It’s great to be right.

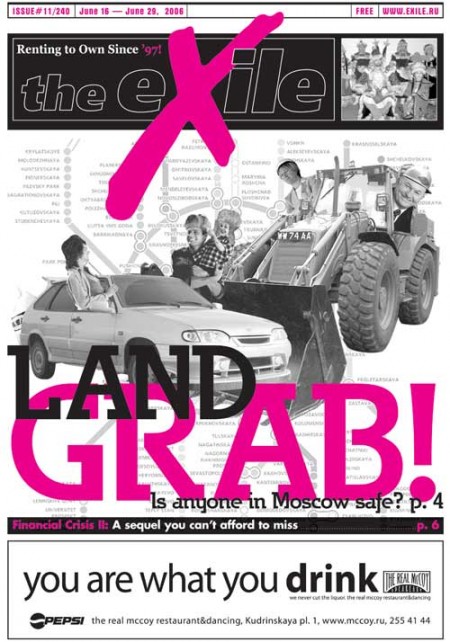

It’s Sunday, a good day to gloat about how I was right and everyone else who gets paid serious money was a fucking idiot. The Financial Crisis that everyone claims they couldn’t possibly see coming? I saw it coming, two years before the collapse–all the way from Moscow. And so I just want to tell all of you lying brainwashed dickheads out there: I toldja so! Yup, that’s right: in 2006, two years before the financial collapse, I wrote a big piece in The eXile headlined “Why You’re Fucked: FINANCIAL CRISIS II: ANOTHER SEQUEL” predicting that the out-of-control credit bubble would explode and tank the financial system. I’m excerpting it below so that you can all worship me,. I believe the word is “prescience”?

And while we’re on the subject, just wanted to remind everyone of the last “who coulda see it coming?” financial collapse that I predicted before anyone else: Russia’s 1998 financial crash.

I got it right in 1998…

Okay, now I can hear you asking through gritted teeth, “But if you’re so smart, Ames, why ain’t you rich?”

Good question. I ask myself that about 150 times a day, and one of the best answers I can come up with is, “Whoever said that there’s a relationship between smarts and wealth?” Maybe if my family wealth came from taxpayer handouts like Megan McArdle’s, I’d be a rich man today. Or if I was born into a filthy rich family. Inherited wealth, and welfare-for-the-rich seem to be the only paths to riches in this country.

Butcha can’t take my gloat away, by gum!

…And I was right about 2008, which I called in 2006. Ha-ha-frickin-ha!

So, getting back to my Sunday gloat: ahem…let me clear my throat here…I WAS FUCKING RIGHT! Yeah, I may be poor, but I’m not a braindead idiot like the rest of you. And while I didn’t get rich off being so smart, I also didn’t sacrifice my healthy years accumulating capital, only to see the whole thing vanish before my eyes. While you were slaving away in a miserable job, I was living in my body the way God intended: fucking, snorting, and basking in the kind of cult-celebrity glory you fools only dream about. And while your savings vanish and your housing values collapse, the investment I made into being more right than you is something that pays dividends forever.

So now I’m going to cash out a few shares of my “I’M RIGHT AND YOU’RE NOT” investment–behold my gloat, for your eyes and everyone else’s, and not only.

Here is an abridged version of my exile article from June 16, 2006:

June 16, 2006

Why You’re Fucked

FINANCIAL CRISIS II: ANOTHER SEQUEL

by Mark Ames

Could we be on the verge of another financial catastrophe? I’ll admit it: I’m hopeful. First, because I’m poor and spiteful, and secondly, because one of the nice things about financial collapses (like military disasters) is that all the ugly, corrupt realities underpinning a so-called economic boom are revealed, and the worst in humanity is laid bare, and everyone everywhere gets pissed off, cynical, and hopeless. That’s the kind of thing that boosts my mood, not to mention my sexual drive. Financial panics are to me what endangered mammal horns are to Chinese men: pure Viagra placebo.

…

In retrospect, the financial crises that ripped through emerging markets in the late 1990s appear inevitable and obvious. So does the bursting of the NASDAQ/dot-com bubble in 2000. But right up to the day of the Asian/Russian collapses, no one expected them, and no one understood them, because the circumstances, and in particular the terminology, had not yet been incorporated into popular financial-crisis discourse.

