If you search your favorite news aggregate for “US housing market”, you’ll find a whole mess of headlines guaranteed to make you feel good about that crappy McTractHome you might have bought at the height of the real estate orgy. Turns out that you’ll start making money on your investment sometime very soon. Just look at the stuff I skimmed off the top of Yahoo and Google News:

Hovnanian CEO sees signsof housing market bottom . . . US home prices turning the corner . . . Valley housing market picking up . . . The Housing Market: Has It Turned the Corner? . . . US Housing May Be Turning Around, Shiller Says . . . Leap in new home sales sends homebuilders higher . . . Home prices, sales on rise in Boston area . . . Dallas home prices showing gains, fueling optimism . . . Index Shows an Improvement in Home Prices

Most of these headlines are based on a single feel-good trend in the Standard & Poor’s/Case-Shiller’s U.S. National Home Price Index, which was just published for the month of June. If they are all talking about it, it must be big.

Here’s how Time magazine digested it for its senile Baby Boomer readers:

“Home prices across most of the country have started to rise from the depths of the housing slump, a critical trend that will help stabilize the broader U.S. economy. . . . Nationally, prices in the second quarter posted their first quarterly increase in three years. . .”

David Streitfeld of The New York Times is 100 percent in sync and hits all the same points:

“In a convincing sign that the worst housing slump of modern times is coming to an end, prices are starting to rise in nearly all of the nation’s large cities. . . . The trend, displayed in newly released data for June, is both pronounced and wide-ranging.”

“Pronounced” and “wide-ranging”? Hot damn! Them is some recession fightin’ words, boy! But this Streitfeld feller’s from that big city where everyone talks real fast and uses such big fancy words. I have even seen a commercial about the New York Times on the TV once that said something about how their journalists were the best in the world and told me to sign up for their weekend edition. So he must know what he’s talking about, right? Wrong. He’s lying. So are all his big-city colleagues. And they’re shameless about it, too. Not like us little town folks.

If there’s one thing I’ve learned during the six months I’ve spent living in the subprime wreckage of Victorville, California, is that most of the news you read about the real estate market is a lie. Positive statistics are routinely taken out of context and misattributed, headlines are exaggerated, and negative trends are totally ignored or dressed up and buried deep down in the text. (There’s another interesting strategy I’ve seen used to exaggerate positive real estate market news: newspapers routinely separate good news from the bad. They are put in separate articles, with negative pieces using technical/business language, while the feel-good fluff is written simply enough for the average sucker to understand.) The newspaper industry’s shameless shilling for the real estate industry knows no political bias. Who knows, maybe it has something to do with all the money that changes hands between them. Like in 2006, when real estate ads stuffed newspaper coffers with $5 billion.

Unfortunately, I didn’t get a single cent worth of that. So let me tell you what really happened to the housing market this June:

Everyone is pointing to the S&P/Case-Shiller Home Price Index as a sign of recovery. The Case-Shiller index tracks the resale values of single-family homes in 20 cities, watching how they compare over time. The index has a two-month lag. So in late August, they released the stats for June. And what those numbers showed—well, I’ll let the numbers speak for themselves.

The reason everyone is so fucking ecstatic is because—now prepare yourself—instead of dropping an expected 16.4% from last year, home prices only fell by only 15.44%. Whoopee! Roll out the marching band and let’s plan a parade! But for some reason, almost no one bothers to mention this piece of mind-bending good news. Instead, they look at the “month over month” changes. And compared to home prices in May, the index for June actually went up 1.4%. One point four percent! That’s right, this is the tiny increase everyone is so giddy about.

But don’t go sinking your kid’s college savings into K&B Homes stocks just yet, because, if you haven’t figured it out yet, the good news is not really good news at all. Looking at “month over month” changes to predict future real estate values is like trying to calculate the slope of a mountain with an electron microscope. At that kind of magnification, you can find convincing proof that the northern wall of the Great Canyon is as flat and smooth as the Great Plains.

Zoom out and it becomes pretty clear that the index’s trend line doesn’t leave much to be optimistic about.

