cost us $500 to remove some branches.

Plants, stones and pavers cost $1,000.

A new fan was $300.

The stove wasn’t connected properly: $250.

The dryer gasket was inserted incorrectly: $200.

We had to check for black mold.

The windows were crap, but we didn’t have the $7-10K it would cost to replace them.

A mower, weedwacker and trimmer cost us about $1,000.

We had to fix a leak in the garage: $500.

Etc.

So, we held on for a few years, until I got pregnant in 2008. I had a great job with a seemingly strong company (they were willing to let me work from home after my leave AND kept asking how soon I could come back).

My husband was told he’d be getting a raise and steadily increasing bonuses.

I had several freelance clients I worked with, too. And we still had zero debt, plus the house seemed under control.

The pregnancy was hard, but I worked up until 8 1/2 months. During my 3-month UNPAID leave, the CEO and executives of the company I worked for were indicted and ended up going to prison for lying to their investors. It was a complete and utter shock to the employees and the business community.

We had the baby (thank GOD we had insurance). I was overwhelmed, exhausted and had terrible postpartum depression. My husband spent the only week he got for paternity leave in the hospital with me as I battled an infection. Fabulous. We ended up fighting and have continued on a downward trajectory since.

My husband’s boss was fired; the new boss would not honor the agreed-upon raise or bonus structure.

This is when the house sprung a leak, among other things.

Meanwhile, several family members and friends went through cancer, divorce, suicide…your typical salad of horrors.

We attempted (or I should say I attempted) the ridiculous homeowner’s programs to help us adjust our loan, but the prepayment penalty fucked us up. I sent our information in about 4 times and we waited up to 6 months with no word. Each time they claimed our info was lost and once they just sent it to some random company to be processed. Instead of being at the top of the list, we kept getting bumped to the back.

I tried desperately to work. Our daughter was born August of 2008 – the month the recession was officially “called”. I tried to get work from my freelance clients to no avail. We had almost no help from family with the baby (mother in law is disabled, father in law is an alcoholic; my parents are invalids and my brother has kids with severe disabilities (plus, my family lives far away). No siblings or friends or family to help meant VERY expensive, hard to find care whenever I went on job interviews or for meetings. I barely eked out any money, especially since the need for my line of work (writer/editor/marketer/etc.) was one generally shelved by companies during the recession.

We did refinance finally, which only served to reduce the interest percentage by like a point, the monthly costs were just as high. Ridiculous – the only ones who benefited were the bank, the broker and the escrow company, as usual. We should have sold, but with a newborn I was freaking out – moving would have been a nightmare (again, few people to help us and not much money to hire anyone).

When we tried to sell ourselves, it was a joke. Realtors would show up at the last minute – no warning – and nearly each time my baby would suddenly need a nasty diaper change – how do you change a baby’s diaper and get rid of the evidence (by disposing it out back) and attempt to spray away the stench and entice a new buyer who is now waiting for like 15 minutes outside your door with a realtor who is trashing your place to them (they HATE it when you sell yourself).

We wasted time and money on the MLS, storage and ads. We couldn’t get the banks to help – they only woke up if you stopped paying your mortgage, apparently. And to sell using a realtor meant that we’d lose money. It all made no sense.

But staying made the least sense. Our house was now worth $50-$100K less than what we’d bought it for. It was small. We had planned on renovations that thankfully we didn’t do and now couldn’t afford. It was an older house, which we realized was a bad idea (although the roof and structure were sound, things were likely to go south). AND the floor plan SUCKED for a baby/toddler – small rooms, hard to childproof, no storage, etc.

So, we ended up shortselling. Another realtor who sweet talked us into using him was unable to manage the banks, and it ends up looking like we foreclosed on our credit reports (because it took so long). Our credit was fucked, we wasted $1,000’s on prepping the house for sale (landscaping, painting, repairs, etc.) and ALL of the mortgage payments/costs/fees disappeared.

We probably should have just foreclosed and stopped paying for a year to save up money prior to moving, but my husband didn’t want to chance us not being able to find a decent rental/landlord. We’ve lucked out with a great landlord and frankly, a nicer, bigger place, but it’s an apartment and we have no yard or parking. We are in debt, I’ve had trouble finding work. My husband has been reluctant to switch or even look for new work (afraid he’ll get fired in the process) and his company has offered shittier and shittier diminishing “benefits”, cut his pay and eliminated bonuses, all while piling more work on him and paying him WAY less than previous employees.

If we had bought our home a few years before – that is, if we had met earlier and had been at the right time in our lives to buy, we would probably be fine. Some people like that tend to look down on people like us – “Oh, I worked HARD for my home; you paid TOO MUCH for yours; you shouldn’t buy a house you CAN’T AFFORD; you are not a responsible person, etc.”

BULLSHIT.

We were so responsible and loyal, we FUCKED ourselves. We followed ALL the rules. When investors strategically go bankrupt (like Donald Trump does regularly) it’s considered smart business; do it as a homeowner, and you are a lowlife scumbag greedy loser.

We invested in a home that was snapped up during the shortsale – there was even a bidding war on it (but it still sold for far below what we’d paid for it 5 years earlier). It is in a GREAT neighborhood near a thriving city. We WORKED HARD. Our BOSSES screwed us over.

Right now, there are many intersections in our town where there are 3 empty properties and a fucking new bank branch (Chase, B of A, etc.) A perfect visual metaphor for what happened: the little guys got screwed and the banks made out like bandits – their only risk was getting bailed out…with OUR OWN MONEY.

I get FUCKING PISSED OFF when I think about it all. Especially since we are often mocked and looked down on, when frankly, all we did was get involved in real estate at a bad time. Who knew WHEN the bubble would burst? we knew we had to get in before it got worse, or so we thought.

We bought our house for $360,000 in 2005. A few years later it was worth about $430,000. It didn’t seem to make sense to sell, since we were having the baby, and once we factored in all the taxes/fees/costs, we’d break even if anything.

5 years after we moved in, we ended up shortselling for $330,000.

3 years later – a few months ago – it sold for $360,000.

Bad luck, bad timing, bad advice, bad move.

Meanwhile, my husband also lost out during the dot com bubble – he was up a few hundred thousand…next thing you know, he lost it all.

The USA is a game, and the house always wins.

Leave a Comment

(Open to all. Comments can and will be censored at whim and without warning.)

Subscribe to the comments via RSS Feed