So what is happening globally this time? What’s the word that everyone’s going to “get” this time around, just as the last time around words like “debt burden” went from being vague economics terms to obvious explanations for why those markets collapsed.

Last time it was a debt bubble. This time it’s a credit bubble. (italicized bold in original–MA) What that means is that since 2000-1, when the US markets crashed and the economy headed into a recession, the US Central Bank pumped shitloads of money (liquidity) via ridiculously low interest rates. This meant that people had not so much “more money” as “easy-to-access” money which they used to buy houses. All that easy money meant housing prices soared for five years straight, to levels unprecedented when compared to the average Joe’s stagnating income. However, all the Joes who owned houses saw their asset prices soar, much like those who held NASDAQ stocks in the 90s saw their stock portfolios soar, and that meant more money to spend on everything from plasma TVs to hybrid SUVs, liposuctions surgeries and everything else sold on credit. The US government worked the same voodoo on its budget — massively increasing spending while at the same time cutting tax revenues. In other words, offering easy, free money to itself.

This easy money, and easy credit, is even easier in other parts of the world. China has seen its money supply grow 20% over the last year, and credit growth has soared 30% in India. The same has been happening in Europe, Japan, and of course Russia, where Russians are offered easy loans to “purchase” everything from vacations in Turkey to crap apartments in podmoskovie.

While in the last crisis, emerging market economies like Russia were forced to issue bonds at increasingly high interest rates in order to finance other high-interest-rate bonds they couldn’t pay off, this time around, thanks to all the easy money and the weak dollar, yields on emerging market bonds are illogically low, approaching developed economy bond yields. Meantime, junk bonds issuance is at its highest rate since the 1999 speculative peak. Mergers and acquisitions are bursting all records. Much of this is financed by debt, and all kinds of popular, profitable debt schemes like repos, credit swaps, and all sorts of “esoteric” debt products and instruments.

Central bank reserves in Russia are approaching an insane $240 billion, while China’s $880 billion now exceeds Japan’s. More and more money is being pumped, inflating prices on any piece of crap asset, from Brazilian bonds to partly-built Moscow panel apartment blocks.

Just as record low interest rates in the US led to unprecedented rises in housing prices, year after year, all this easy money is leading to massive price rises in commodities. Copper has doubled just this year alone. Oil — everyone here knows what’s happened. In Moscow and elsewhere in Russia, housing prices have soared every year since 1999, including 45% in Moscow just this year alone. The stock market also boomed 50% before falling.

This is the bubble. Easy credit swells prices to ridiculous heights. The credit-issuance bubble is untenable. And now it’s starting to pop. And what’s making it pop is an ever-so-slight pullback from five years of reckless easy money in the US, where it all started — in the form of today’s higher US Federal Reserve interest rates. Even though they’ve raised rates 16 times, they’re set to continue raising rates because inflation is still rising, and the dollar is still weak. The catch is that inflation is rising because of the easy credit. If the credit’s cut off, inflation will slow, but the bubble will pop and take the whole thing crashing down. If credit remains easy, inflation will continue to spin out of control, requiring even more credit tightening later and an even bigger bubble burst.

Recent signals that the Fed planned to continue raising rates were the catalyst for this past month’s credit-bubble pop — and why Russia’s stock market is tanking. That’s because the US still controls, to an incredible degree, international finance. If US rates keep going up, that means money gets less and less easy. No one in the financial markets world wants to be the last to the gate. So they pull out of the speculative markets first — like Russia — and as the bubble burst grows, money retreats to safe places, such as US bonds, which are now returning rates not all that different from Brazilian bonds. Panic sets in — money follows money, and just as asset inflation becomes irrational, so does asset deflation.

The bottom line is this: the global economy is experiencing one of those insane, untenable imbalances, all emanating from New York and Washington, just like the last time around, most of the effects of which will be felt in Mumbai, Istanbul and Moscow.

As the easy credit dries up in the US, assets that inflated most wildly — like American houses and Russian stocks — are the first to fall. And both already are.

What’s happening with emerging market stocks is just a snapshot of what’s to come. In just the last month, the stock market selloffs have wiped out $2 trillion in wealth around the globe. That’s scary, and that means that more money’s going to be leaving places like Russia. And just like last time, first it’s the stocks and bonds that get hit, and eventually, property prices get creamed as more and more money leaves.