See that little knob at end of that graph? That’s what passes for “pronounced” and “wide-ranging” in financial reporting circles these day. The fact is, the Case-Schiller Index is down 15.4% over the last year and 31.3% from the high in 2006.

The positive gains don’t look like much, especially when you find out that this minuscule hick-up was a direct result of shady manipulations of and government intervention in the real estate market. (Hell, the Case-Schiller Index isn’t even seasonally adjusted. Recession and market inflation aside, there is almost always an increase in home sales during summer months.)

Financial reporters sure do have short memories. It seems everyone has forgotten that 2009 will go down in history as the Summer of Real Estate Reinflation, which was fueled by legalized accounting fraud and a whole lot of taxpayer money.

In June, I wrote about how the federal government was helping banks reinflate home prices by allowing them to keep huge numbers of their foreclosed properties off the market, which created a “shadow” inventory that even now could supply America’s housing demand for the next two years:

To put it simply: banks are limiting supply in order to keep inflating the bubble. Keeping properties off the market makes sense for two reasons: it allows banks to engage in another round of brazen ripoffs by selling at least some of their properties at artificially high prices to a new wave of sucker investors (many of which are first-time home buyers). But more importantly, it allows the banks to avoid recording a loss on their balance sheets, making them look more profitable then they really are

That same month, doing a little snooping around in Victorville, I stumbled on a horrifying discovery: the Federal Housing Administration had officially taken over for the subprime mortgage industry and proceeded to pump newer, riskier home buyers into the debtor game in order to prop up home sales:

It is as deadly to our vampiric debtor economy as a stake through the heart: the FHA loan. By guaranteeing certain mortgages, the Federal Housing Administration has been helping middle- and low-income Americans purchase their first homes ever since the 1930s. But this modest leg-up program has been been hijacked and transformed into the new subprime-loan market operated by lenders who are as corrupt, predatory and shortsighted as the original subprime lenders, and maybe even more so. Because this time taxpayers have been put on the hook for the risk well in advance. Real-estate insiders have been sounding the alarm about this new shadow subprime mortgage market — which is now almost $600 billion strong — for months now. But instead of listening, Congress has been trying to expand the FHA loan program.

Right now, the FHA is in essence giving out no-money-down loans to anyone who doesn’t already own a house, regardless of credit history . . . Not surprisingly, it seems that risk-free loans are the only way banks can be persuaded to start lending again.

Now, two months later, the FHA has taken on so much risky subprime debt that even FHA officials are beginning to worry that the agency will run out of funds and will be forced to come to Congress asking for a massive taxpayer bailout. Just in the past year, the FHA has taken on $200 billion in new obligations, according to the Wall Street Journal. In 2008, outstanding FHA-backed loans totaled $429 billion. By the end of 2009, they’ll be somewhere around $630 billion. (The FHA took on $16.7 billion of new debt obligations every month, or $835 million every day of the work week.)

But it gets worse. According to USA Today, the FHA backed about 3% of mortgages in 2006. This year, its market share is going to hit 24%. To put it another way: in just a few years, the FHA has ramped up its subprime mortgage operation so recklessly that now taxpayers are responsible for almost 1 out of every 4 mortgages!

Not surprisingly, default rates on those loans have been rising, too. This month, it was reported that 7.8% of FHA loans are no good. Which means that, right now, you and I are going to have to fork over $50 billion to banks like Wells Fargo, JP Morgan Chase, Citi and countless other welfare-queen banks to cover the borrowers who defaulted on their FHA-backed loans.

Look at the little knob on that graph again. That’s what $16.7 billion taxpayer dollars a month gets you. And it’s also one of the main things driving the “improvements” in the housing market, according to USA Today:

FHA loans “are one of the most important sources in this market,” says Mark Zandi of Moody’s Economy.com. “Without FHA, the housing slide would be much more severe. We wouldn’t be talking about a recovery now. We’d still be talking about a crash.” [emphasis mine]

People might not be talking about a crash, but they are talking about a bailout, which is nothing less than government intervention to avert a crash. Like in this recent article from the Wall Street Journal:

The rising losses at the FHA, part of the U.S. Department of Housing and Urban Development, come as the agency has rapidly increased its role in guaranteeing loans in an attempt to stabilize the housing market.