How far everything will fall, and for how long, is anyone’s guess. All one can do is hope. And my hope is that the whole fucking house of cards comes crashing down, to the point where in a couple of years from now, humanoids will be roaming barren cities in packs, competing with crows and stray dogs for carcass bones. Because when that happens, everything, even a nifty three-room apartment in Kitai Gorod, or a humble condo at Zuma Beach in Malibu, will be affordable to a lifelong fuckup like me.

So keep the easy credit rolling, ye greedy finance goons…the higher it rises, the harder it will fall. And the more for me.

Mark Ames is the author of Going Postal: Rage, Murder and Rebellion from Reagan’s Workplaces to Clinton’s Columbine.

Click the cover & buy the book!

Read more: financial crisis, Mark Ames, Gloats

Got something to say to us? Then send us a letter.

Want us to stick around? Donate to The eXiled.

Twitter twerps can follow us at twitter.com/exiledonline

48 Comments

Add your own1. Meh. | September 27th, 2009 at 3:10 pm

Who are you gloating at? Most people who know anything at all about, well, anything saw this coming. The people who at CNBC and other bullshit financial news sources are idiots and everyone knows that. Plus, they don’t get paid to broadcast the truth so it’s quite possible that they saw the crash coming as well. But reporting on it wouldn’t serve their corporate interests.

Please write more about Russia and Going Postal murders. You’re better at that.

2. buzz kimball | September 27th, 2009 at 3:19 pm

so what’s in store for the future, brainiac ?

is obamma going to save our white ass and return the economy to ‘growth’…

or are we talking USS TITANIC ?

3. Jeff Albertson | September 27th, 2009 at 3:30 pm

You are, in fact the Man. and thanks for featuring the Ron Paul interview in What You Should Know. He was also predicting the Meltdown in 2006, and totally without the aid of drugs and hookers.

4. rossiya | September 27th, 2009 at 4:08 pm

Actually Meh is completely whack. I foretold this crash in spring 2008 and was almost laughed out of the office. Is was obvious only as mathematical rigor thwarts delusion and stupidity. There were no Mehs advising caution early last year. In fact, being bearish was portrayed at the same level as a domestic terrorist.

5. leipzig | September 27th, 2009 at 4:13 pm

Can we see you naked now?

6. Jack Reynolds | September 27th, 2009 at 4:33 pm

When you remember Russian women, do your balls swell up out of your boxers and turn icy blue?

7. WE | September 27th, 2009 at 4:40 pm

“It is in fact a crime for an American to be poor, even though America is a nation of poor. Every other nation has folk traditions of men who were poor but extremely wise and virtuous, and therefore more estimable than anyone with power and gold. No such tales are told by the American poor. They mock themselves and glorify their betters. The meanest eating or drinking establishment, owned by a man who is himself poor, is very likely to have a sign on its wall asking this cruel question: If you’re so smart, why ain’t you rich?” Kurt Vonnegut-Slaughter House Five

I guess Vonnegut sided with you Mark.

8. porkers-at-the-trough | September 27th, 2009 at 4:46 pm

Well, I gotcha beat, Ames… I’m gonna write a gazillion-word anonymous post and assume you’re going to post my drivel. Am I right?

9. gatorade | September 27th, 2009 at 5:28 pm

it’d be good, mark, if you talked to the same people who were there when you wrote that stuff. they may have a memory to tell….

10. Quadrillion Dollar Man | September 27th, 2009 at 6:44 pm

Well I won’t give you credit for calling it, because everyone who wasn’t bought and paid for by the oligarchy knew this was happening.

However I will give you credit for living a life of hedonism and pleasure instead of slaving away 12 hours a day at some hedge fund only to end up back on the street exactly where you are. That was the right call to make in 90’s America – go long on Moscow hedonism.

But now that you’ve all been kicked out of Russia, what are you going long on?

11. chrisv | September 27th, 2009 at 7:32 pm

Very deserved gloat, Mark. However, while I do not want to rain on your parade, I should note that there were many more people that were just as right as you.

It was not very hard to figure out that the average person could not afford the average house, and then to connect the dots from there. For example if you look at the housing forums on craigslist where average people were discussing the prices of housing, it was pretty clear to many people that there would be a huge crash.

This thing about how “nobody could have possibly predicted this financial crisis” is another piece of media manufactured bs, just like previous favorites like “everyone is in favor of the war”, “virtually all Americans agree that we must give up some civil rights to protect ourselves from terror”, “who could have possibly known that in the face of all this evidence Saddam did not have WMDs”, etc.

It is just very convenient for a lot of powerful people to pretend that the financial crisis was some kind of unpredictable natural disaster like an earthquake rather than something a lot of people willingly and knowingly went into. I am sure even that most people responsible for the damn thing could have and did predict it as well but did not want to stop it because they were making so much money and were sure they would find a way out once the shit hit the fan.

12. AIG | September 27th, 2009 at 10:09 pm

hahaha

Is this your nostalgia file?

Ah fuck it. Awesome picture.

13. Allen | September 28th, 2009 at 12:16 am

That is one serious Miami-Vice gloat look being rocked there …

Good call. Deserved gloat. There were quite a few people who saw the recession coming years in advance, however.

But that’s the kind of thing that somehow never fully gets let out of the bag to the level of action — because they want the average person to take the full force of he invisible fisting hand … you know for the health of the market and its ghostly cycles. There’s that and then there’s also some serious “I don’t wanna think about it” syndrome, because this one was so big that even many rich folks were bound to lose a lot.

Tied to this is the fact that all the little irrational greed machines never fully believe they’re fucked. They cannot bring themselves to recognize the whole stack of quarters has been flushed; it’s gone; the time to cut one’s losses is now; they believe just enough that that next crank of that machine arm will bring the jackpot … and after all, surely they’re in too deep to quit now.

14. rossiya | September 28th, 2009 at 2:47 am

chrisv you display the infallibility of retrospect. I see this often in the market, where the candlesticks display a perfect pattern. Yet almost nobody correctly picks the direction of the next candlestick. And that skill distinguishes Mark. It means he’s onto something that you weren’t. Americans in 2006 were all about war and global homogeneity, and in 2007 they came close to starting WWIII. The financial sphere is merely playing catch-up to US barbarity.

15. SweetLeftFoot | September 28th, 2009 at 3:35 am

Yep Ames, has been at the power pipe again. Anyway, good piece. Worth a gloat even if you weren’t exactly the only person on Earth who called it.

16. DarthFurious | September 28th, 2009 at 6:57 am

I’m a fan for the most part, really I am. Especially all the class warfare shit-disturber material. But really dude, how hard is it to watch the same rubes line up at the same three-card monty table every day and not see what’s coming?

17. Plamen Petkov | September 28th, 2009 at 9:34 am

Not to bust your gloating but I knew USA was fucked in 2005, a year before you so I sold my house in Las Vegas(for a nice profit i might add) and got the eff outta that shithole for good. I just got no articles to show for it. Ah well, leave and learn(pun intended). Wonder how the two lesbian Asian chicks I sold the house to are doing and when they lost it.

18. Iok Sotot, Eater of Souls | September 28th, 2009 at 10:29 am

Mark Ames, I salute you!

19. Esolo | September 28th, 2009 at 12:08 pm

This is one article I came across a while ago where self proclaimed “Financial Wizards” appologized to Queen Elizabeth II.

http://www.telegraph.co.uk/news/newstopics/theroyalfamily/5912697/Queen-told-how-economists-missed-financial-crisis.html

The best quote is how the letter ends:

“In summary, your majesty, the failure to foresee the timing, extent and severity of the crisis and to head it off, while it had many causes, was principally a failure of the collective imagination of many bright people, both in this country and internationally, to understand the risks to the system as a whole.”

Collective imagination? “bright people”?

Something really nerdy about that when you have a bunch of Wizards apologizing to a Queen for being really good, yet failures at magic spells.

20. Fu Manchu | September 28th, 2009 at 2:05 pm

Meh.. saw it coming in 2000. The very year I graduated college and got a real job. The very year I quit taking Ayn Rand seriously.

No “I told you so” will stop the heartbreak of watching my family suffer in their shitty jobs… even though I swore in 2002 that these wars would kill our empire.

I was right and they were wrong. I even felt fine with it, because I want the empire to die.

And in this anonymity I can say something I’ve never told anyone I actually know: watching those towers fall live on TV I jumped up and shouted “awesome!”