It isn’t clear how the rising losses may affect home buyers. Options for the agency could include politically unpalatable choices, such as asking for taxpayer funds to boost reserves or increasing the premiums borrowers pay for the insurance offered by the agency. Agency officials say if there is a shortfall, they don’t have to do anything except report it to lawmakers. But some mortgage and housing analysts see trouble ahead. “They’re probably going to need a bailout at some point because they’re making loans in a riskier environment,” says Edward Pinto, a mortgage-industry consultant and former chief credit officer at Fannie Mae. “…I’ve never seen an entity successfully outrun a situation like this.” [emphasis mine]

So there you have it, folks. This is America’s New Capitalism at work.

There has always been a socialist element to the real estate market, but now it is finally starting to come out of the closet and enjoy life fully out in the open.

And the thing to remember is that this coming-out process started long before President Obama turned the good ol’ US of A into the Socialist States of America. Backed by realtors, home builders and mortgage bankers, it was George W. Bush who morphed FHA loans into the bigger, better, fully taxpayer-backed subprime program that it is today. The same groups now wants to bring this process to its final conclusion and have the government guarantee pretty much ALL mortgages. And to think that all this started happening waaay back in 2007, when America was supposedly still a proud, capitalist nation.

Read more: bailout, banking, fha, fha loans, housing, real estate, socialism, Yasha Levine, Banking Porn

Got something to say to us? Then send us a letter.

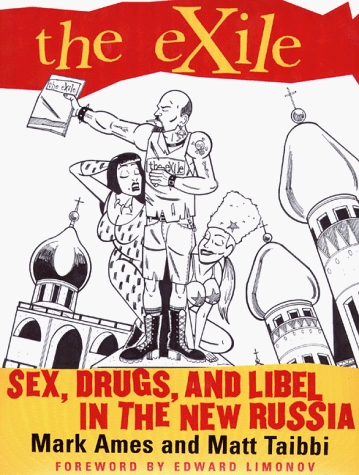

Want us to stick around? Donate to The eXiled.

Twitter twerps can follow us at twitter.com/exiledonline

25 Comments

Add your own1. az | September 4th, 2009 at 6:33 pm

There’s nothing really socialist about big business using the government to steal money from people who work for it, Yasha. I mean if anything, it’s a characteristic of regular ole’ capitalism. Don’t want to sound like one of those Southerners but this has been the case since the Civil War and the mass industrialization of the North that followed and of the South that followed 100 years later. Back then folks didn’t make enough money to take from beyond property taxes until the unions came around is all.

You might find it funny but if there is one thing that this crisis and the Great Depression have in common, it’s that in both economic cycles organized labor was weakening and a great expansion of credit followed as people could no longer afford to buy as many things which lowered profit margins.

2. Ming | September 4th, 2009 at 8:07 pm

“month over month” . . . “year over year” . . . “quarter over quarter”: the same specious drivel pumped before 2001 by tech houses which had never before (nor, among the few survivors, ever since) posted 1 penny of profit.

And everybody bought in to it.

3. 16 Shells from a 30.06 | September 4th, 2009 at 9:26 pm

Because Americans have a god given right to overpriced real estate. Toe that line, boy! Pay those bankers!

4. CultofSkaro23 | September 4th, 2009 at 9:46 pm

I think his references to Socialism are intended to be ironic. A sort of tongue in cheek reference to the old maxim of “Socialism for the rich, Capitalism for the poor” possibly.

5. antiLeft | September 4th, 2009 at 10:07 pm

Lets just build more suburban tract communities who’s sole purpose is to be purchased so the purchasers can fantasize and dream about reselling that house for a higher price to get $$$ to buy…. an even bigger house! with 2 car garages and a big ass lawn. Maybe wait till that one rises in prices and sell that to get $$$ for a 4 car garage and even bigger square footing. American “need” their square footing, big car garages and they need their property “values to increase”

6. Robert Hodge | September 5th, 2009 at 2:09 am

“This is America’s New Capitalism at work.”