That was a fine day for me… we all watched CNN at work and no one expected me to get anything done. I left early to “work from home” and lit up a fat bowl.

But then I saw how ugly it really gets. A week later, some redneck tried to pull me out of the car because he didn’t like my driving.

People were saying ugly things; like “war in Iraq will fix the economy.”

I knew better, but wouldn’t say so anymore, because everyone I knew had divided into the ugly (“Muslims should die”) and the apathetic (“why would you bring this up and harsh my buzz?”)

But today… I don’t tell anyone “I told you so”.

There’s no fun in it.

21. Flatulissimo | September 28th, 2009 at 3:49 pm

Well played, sir, well played. I figured this post would bring out all the “Duh, I saw this coming, too” people, and here they are. Hell, some of them might even be telling the truth, since this website probably attracts a higher percentage of people who are receptive to such heretical views. However, how many of you folks saying “meh” published your thoughts publicly, with your real name attached to it for the world to see? Very fucking few. Besides Mark, I can think of Eric Janszen at itulip.com, and maybe some of the folks at some housing bubble blogs, who predicted what is happening now. For the VAST majority of the population, however, the idea that the US of A would experience a massive financial collapse? Such a thing was unthinkable.

Hell, is STILL unthinkable to most, even though it is actually happening right now. One of my co-workers is buying a condo as we speak! Really! It hasn’t even been constructed yet! I tried to drop some hints that maybe buying a condo at the beginning of the biggest real estate bust and financial catastrophe in history was a bad idea, but too many years of HGTV made the use of logic impossible. Seems like most people are going to insist on figuring this out the hard way.

22. Flatulissimo | September 28th, 2009 at 4:00 pm

Oh, and for the record, I saw this coming, too. In around 2005. I’m not rich either, but I enjoyed myself rather than buying into the bullshit culture of the aughts. I don’t have much money, but then, I didn’t work very hard, either. Bastards who slaved away at jobs they hated to pursue the “American Dream” are left with jack/squat. If the past decade was spent by most pursuing the American Dream, I can only conclude that most Americans have really boring fuckin’ dreams…

23. Tarkovsky | September 28th, 2009 at 4:24 pm

Lots of Monday Night Quarterbacking going on here. How many of you put your prescient financial insights on the internet for all to see back in 2006? Yeah, that’s what I thought.

That’s why Mark gets to gloat while you just get to bitch in the comment section. Gloat on, Markus, gloat on.

24. wengler | September 28th, 2009 at 7:36 pm

I think a lot of people know that something is wrong, but it takes a good analyst to get all the details right.

Putting the flame to our own industrial sector- the engine that built the modern western world after World War II- in the name of destroying the middle class and enriching billionaires was probably the tipping point. It took over a century to build an industrial economy, yet it only took 30 years to destroy it. The “hi-tech” economy has only enabled the continued capital flight as US labor simply can’t compete against slave labor overseas.

The capitalist class wants more capital, the powerful want more power, and a peasant mentality pervades the American underclass as they compete for scraps off of the master’s table. Back in the day, we had ‘dangerous’ speakers like Debs going to prison for telling the truth. Now who do we have as a counter to mainstream opinion? Ron Paul? A guy who draws from the same pool as the Birch Society? Noam Chomsky? Someone who I like but whose cadence would put a hummingbird to sleep and whose name isn’t even known outside of academic institutions?

You’ll get either punched or ignored for saying “I told you so” but as you can see no one in power really paid a price for the last 30 years of fuck-ups, and people so devastatingly wrong are still getting paid by their bankrupt newspaper patrons

It is very simple at this point. We are fucked.

25. Allen | September 29th, 2009 at 12:38 am

I got to save a meager amount of money on the stock market by (eventually! Shit is harder than you think) pulling my “investments”, thanks to common sense and the foresight of folks like Mark.

Clearly something was fucked and a lot of people saw it (but absolutely few had the guts to PRINT it). When it became clear even the slightest push to the housing credit bubble would scrap the U.S. economy, it was clear a storm of excrement was brewing … and it’s not like the problem was going to fix itself.