Sorry Yasha… this is called fascism. There is nothing capitalist about our current situation. The Federal Reserve bank keeping interest rates at artificially low levels therefore encouraging risky lending and borrowing, and forcing savers to speculate with their money is fascist.

90% of the problem is caused by the morons in government and our criminal fed.

7. LIExpressway | September 5th, 2009 at 8:00 am

“The Federal Reserve bank keeping interest rates at artificially low levels therefore encouraging risky lending and borrowing, and forcing savers to speculate with their money is fascist.”

How the hell is that fascism, not saying it’s not bad but how is that fascist. I can’t make the connection.

I hate that these days people are using words like fascism and socialism incorrectly.

Socialism is easy to define, as there is are many 19th century socialist thinkers who clearly wrote there ideas down. I am not aware of too many great fascist economic thinkers.

Fascism is something of the 20th century and harder to define. Fascism is also a revolutionary movement.

Read this so you don’t sound dumb.

http://www.salemstate.edu/…/Paxton_Five%20Stages%20of%20Fascism.pdf

8. twentyeight | September 5th, 2009 at 9:10 am

Where are the retardofascist sock puppets who usually show up in these comments threads?

9. 16 Shells from a 30.06 | September 5th, 2009 at 12:30 pm

Does doc embed code work here?

The Five Stages Of Fascism –

10. Dammerung | September 5th, 2009 at 4:57 pm

Real capitalists like Schiff and Lew Rockwell have been screaming about this since 2003 and before. Capitalism TRIED to kill these banks and hedge fund schemes, but the government wouldn’t allow it. Capitalism tried to kill GM and Chrysler and those other shit-factories too: again, the government wouldn’t stand it. The only capitalism allowed in this country is when you lose your job and get everything repossessed. If you pump out babies for a living, or dole out obviously flawed loans, or build fighter jets – you can raid the public purse literally at will.

11. az | September 5th, 2009 at 8:35 pm

Dammerung: Capitalism doesn’t DO anything, it’s simply a relation between men that is defined by the quantifiable ownership of (private) property and the strive for profit.

@ LIExpressway, you’re right, this isn’t fascism, it’s rather left-wing even when it is “the decay of capitalism.” Of course social democracy has been called by the Comintern, “social fascism” so I think there may be a point there. Though this is a very American left-liberal kind of fascism so we may never know.

12. captain america | September 5th, 2009 at 9:50 pm

i think i’m with sock puppet #10. well said, dammerung.

13. fast_dave | September 5th, 2009 at 11:42 pm

Yasha – the fun is just getting started…

Have you ever heard of Taylor, Bean & Whitaker Mortgage Corp.?

Probably not – but two weeks ago within the Mortgage Industry the following announcement was a Nuclear Bomb Drop – as these guys hold a huge slice of the US Housing Market:

Taylor Bean Files for Bankruptcy

http://online.wsj.com/article/SB125113724702954379.html

Add to that the overall stability of the FHA:

Behind FHA Strains, a Push to Lift Housing

http://online.wsj.com/article/SB125211204270688031.html

Stock up on ammo –

14. Flozzi | September 7th, 2009 at 5:50 pm

Yasha,

Help me understand something. Is the index inflation-adjusted? I went to

http://www2.standardandpoors.com/spf/pdf/index/SP_CS_Home_Price_Indices_Methodology_Web.pdf

and I can’t find any mention of the word “inflation” in this document.

15. wengler | September 7th, 2009 at 11:19 pm

In America, the capitalist is weary of investing in organizations that make useful things for a living. Instead his new(or is it old?) investment is buying a fair stake in policymakers in order to give him money for nothing.

Remember when the haters of democracy used to invoke fear that the rich would be impoverished by the voting masses? Well the criminals with the capital got there first.

And what is the most visible response to this massive theft? Support for the criminals and their enablers by their victims.

This will end well.

16. fajensen | September 8th, 2009 at 6:56 am

But … why should one *not* move to that fine, almost free, McMansion they offer you?

Just be a good boy, take the Obama tax credit, sign the mortgage, never pay anything and with luck one will never get evicted because someone, somewhere would then have to book a loss for lending money to a deadbeat like oneself.