The key here is not “predicting” but having the guts to print. A lot of the experts must have had some idea things were fucked, but they could never have come out and said it. That would be like blasphemy — failure of optimism is the cardinal sin of the finance religion. It should be no surprise that in the U.S.A. no lessons seem to have been learned, and the “bankers” have returned to their old activities unrestrained. Voodoo Capitalism finds its mecca in America; the invisible ghost hand is America’s One True God.

26. AK | September 29th, 2009 at 1:20 am

Do you dye your hair?

this goes well with the role of hedonistic prophet, and the colour is just perfect

27. Seymour Butz | September 29th, 2009 at 5:23 am

Yeah, I remember that article. Along with some other stuff I read back then it convinced me to stuff the little inheritance/good luck in my career I’d come into at the time in a money market account instead of jumping into Boston real estate at the peak of the biggest asset bubble ever. What stuck in my mind in particular was your line about Malibu condos. Seemed like ol’ Ames had LA on the brain at the time… Maybe you’d been there writing a book or something? The thing that maybe nobody saw coming I guess was the intervention to save those 2005 condo prices at the expense of everything else. Once it started happening last year I seriously thought I’d be able to get a modest condo in the Boston area for 50k or whatever. Why not? You could in the early 90s. But it never happened. They killed off my money market interest rate to save all the mortgage slaves instead. At my expense? I don’t know. Probably. It’s too complicated even for me and I read all the smarties. I guess that’s why Wall St. always wins.

28. random | September 29th, 2009 at 8:46 am

If you, who say so, were confident the bubble was about to burst, you could have made a lot of money trading.

If you did. Well done. If you didn’t, your proclamations of your own brilliance are a bit hollow.

29. Joe Blow | September 29th, 2009 at 12:05 pm

I went to 50% cash in 2007… started getting back in in June 08. invested a lot in early 09 so am getting a good bounce.

pretty much even with sept 08 and even a bit ahead.

30. gosh | September 29th, 2009 at 1:41 pm

summer of 2006, the real estate market in CA in Fla. already started crashing. You had lots of people pointing that out. Steve Keen (set up his blog on debt deflation in 2004), guys at the Levy Economics Institute, Thomas Palley, David Kotz, and many other economists. so it’s hard to claim originality for Ames.

now of course I’m more than ready to believe that Ames did not read these people, but still, anybody who had a look at the shiller hom prcie index, could easily figure that we’re in for a major asset bubble deflation.

now of course the really hard thing to explain is why the crisis is so deep. and I don’t think that the housing bubble-bust is sufficinet to explain that.

31. John | September 29th, 2009 at 1:52 pm

Two things Ames:

1) In this picture you look like a Roman

2) You know it’s possible to bet short on the markets, right? There were so many fat, juicy companies out there from 2006-2009 that clearly had negative profits, poisoned balance sheets, and were waiting for government bailouts that it was like a fucking turkey hunt out there.

32. rossiya | September 29th, 2009 at 11:59 pm

>now of course the really hard thing to

>explain is why the crisis is so deep. and I

>don’t think that the housing bubble-bust is

>sufficinet to explain that.

It’s called fractional reserve banking. The Rothschilds [FED] call loans, and your branch bank must call 100 times that amount. Instant world depression right on a laptop! Then they buy everything at firesale prices. They teach schoolkids that is the “business cycle”, and the circle is complete.

33. gosh | September 30th, 2009 at 6:16 am

Rossiya, you’re completely wrong. Fractional reserve banking has been around for say 200 years. This is how the modern credit system has always worked, ever since capitalism really got going in the early 19th century. if you maintain that the fundamental root cause of economic crises is credit (mis)allocation, show me how it caused the crisis of the seventies, where general indebtedness was very low. huh?

nah, i’ll direct you to some more serious stuff:

The Falling Rate of Profit as the Cause of Long Waves: Theory and Empirical Evidence

(of course, bankruptcies, whose proximate cause is being unable to pay debts are a typical thing during all economic crises. but to say that an excessive debt burden caused a crisis is simply a tautology. the question is: why does value production (again and again) become too anaemic to service debts? this is the Big Question.)

34. ............ | September 30th, 2009 at 8:35 am

just a few of the titles of the LEVY Economics Institute’s Strategic Analysis Series:

Strategic Analysis | April 2007

The U.S. Economy: What’s Next?

The collapse in the subprime mortgage market, along with multiple signals of distress in the broader housing market, has already drawn forth a large body of comment.

Strategic Analysis, April 2007

Strategic Analysis | November 2006

Can Global Imbalances Continue?

In this new Strategic Analysis, we review what we believe is the most important economic policy issue facing policymakers in the United States and abroad: the prospect of a growth recession in the United States.

Strategic Analysis | May 2006

Can the Growth in the U.S. Current Account Deficit Be Sustained? Can the growth in the current account deficit be sustained? How does the flow of deficits feed the stock of debt? How will the burden of servicing this debt affect future deficits and economic growth?

Strategic Analysis | January 2006

Are Housing Prices, Household Debt, and Growth Sustainable? Rising home prices and low interest rates have fueled the recent surge in mortgage borrowing and enabled consumers to spend at high rates relative to their income.

Strategic Analysis | March 2005

How Fragile Is the U.S. Economy? As we projected in a previous Strategic Analysis, the United States’ economy experienced growth rates higher than 4 percent in 2004. The question we want to raise in this Strategic Analysis is whether these rates will persist or come back down

Strategic Analysis | April 2004

Is Deficit-financed Growth Limited? Wynne Godley, our Levy Institute colleague, has warned since 1999 that the falling personal saving and rising borrowing trends that had powered the U.S.

Strategic Analysis | November 2002 (!!!)

Is Personal Debt Sustainable?

The long economic expansion was fueled by an unprecedented rise in private expenditure relative to income, financed by a growing flow of net credit to the private. On the surface, it seemed that the growing burden of the household sector’s debt was counterbalanced by a spectacular rise in the relative value of its financial assets, but this was never a match among equals, and the great meltdown in the financial markets has proved this imbalance to be true.

35. james | September 30th, 2009 at 9:16 am

WOW your Nostradamus and I’m NOT! (I can’t even spell “you’re” for chrissakes!)

Everybody knew about the coming crisis that is like predicting each new US president will be involved in a war or conflict.

LaRouche is a pastry chef and by gum I dream of having a pastry chef like him babysit my kids! Wouldn’t you?

36. james | September 30th, 2009 at 2:16 pm

Lyndon LaRouche touched me in funny places when I was a child. I wish he would continue to touch me there. Any suggestions?

37. james | September 30th, 2009 at 5:18 pm

Okay if LaRouche won’t molest, me, is there someone who will? Please?

38. rossiya | September 30th, 2009 at 8:26 pm

Gosh, you’re completely wrong. All the Rothschilds do is split zero into credit[bills] and debit[debt]. The entire commercial system invented by the Templars and stolen by the Jesuits and enforced by the banksters is about debt chasing those who have used worthless bills. At some point debt will find credit just as antimatter always finds it’s counterpart and they annihilate back to zero. You can’t get something from nothing, but only oblivion.

Inflation was printing too many worthless bills without an asset base to bubble, be that tulips or buildings. Seems you missed the point.

200 years ago Americans used colonial scrip, which consideration for economic assets. Inflation was nonexistent, and the US grew so quickly that England instigated the revolutionary War, indebting all Americans to the Bank of England. This tribute you now pay is commonly known as income tax.

39. Huge fan of Mark Ames | October 1st, 2009 at 9:12 am

Hi folks! I don’t have a job or a life so I just keep on posting comments here, and yeah, I’m also a closet anti-Semite. Closeted about lots of things. You should see my face. I’m even uglier than that woman in Misery, but I’m just as much of a fan of Ames as she was.

40. Hilter | October 1st, 2009 at 10:37 am

“anti-Semite” I have not said anything about the Arabs seeing how the people who call themselves Jews are Eastern European Khazars with little or no historical connection to the Middle East.

No job or life that is how I am able to pay for the broadband connection to comment on this site.

No life who is the one monitoring, censoring and editing comments?

41. Necronomic Justice | October 1st, 2009 at 1:47 pm

@40 “Who is the one monitoring, censoring and editing comments?”

I don’t know who all does it, but if I had job I would pay good money for them to keep at it.

It’s good stuff.

42. David C. | October 2nd, 2009 at 5:52 am

It’s easy to see what’s coming, but hard to get the timing right (which is the key to surfing the waves, financially).