17. Fascist Capitalist | September 8th, 2009 at 7:20 am

Oh gee, what a surprise. America is a fascist capitalist state? Wow. How about that?

Welcome to the party, there’s the snacks, there’s the punch, thanks for stopping by.

18. LOLZORG | September 8th, 2009 at 11:40 am

Socialism for the rich, Capitalism and unemployment for the rest. Is America a great country or what? And the best part? While you pay 25-35 percent in taxes, the rich pay 15 percent, and whine when they have to pay 16 percent. America…fuck yeah! LOLZORG!

19. real estate | September 8th, 2009 at 10:01 pm

Fight the temptation to accept the first approval that comes your way; usually the better mantra when it comes to mortgage rates is “The best is yet to come,” than “It’s now or never.”

20. Requia | September 10th, 2009 at 11:30 am

“Fascism should more appropriately be called Corporatism because it is a merger of state and corporate power” Benito Mussolini

21. Sin Fronteras | September 10th, 2009 at 2:00 pm

@20

http://www.publiceye.org/fascist/corporatism.html

“Where the quote comes from remains a mystery, and while it is possible Mussolini said it someplace at some time, a number of researchers have been unable to find it after months of research.”

22. kotof | September 16th, 2009 at 4:38 am

Класс! Афтару респект!

23. Tiki | November 19th, 2009 at 9:06 am

Hello I recently wrote a reply to the following website. I tire of so many duck and fake websites that pretend the truth. We know this. So here is the mans website that censored me and my original reply to him.

http://watchingmarcitz.com/2009/11/15/housing-wasnt-a-free-market/?ref=patrick.net

Has nothing to do with free. You want to educate all of these smart boys. They have the paperwork. Why don’t these go getters read it. In fact if they did read it and tried not to follow the crowd. Jumping off the cliff like some stupid retarded lemming. Their hair would stand up on end in horror.

I need a vacation. In fact. I am going to take one. I didn’t throw my money away and live on payments, like some down and out buy here pay here swap your title for cash family hero.

I don’t blame the government. All they were doing was trying to help the banks sell loans after all. That’s their job. Now its up to them to turn this around and help sell more loans. I long to be a loan officer in the White House.

So blame the lending dimensions. Blame the risk that was setup. Blame the Mortgage people in the federal government. Of course no college boy got in trouble here. They are way to smart for that. College boys of course can figure out that you just may loose your job, thirty years on a mortgage is a long shot honey we just may make it. Give me a break. If your that stupid to take a long shot like that you deserve to live in a tent.

So here I sit. To smart to have taken the risk. While all the college boys. To many to number. Who thought they were so bright. Who just loved conservatism. Who sat around and bewailed all the government programs. Grovel at the feet of the newly appointed loan people in the White House. Not daring to invoke all the government waste. Realizing they had made a stupid move hanging with all their good so called conservative buddies who knew it all. Their love of their con friends reminds me of the Dylan lyrics. “Once upon a time you dressed so fine. You threw the bums a dime in your prime, didn’t you? “You used to laugh about everybody that was hangin’out. Now you don’t talk so loud. Now you don’t seem so proud. About having to scrounge your next meal.”

Your good friends. Stuck it to you good. As I sit here watching you get slowly washing down the drain. All the smart boys in their overpriced houses and cars. They used to sit and laugh as you ran like rats trying to pay it off. All the while thinking hey we are just like them. Get a job. Try not borrowing your way to happiness. Don’t live on payments. People that have you make payments on anything arent your friends. They are just screwing you. Try to remember that MR MBA.

24. Chuck | December 16th, 2009 at 1:33 pm

Whos buying all these new homes? I’ll tell you who. It’s all the fucking ARABS,INDIANS, and other TOWEL HEADS who use EUROS, that can now buy more with a weak DOLLAR!!! THIS COUNTY IS GOING TO HELL!!!!

25. Joe in San Diego | April 26th, 2010 at 11:24 pm

Time to strap in because its really about to hit the fan!

Leave a Comment

(Open to all. Comments can and will be censored at whim and without warning.)

Subscribe to the comments via RSS Feed