For a much more comprehensive look at the once-in-13-generations financial mania and contemporary analysis (not a post-mortem), try this:

http://www.elliottwave.com/more_info/mania-chronicles/default.aspx?code=oco

Of course, at $119 plus S&H it’s probably only for those who got the timing right, too.

“Every page includes compelling and often astonishingly accurate forecasts along with the inevitable miscues, to which the authors adjusted as required. In every instance you are there, experiencing events as they happened. From size alone, you can tell that this is not the sort of text you read in a few sittings. it’s an encyclopedic resource that includes a full index and table of contents, so you can search by topics that interest you most, whether they be financial or cultural.”

43. james | October 2nd, 2009 at 8:06 am

You and Steve Wonder saw the financial collapse.

44. thuggin | October 2nd, 2009 at 10:36 pm

be serious … in the photo … you’re standing in line at the mall, aren’t you. buying more of those SUPER dorky Hawaiian shirts?

45. dermotmoconnor | October 3rd, 2009 at 5:12 pm

Mark – in the photo there’s a HUGE white thing in the back of your mouth (your right, image left).

Is it gum, or do you have the world’s largest molar?

In any event, well done sir!

Re: predicting the collapse… Mike Ruppert back in 05/6 practically begged people to sell their homes and buy gold. Damned good advice!

If you accept the Peak Oil interpretation, light sweet crude production hit a peak in 05, and has declined since. Even throwing in shite like tar sands as oil has barely allowed for a production increase – and we seem to be on a plateau.

Expensive oil = Big Trouble. Google “TheAutomaticEarth” for continuing analysis of the meltdown, as well as “The Oil Drum” for coverage of the energy situation.

46. Tam | October 5th, 2009 at 2:41 pm

Mark

A well deserved pat on the back there. That article brought back memories. It was in the first ever issue of the Exile i read and the only issue I’ve ever had a hard copy of it; I was visiting Moscow at the time and was amazed at how different it was from ANY other magazine I’d ever read. I kept it and still have it now…

To be honest, it wasn’t in itself THAT unusual an idea in the UK at least, (smarter British financial reporters like Anthony Hilton and Larry Elliot had been writing about it in the financial pages as well as goldbug assholes like Bill Bonner at the ‘daily reckoning’ website have been banging on about economic catastrophe stuff like this for years) but what was surprising was seeing it so vividly written in black and white on paper (instead of just on the internet) and available for free all over the city. It made me realise just how narrow the range of ideas discussed that make it to the print media actually is.

There was however another article in the same issue, which was about something pretty amazing which hadn’t even occurred to someone as smart as me. It was a fascinating review of the hit Turkish flick ‘Irak : Valley oif the Wolves’. I know you make a point of pretty much ignoring comments but you really ought to retrieve the article from the vaults about how we NEVER see a film with the Americans as the bad guys in a movie…

47. Pieter | October 29th, 2009 at 12:44 am

Very good. Very honest also to admit you’re not rich. I agree that born in the right family is EXTREMELY important for your future life. Dads in rich families most of the time have learned how the world works from their dad and their dad from their dad etc. If you’re from an average family and you have to figure out that all the left wing propaganda from 1970 until now was total bullshit and you don’t have a starting capital, well, it will be pretty hard.

Anyway, I also figured a crash would come but didn’t know exactly what year, I figured it would be 2009 and it was 2008, stupid. But I did get out of gold stocks in 2007 and back in at the end of 2008, beginning of 2009.

To make it very abstract, we are quickly approaching HISTORICAL TIMES, there will be events that are going to be horrible. The world is turning to socialism/ fascism again…. so buy gold and gold stocks, that’s what the rich do to preserve their wealth. You can hitch along.

Nice girls on the pictures. How’s live in Russia? Would be also interesting to learn a little about that..

48. Pieter | October 29th, 2009 at 12:46 pm

My apologies. I came to this discussion via a google web search. Apparently there’s an alternative paper/ site behind this.

I didn’t know that so forget this comment that it would be interesting to know about life in Russia, should read your excellent site first..

I was in Russia in 2003, extremely nice people. Everybody was so nice. So easy to get along with everybody, very different from Europe. Anyway, married a Russian and learned also some disturbing things but they prepared me for what’s probably coming. So buy gold.

Leave a Comment

(Open to all. Comments can and will be censored at whim and without warning.)

Subscribe to the comments via RSS Feed